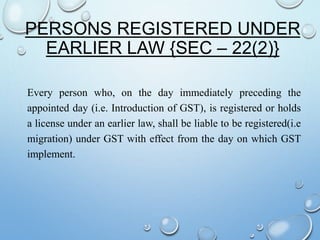

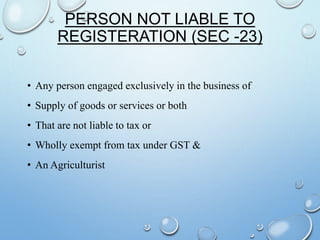

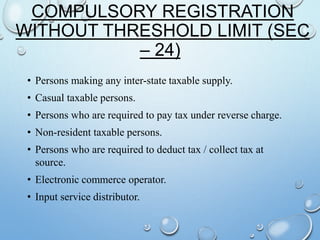

Registration is required under GST for any supplier of goods or services whose aggregate turnover exceeds Rs. 20 lakh. Persons registered under earlier laws will be migrated to GST. Exemptions from registration include agriculturists and those exclusively engaged in exempt supplies. Additional categories requiring compulsory registration include inter-state suppliers and e-commerce operators. Registration involves declaring PAN and other details to obtain a temporary reference number, applying online with documents, and receiving a GSTIN. Amendments and cancellations to registrations are also conducted online. Non-resident taxable persons can obtain temporary registration by submitting passport details.

![REGISTRATION REQUIREMENT

Supplier of goods and services with Aggregate

Turnover over Specified limit

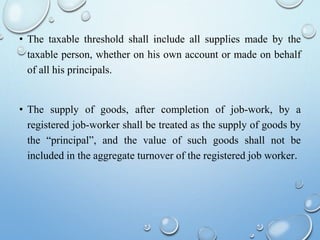

As per section 22 of CGST Act 2017, every supplier shall be

liable to be registered under this act in the state from where

he makes a taxable supply of goods or services if his

aggregate turnover in a financial year exceeds Rs. 20

lakh [ Rs.10 lakhs in case of special states(north east)

including Sikkim].](https://image.slidesharecdn.com/regisautosaved-170630163507/85/Registration-under-GST-2-320.jpg)