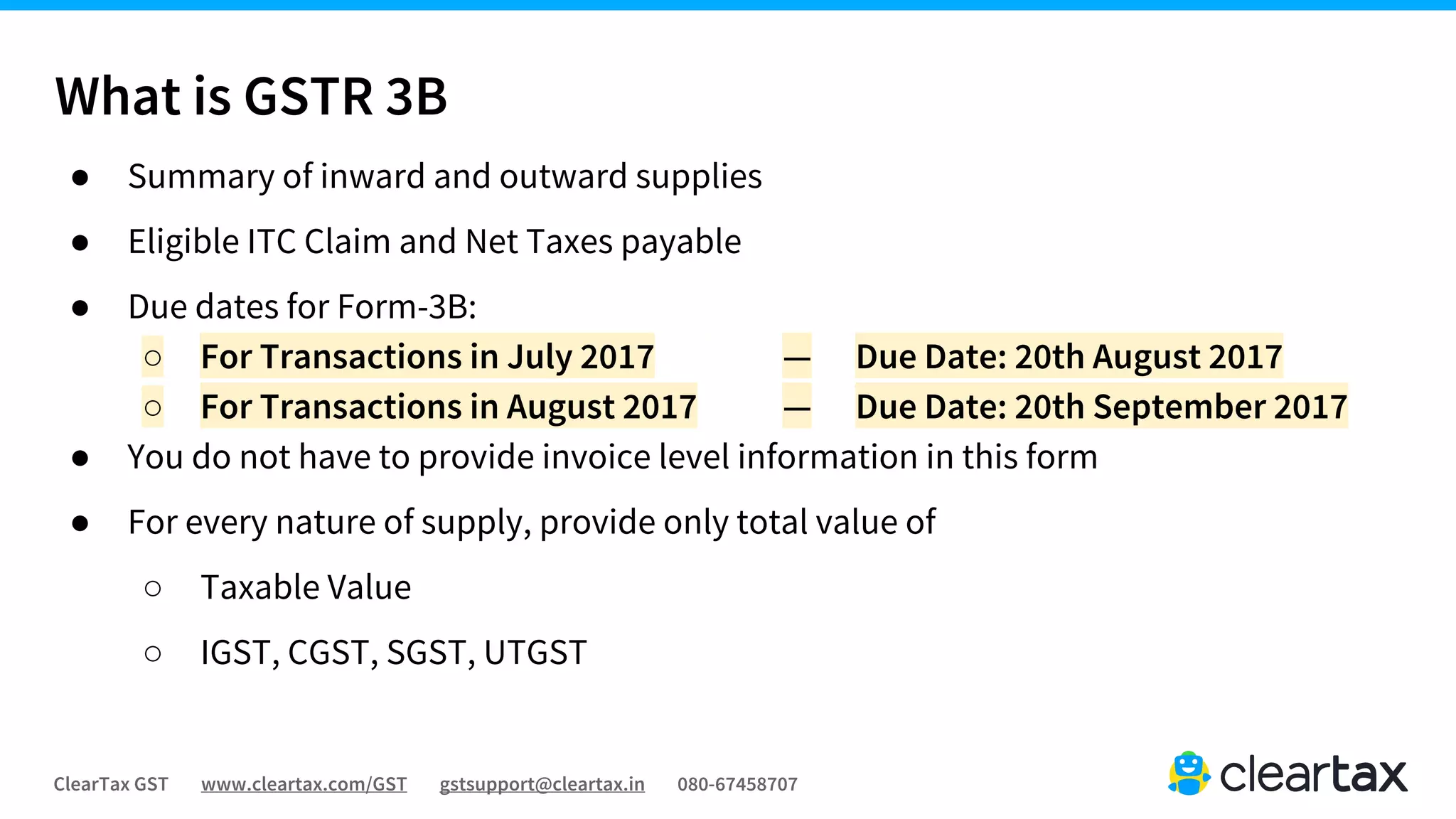

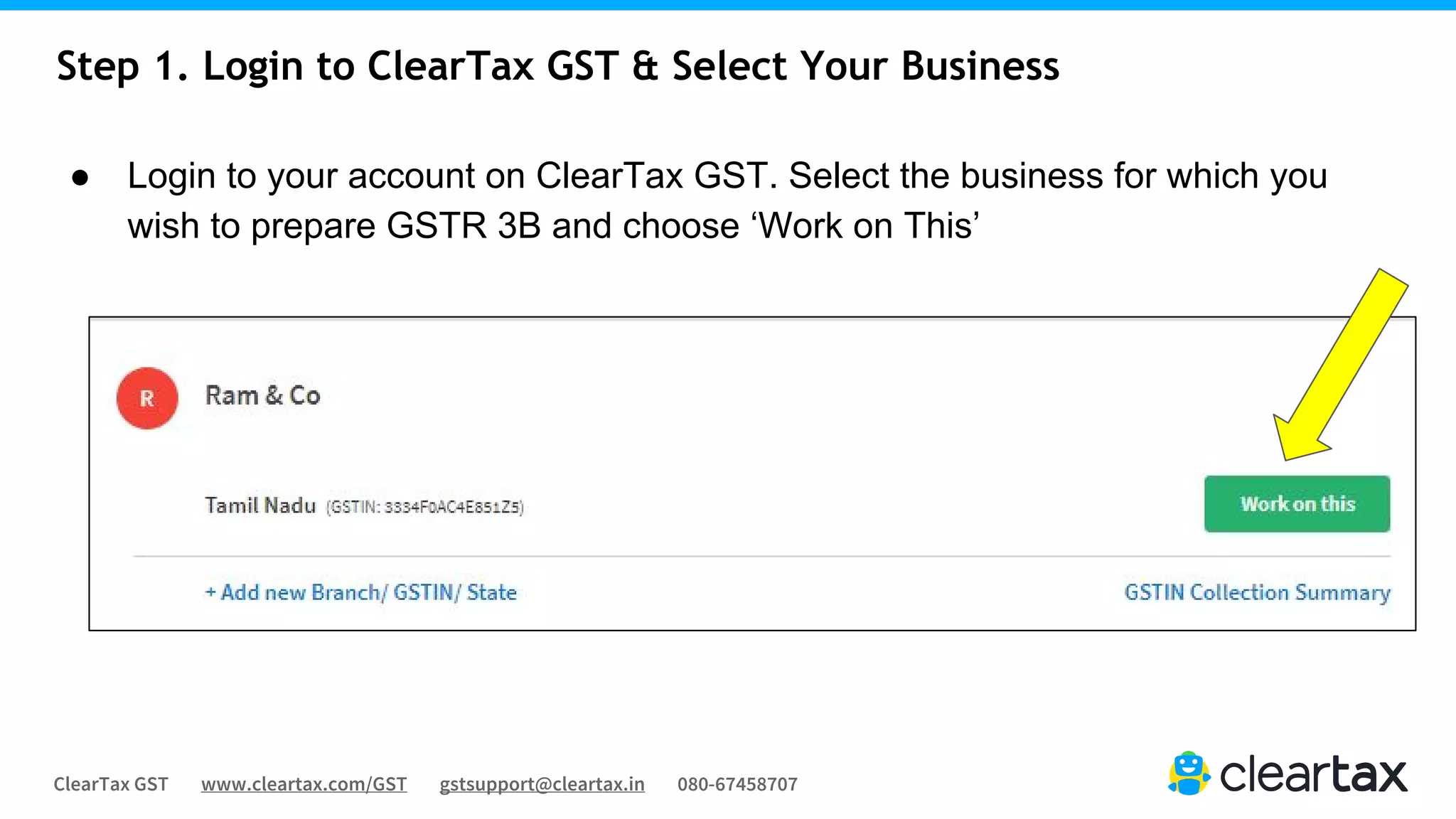

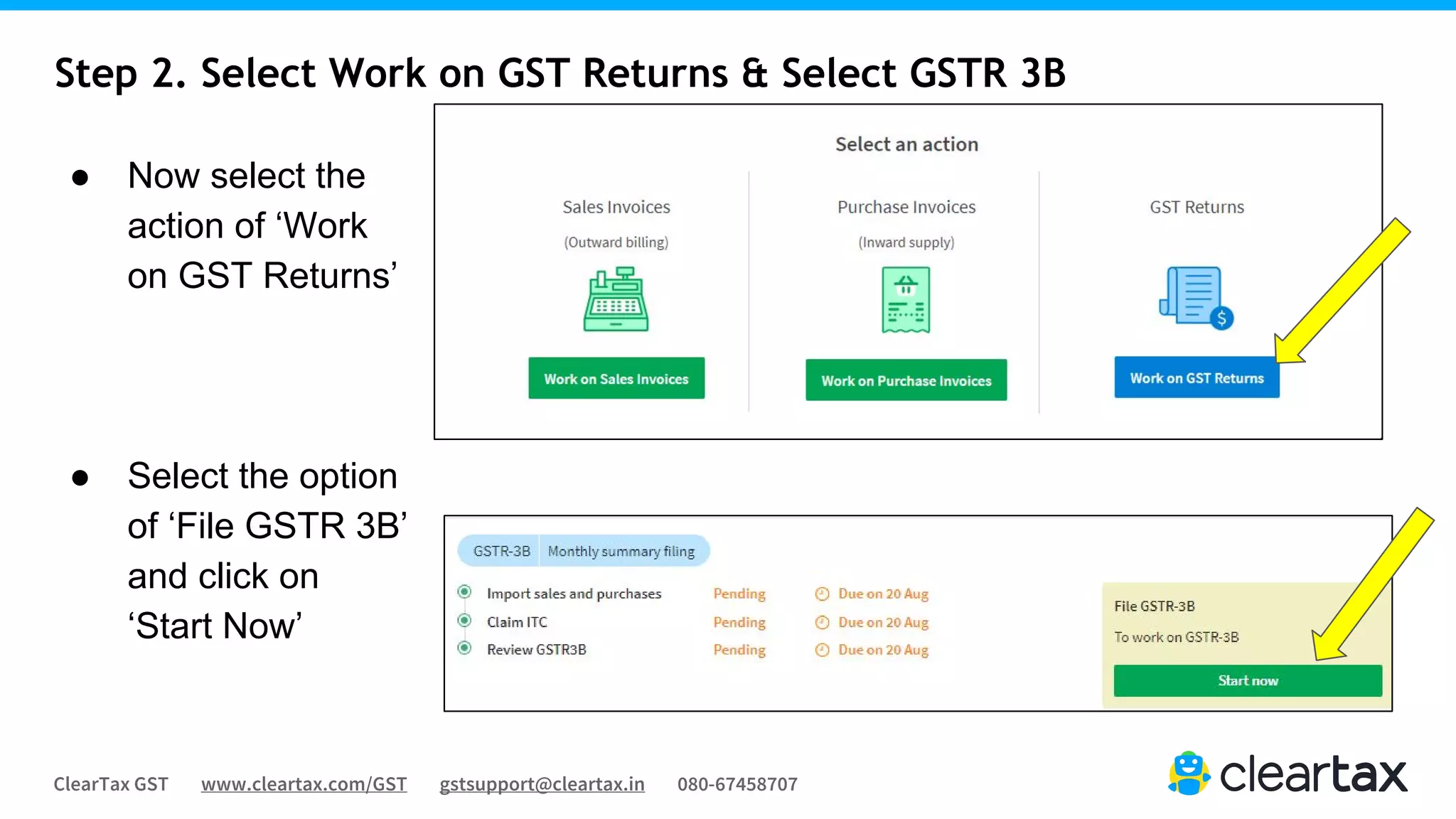

