The document provides an overview of basic concepts related to income tax in India, including definitions of key terms like tax, direct tax, indirect tax, income, assessee, capital/revenue receipts and expenditures. It explains that the Income Tax Act of 1961 governs income tax and its provisions for determining taxable income and tax liability. Income includes various sources like profits, dividends, capital gains, interest etc. Computation of taxable income involves calculating income under different heads, applying deductions and exemptions, and determining the final tax liability.

![INCOME

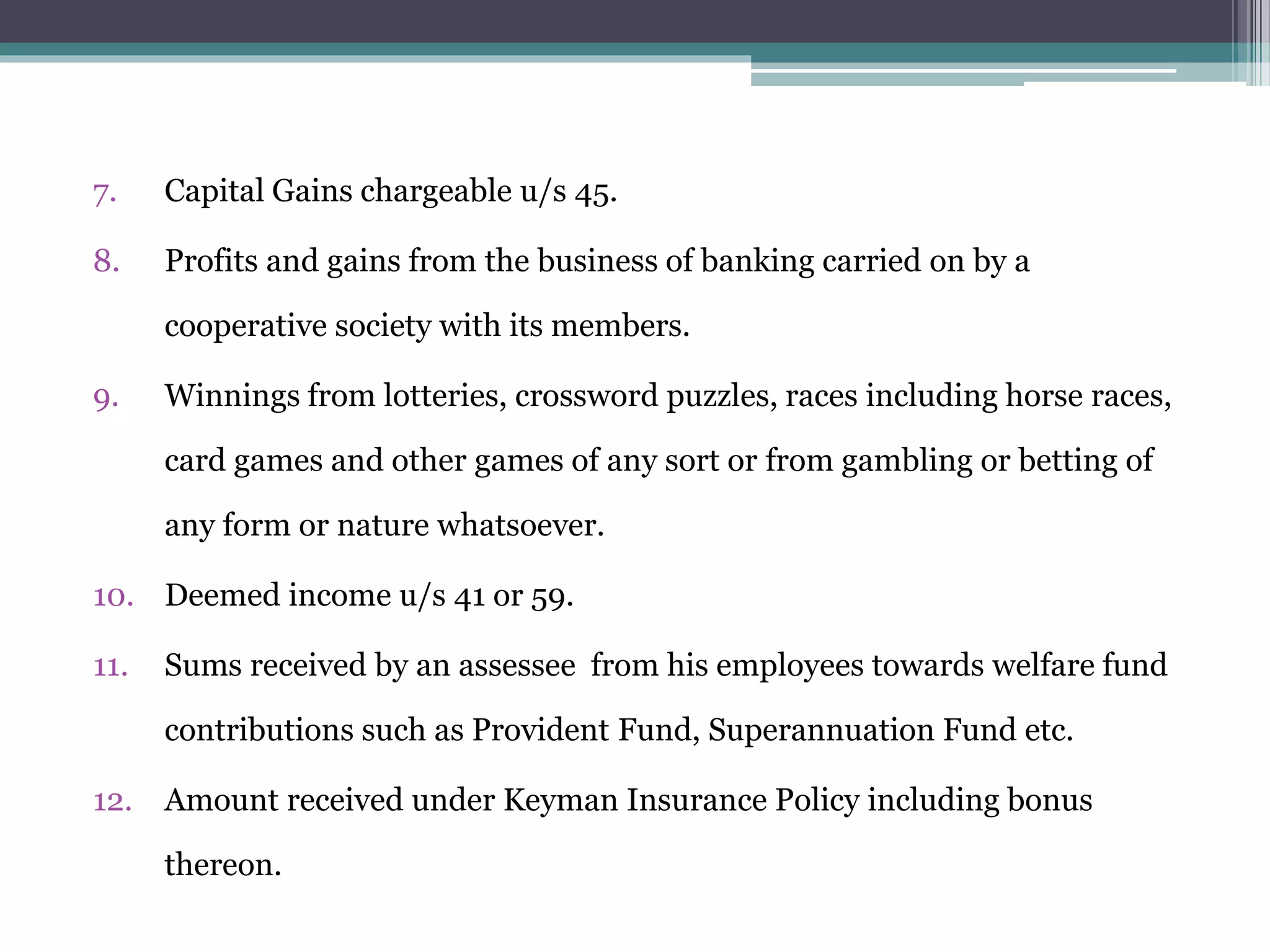

As per [Section 2(24)], Income includes :

1. Profits or gains of business or profession.

2. Dividend.

3. Voluntary Contribution received by a Charitable / Religious Trust or University /

Education Institution or Hospital

4. Value of perquisite or profit in lieu of salary taxable u/s 17 and special allowance or

benefit specifically granted either to meet personal expenses or for performance of

duties of an office or an employment of profit.

