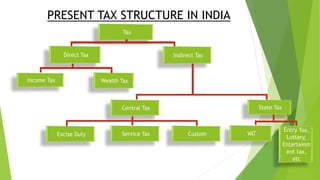

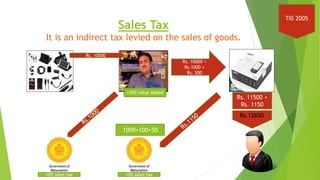

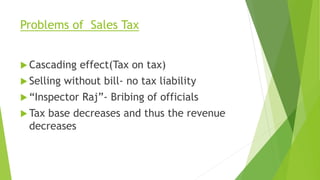

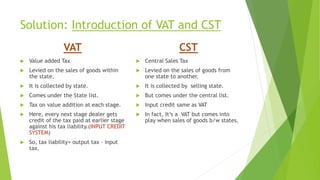

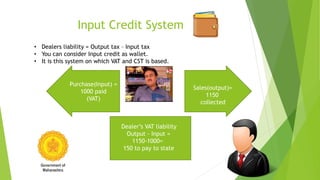

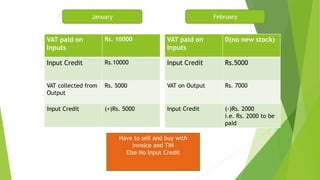

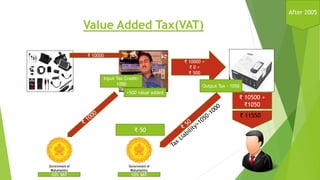

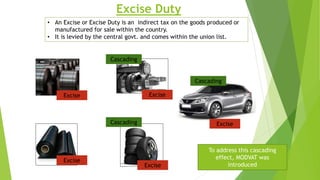

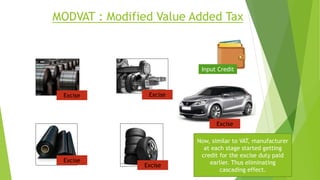

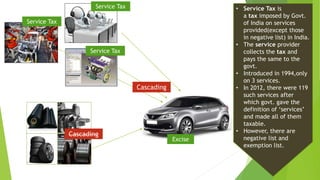

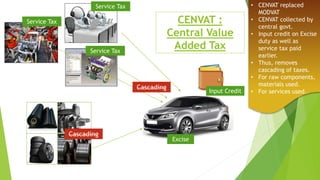

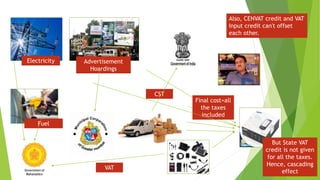

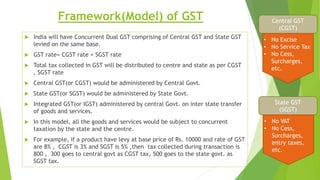

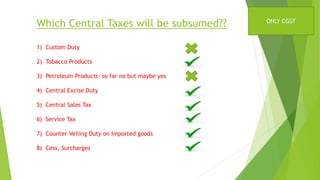

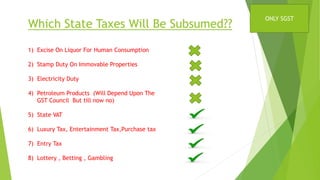

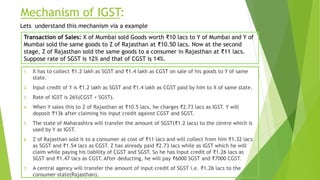

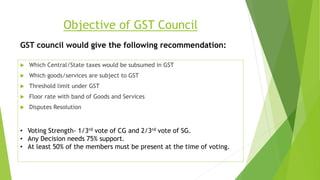

The document provides an overview of goods and services tax (GST) in India. It describes the existing indirect tax structure, including various central and state taxes like VAT, CST, excise duty, and service tax. It explains the problems with the current system, such as cascading effects and compliance burden. GST aims to simplify and harmonize indirect taxation by introducing a single tax on the supply of goods and services throughout India, subsuming multiple taxes. It will follow a dual GST model with taxation powers shared between the central and state governments. The key benefits of GST include removing cascading taxes, improving compliance, and creating a unified national market.