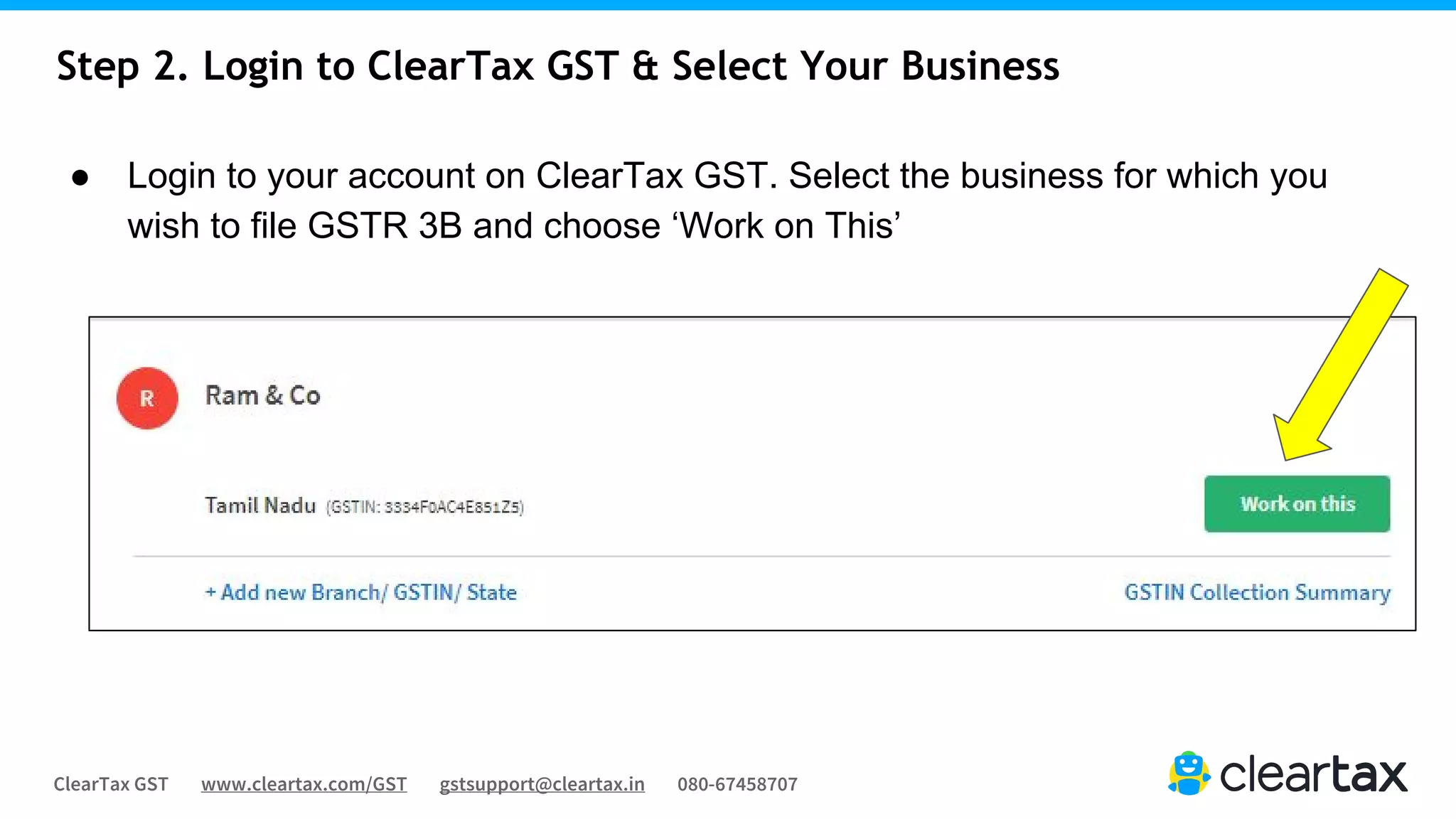

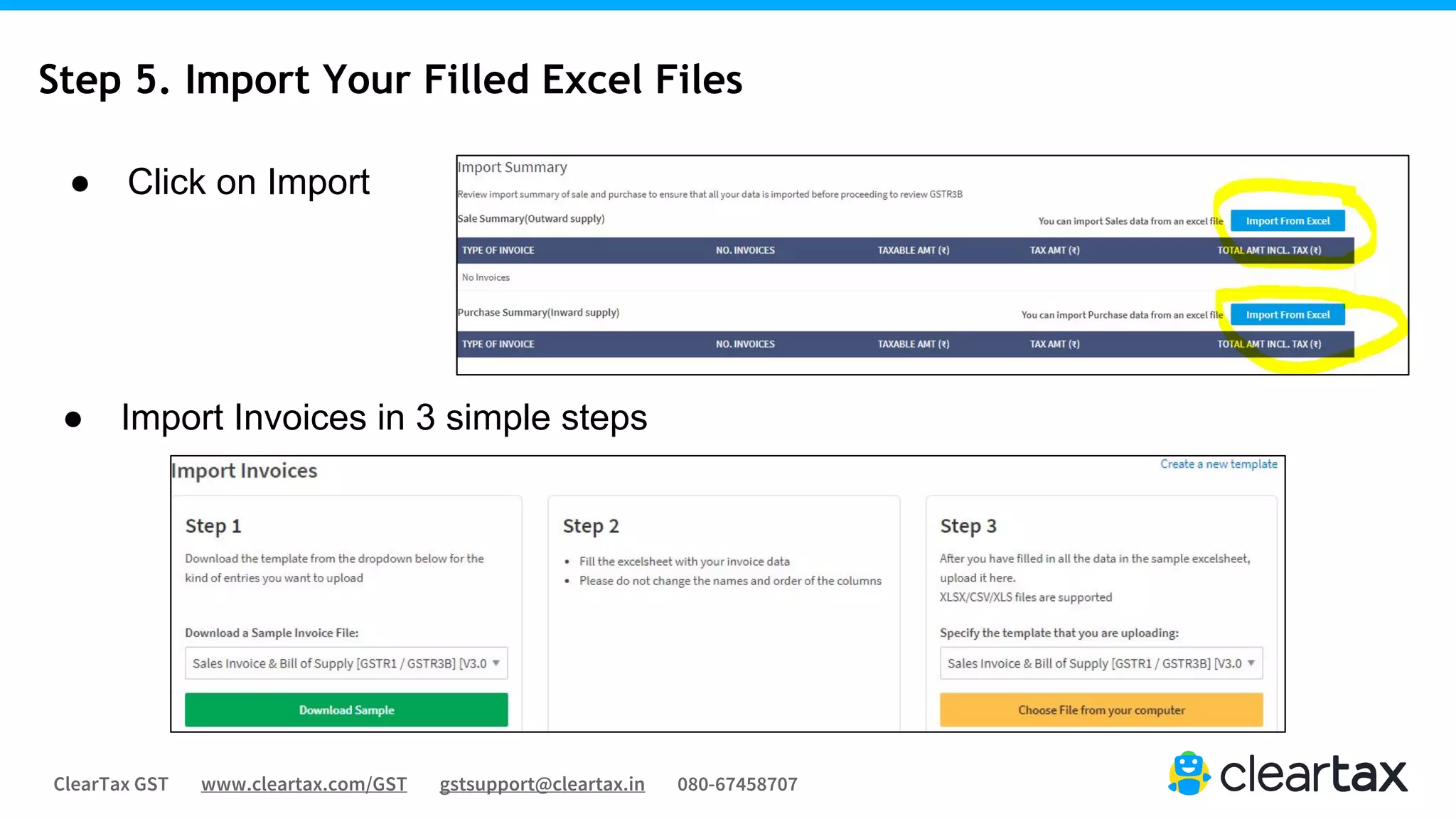

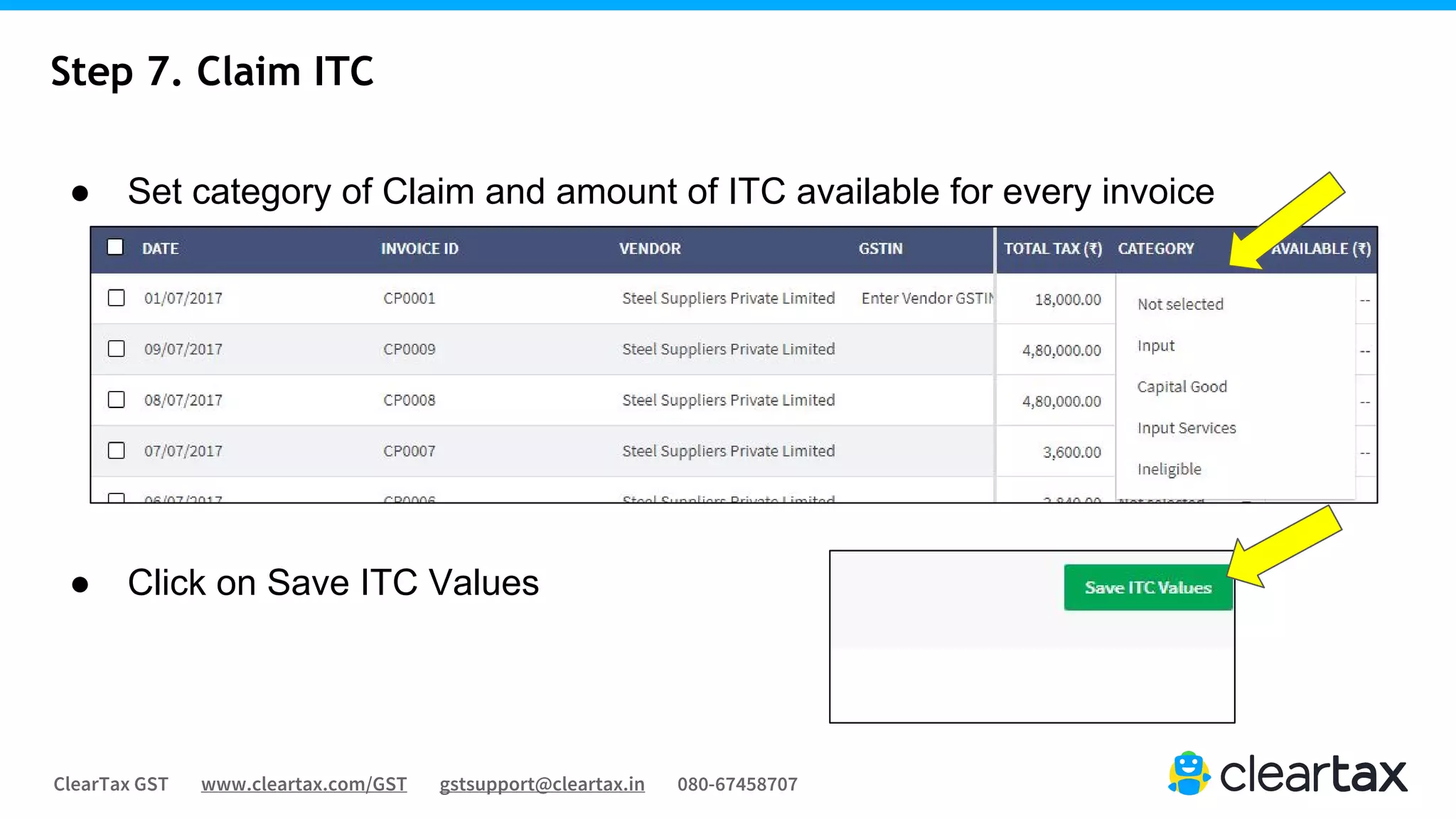