5. Export incentives, like Duty Drawback, Cash Compensatory Support, Sale of licences

etc.

6. Interest, salary, bonus, commission or remuneration earned by a partner of a Firm from

such Firm.](https://image.slidesharecdn.com/it-160219155655/75/Introduction-to-Income-Tax-5-2048.jpg)

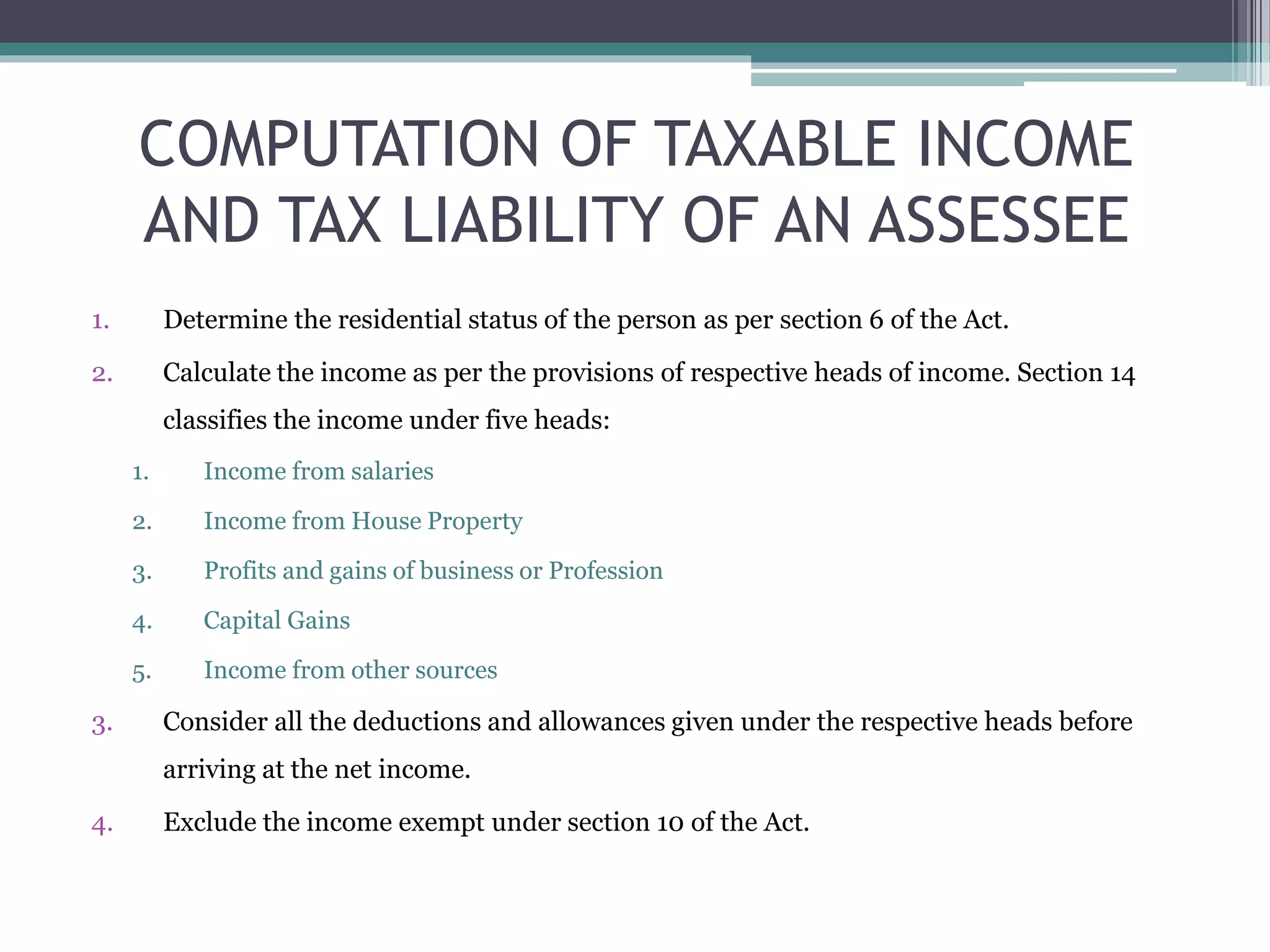

![ ASSESSMENT YEAR [SECTION 2(9)]

“Assessment year” means the period of twelve months commencing on 1st

April every year and ending on 31st March of the next year. Income of

previous year of an assessee is taxed during the following assessment year

at the rates prescribed by the relevant Finance Act.

PREVIOUS YEAR (SECTION 3)

Income earned in a year is taxable in the next year. The year in which

income is earned is known as previous year. From the assessment year

1989-90 onwards, all assessees are required to follow financial year (i.e.

