The document provides an overview of the Goods and Services Tax (GST) system in India. Some key points:

- GST is a consumption-based tax levied on the supply of goods and services. It comprises Central GST, State GST, and Integrated GST.

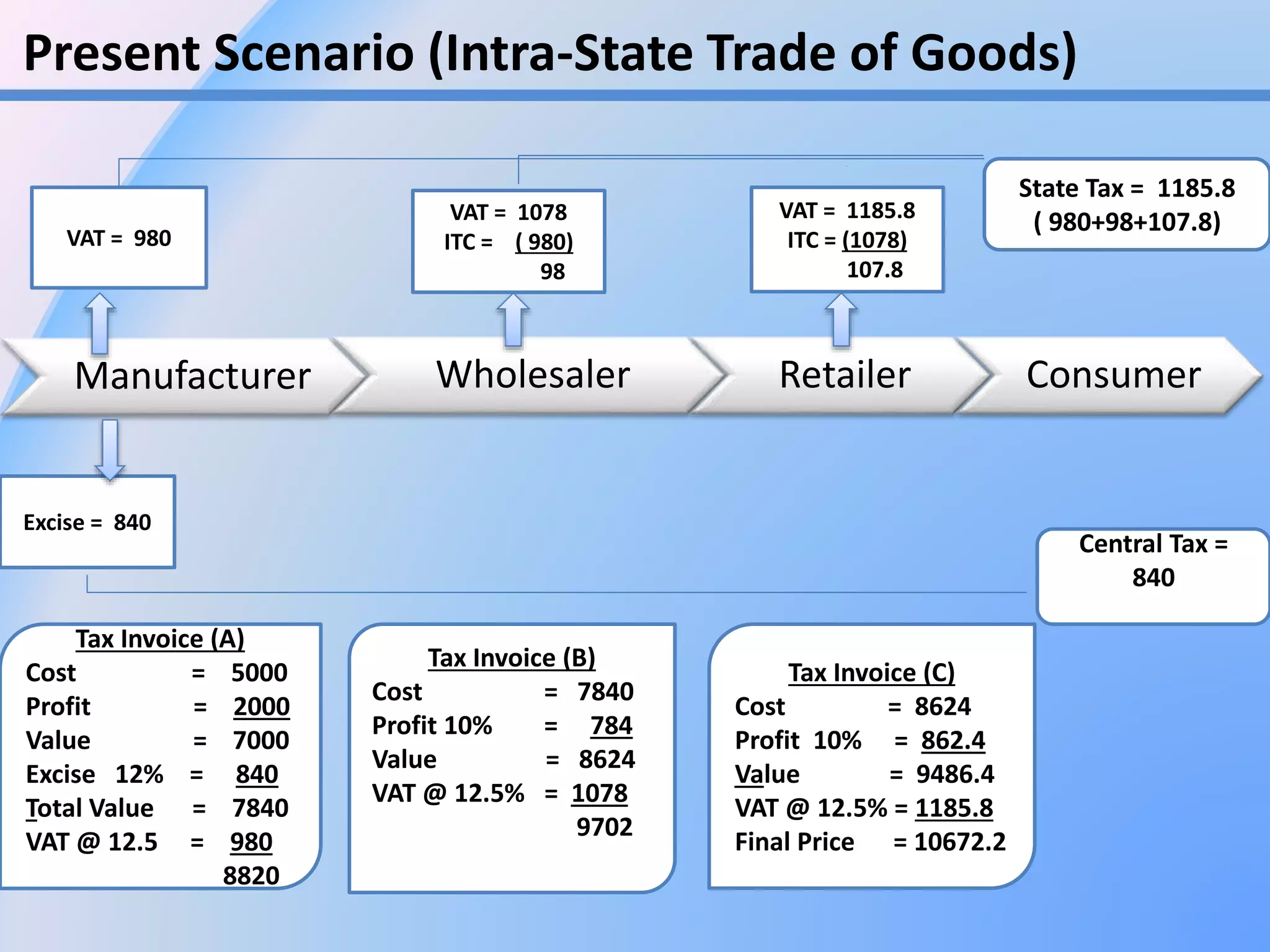

- Many existing taxes at the central and state level will be subsumed under GST including excise duty, VAT, service tax, etc.