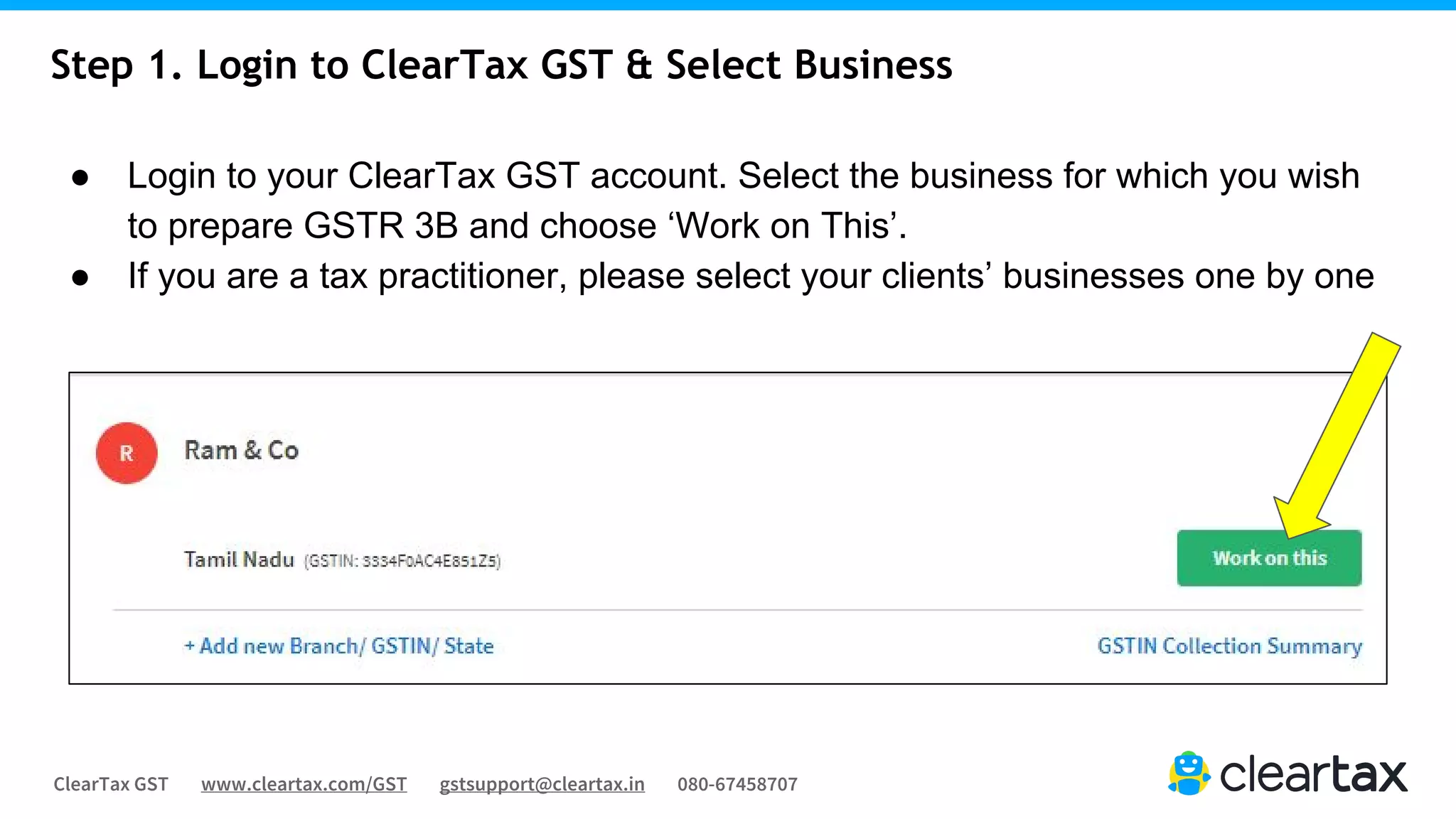

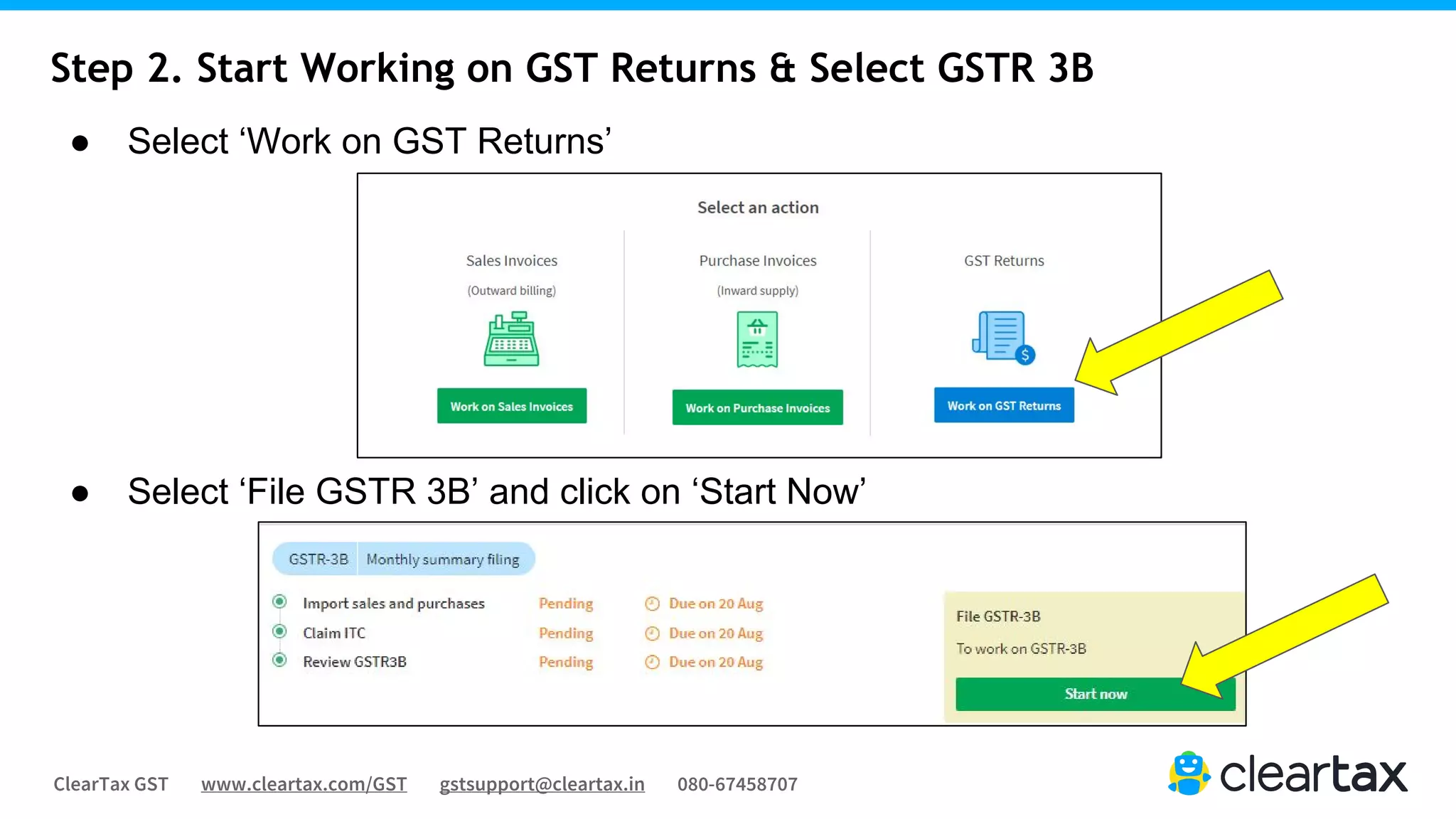