April 1 to March 31) as previous year. The uniform previous year has to be

followed for all sources of income.](https://image.slidesharecdn.com/it-160219155655/75/Introduction-to-Income-Tax-9-2048.jpg)

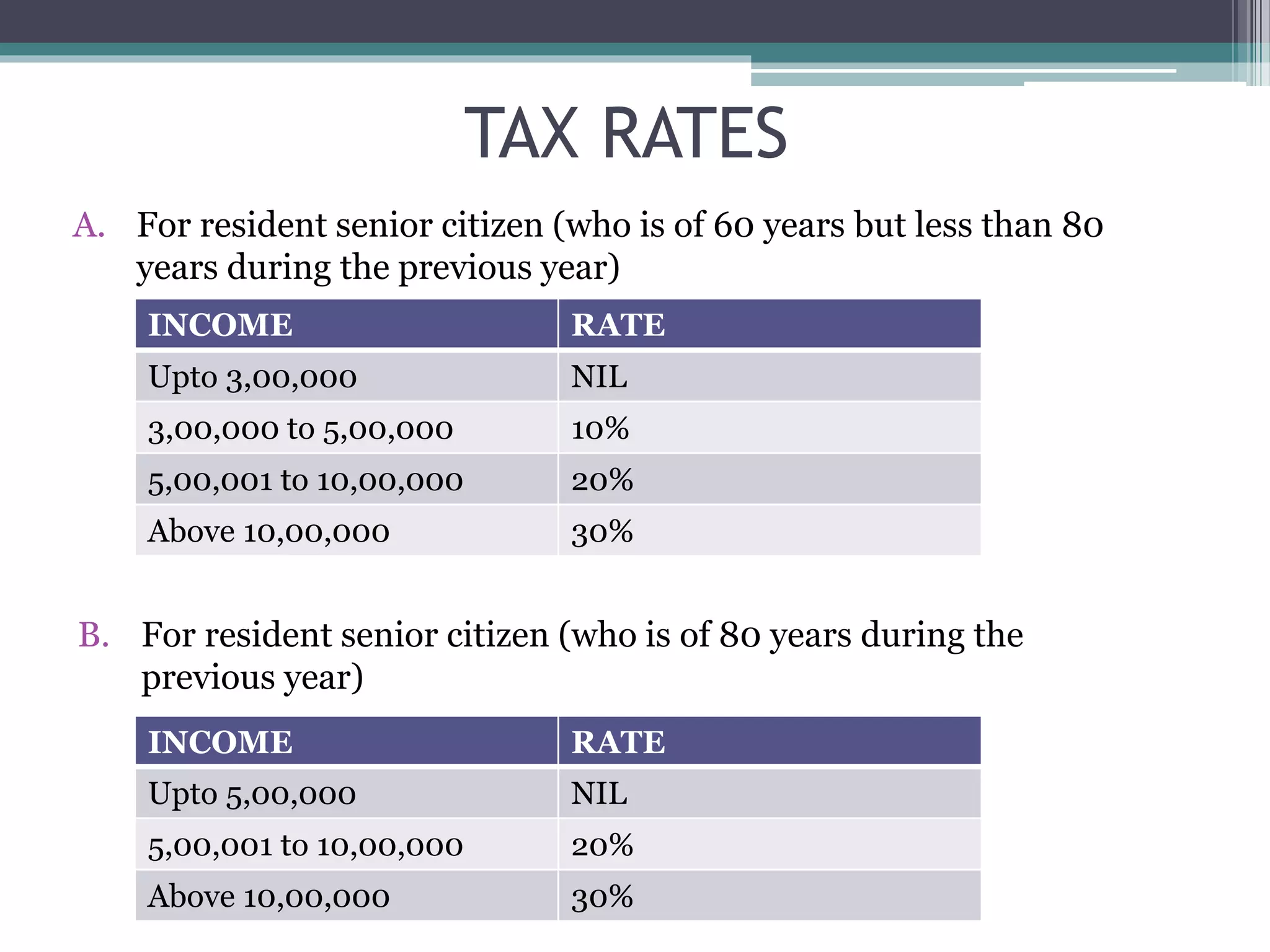

![ROUNDING OFF TOTAL INCOME AND TAX

• Rounding Off Income [Sec. 288A]: The Total Income computed

under this Act, shall be rounded off to the nearest multiple of 10.

• Rounding Off Tax [Sec. 288B] : The amount of Tax including Tax

Deducted at Source (TDS) and advance tax, interest, penalty, fine or

any other sum payable, and the amount of refund due under the

Income Tax Act, shall be rounded off to the nearest ‘10.](https://image.slidesharecdn.com/it-160219155655/75/Introduction-to-Income-Tax-23-2048.jpg)