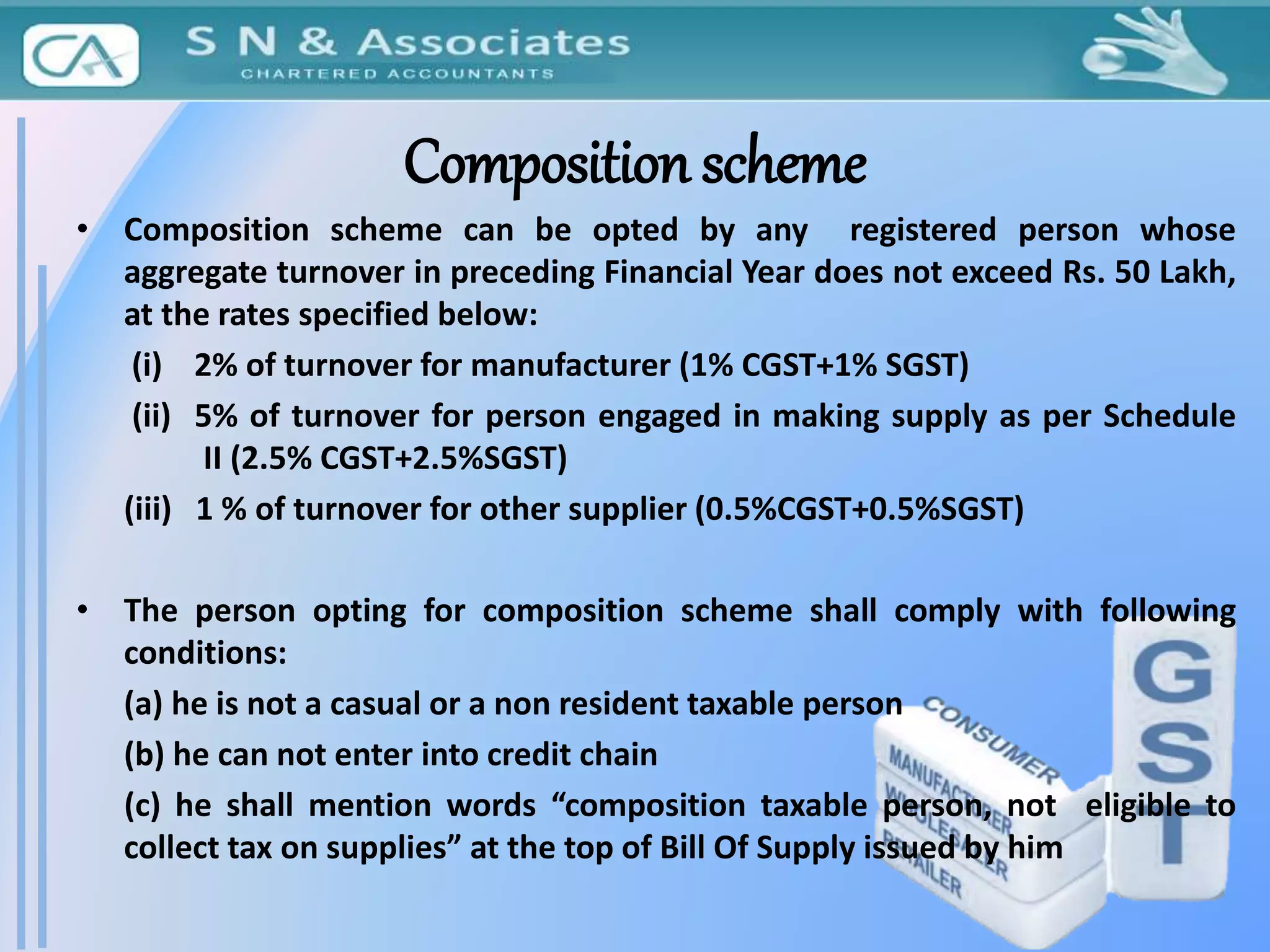

- GST will have multiple tax slabs of 0%, 5%, 12%, 18%, 28% and a cess on luxury and 'sin' goods. Composition scheme available for small businesses.