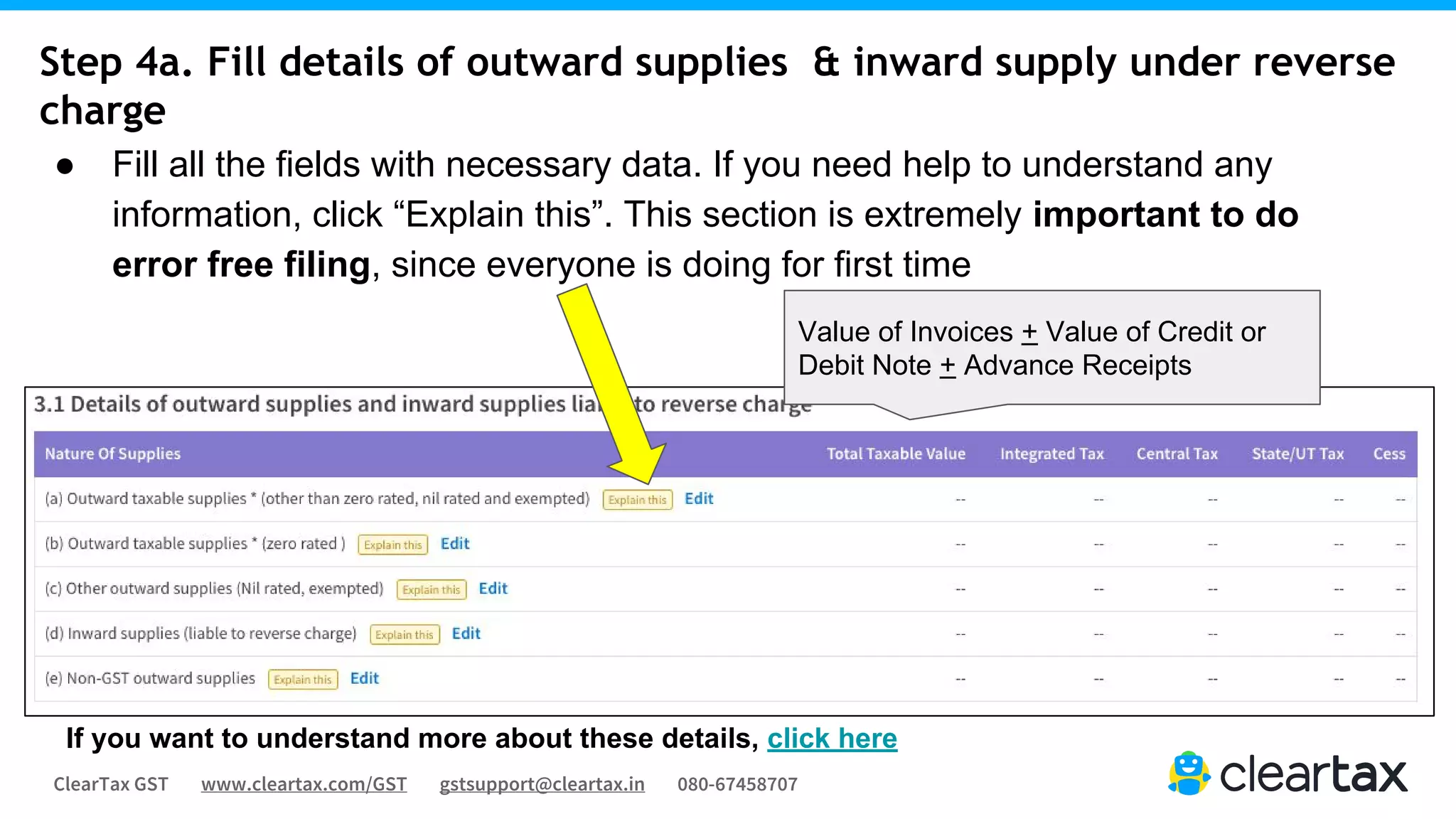

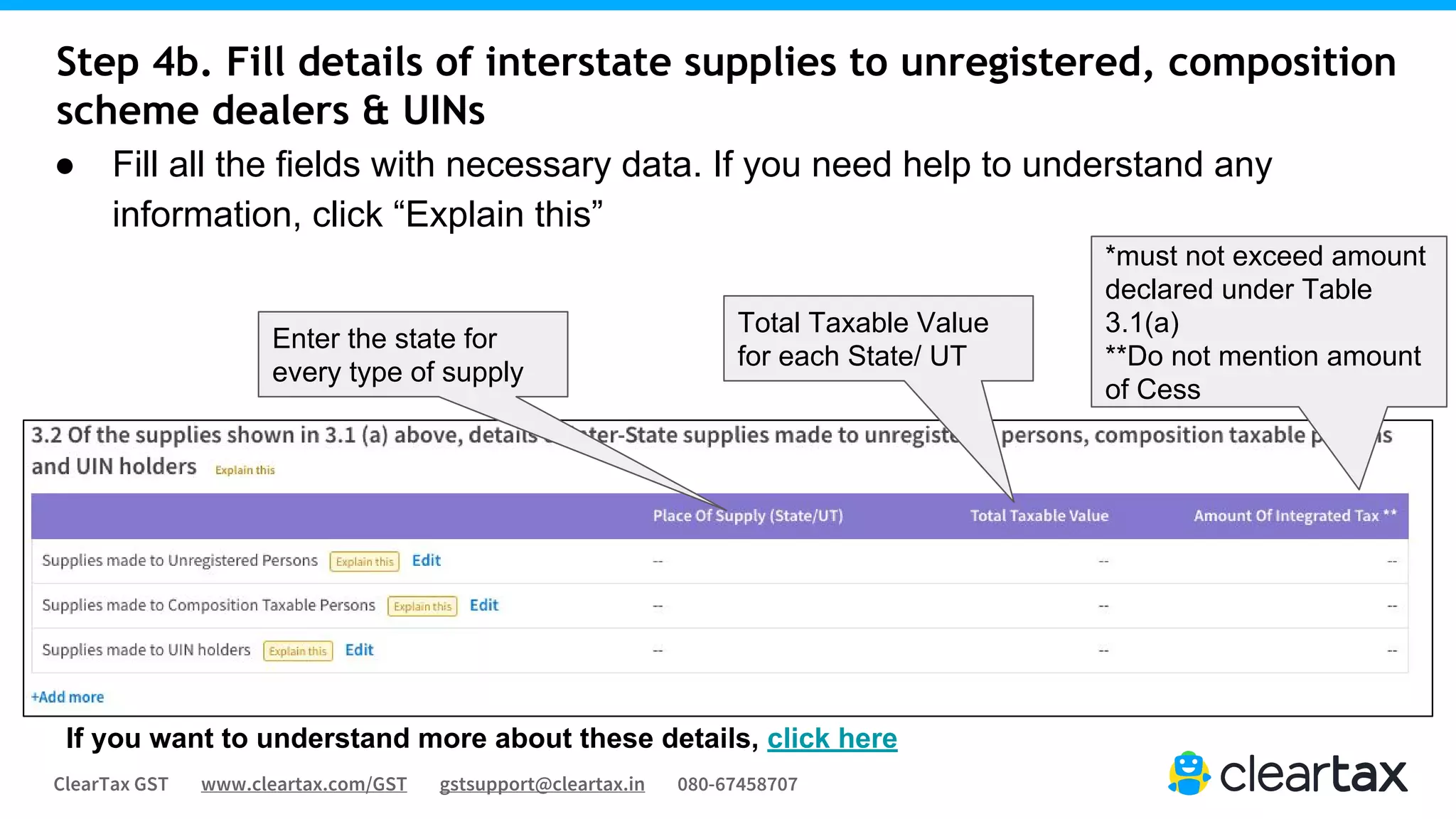

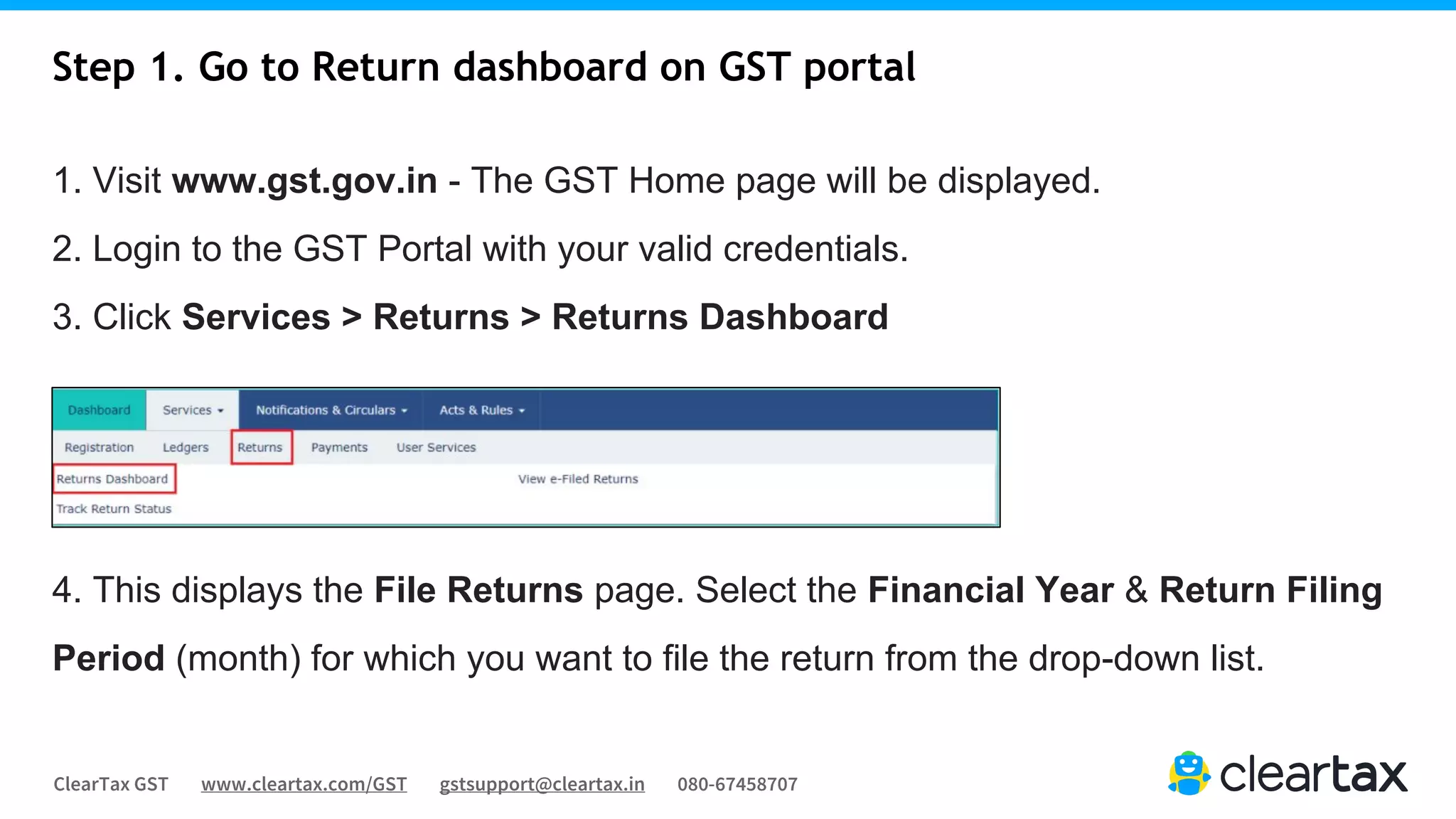

The document is a comprehensive guide on preparing and filing the GSTR-3B return using ClearTax. It outlines who needs to file the return, the importance of filing to avoid penalties, and detailed steps to prepare the return using ClearTax software or Excel templates. It offers guidance for both tax practitioners and business owners on efficiently managing GSTR-3B filing and also emphasizes the benefits of using ClearTax for accurate and streamlined tax submissions.