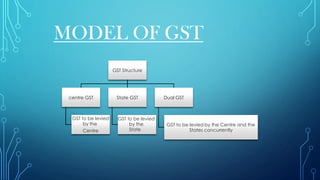

The document discusses Goods and Services Tax (GST) in India. It states that GST is a comprehensive indirect tax on the supply of goods and services throughout India. It will replace many central and state taxes and aims to overcome the cascading effect and complexity of taxes under the current system. GST is proposed as a dual GST with taxation powers divided between the central and state governments. It is expected to lead to a uniform, transparent and corruption-free tax system across India.