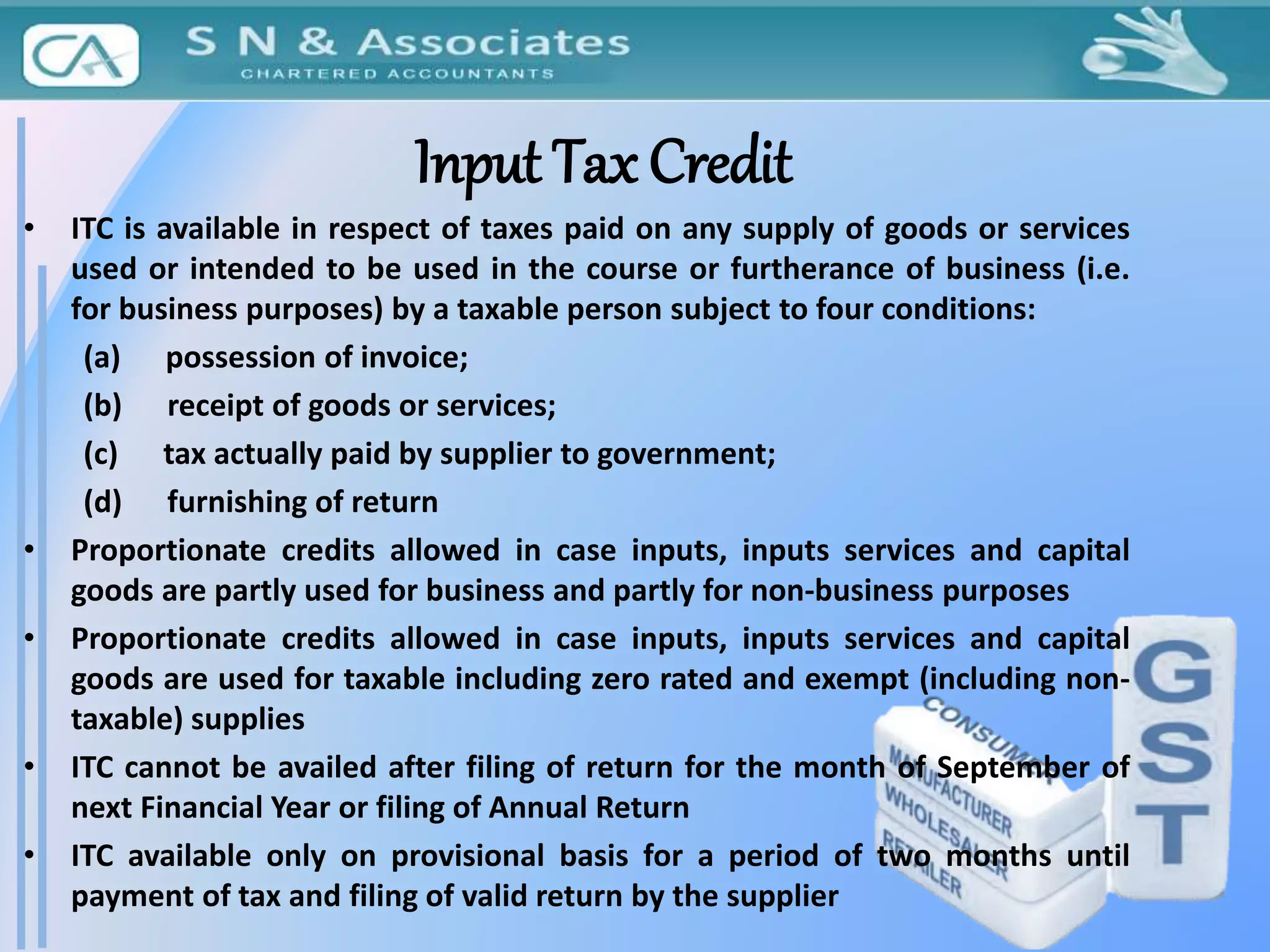

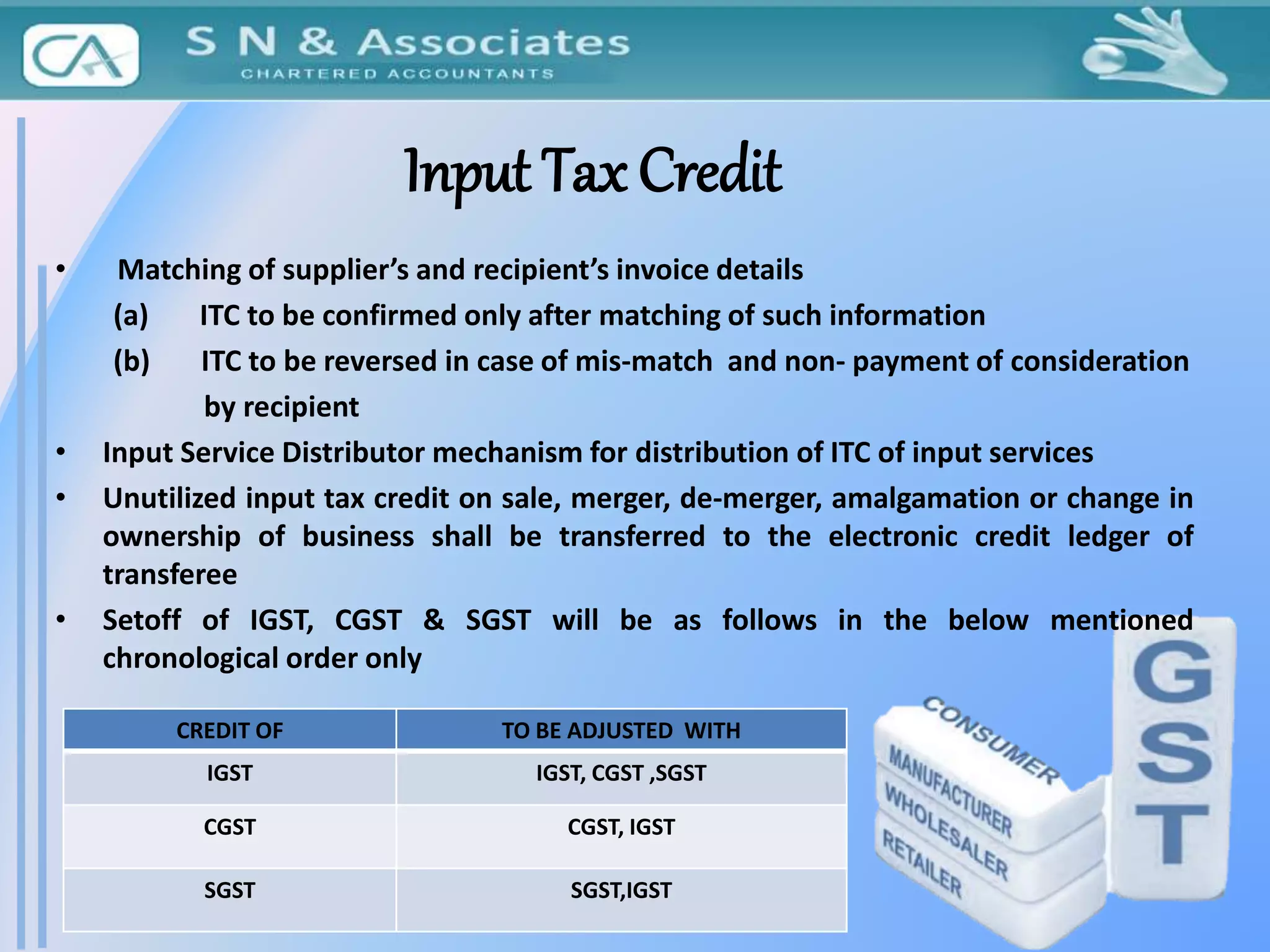

- Input tax credit mechanism allows set-off of taxes paid