This document provides an overview of the existing taxation system in India and how it will be replaced by the Goods and Services Tax (GST). It discusses the different direct and indirect taxes currently imposed in India, including income tax, wealth tax, capital gains tax, sales tax, service tax, value added tax, customs duty, and octroi. The implementation of GST aims to simplify this complex system by integrating various central and state taxes into a single tax applicable to both goods and services. GST is expected to reduce the overall tax burden, increase tax collection and compliance, and help develop a common national market.

![34

Elimination of multiplicity of taxes and their cascading effects.

Rationalization of tax structure and simplificationof compliance

procedures.

Harmonization of Centre and State tax administrations, which

would reduce duplication and compliance costs.

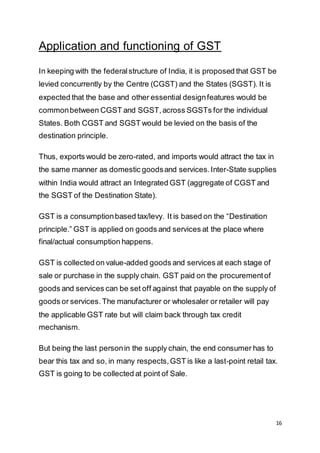

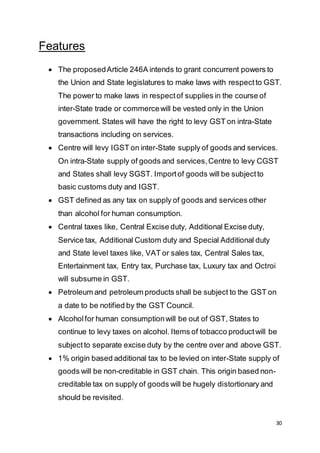

Taxesto be subsumed-

GST would replace most indirect taxes currently in place such as:

CentralTaxes

Central Excise Duty

[including additional excise

duties, excise duty under

the Medicinal and Toilet

Preparations (Excise

Duties) Act, 1955]

Service tax

Additional Customs Duty

(CVD)

SpecialAdditional Duty of

Customs (SAD)

Central surcharges and

cesses

State Taxes

Value Added Tax

Central Sales Tax( Levied by

the Centre and collected bythe

States )

Octroi and Entry Tax

Purchase Tax

Luxury Tax

Taxes on lottery, betting &

gambling

State cessesand surcharges

Entertainment tax (other than

the tax levied by the local

bodies)](https://image.slidesharecdn.com/finalsem5-160120130003/85/IMPLEMENTATION-OF-GST-IN-INDIA-1-34-320.jpg)

![51

Bibliography

www.mint.com. 2014. Will GST make things costlier or cheaper.

[ONLINE] Available at:

http://www.livemint.com/Money/ZBV1v5fDFpLM6RlXil8giO/Will-

GST-make-things-costlier-or-cheaper.html.[Accessed16

September15].

www.prsindia.org. 2013. Constitutional amendments.[ONLINE]

Available at: http://www.prsindia.org/billtrack/the-constitution-

122nd-amendment-gst-bill-2014-3505/.[Accessed15 September

15].

quora. 2013. How will GST work in India. [ONLINE] Available at:

https://www.quora.com/How-will-the-goods-and-sevices-tax-GST-

work-in-India-How-is-it-any-different-than-the-value-added-tax-

VAT. [Accessed 21 September15].

ey. 2015. The roadmap. [ONLINE] Available at:

http://www.ey.com/IN/en/Services/Tax/EY-goods-and-services-tax-

gst. [Accessed 17 September15].

Wikipedia.2015.goodsandservicetaxindia. [ONLINE] Available at:

https://en.wikipedia.org/wiki/Goods_and_Services_Tax_(India)_Bill

. [Accessed 23 September15].

www.gstindia.com. 2014. What is GST. [ONLINE] Available at:

https://www.google.co.in/url?sa=t&rct=j&q=&esrc=s&source=web&

cd=3&cad=rja&uact=8&ved=0CCQQFjACahUKEwiG_MiZko_IAhU

NCY4KHfZ4Chs&url=http%3A%2F%2Fwww.gstindia.com%2F&us

g=AFQjCNFeIaxMfDH9vrlZO_UBj-ben5pMKA.[Accessed24

September15]](https://image.slidesharecdn.com/finalsem5-160120130003/85/IMPLEMENTATION-OF-GST-IN-INDIA-1-51-320.jpg)

![52

www.legalservicesindia.com.2012.GST feasibility. [ONLINE]

Available at:

http://www.legalservicesindia.com/article/article/goods-&-services-

tax-feasibilty-in-india-652-1.html. [Accessed18 September15].

www.mapsofindia.com.2013.howwillgstchangeindia. [ONLINE]

Available at: http://www.mapsofindia.com/my-

india/government/gst-one-step-towards-simplifying-the-muddled-

up-tax-system. [Accessed 16 September15].

www.top10wala.com. 2014. Top facts about GST. [ONLINE]

Available at: http://top10wala.in/facts-about-gst-india-advantages/.

[Accessed24 September15].

www.taxguru.com. 2011. Proposed GST and process.[ONLINE]

Available at: http://taxguru.in/goods-and-service-tax/roadmap-

goods-service-tax-gst.html.[Accessed 08 September15].

www.empcom.gov.in. 2014.GST.[ONLINE] Available at:

http://www.empcom.gov.in/content/7_1_GoodsandServicesTax.as

px. [Accessed22 September15].

www.timesofindia.com.2015.GST roadmap. [ONLINE] Available

at: http://timesofindia.indiatimes.com/business/india-

business/Finance-minister-Arun-Jaitley-to-meet-state-finance-

ministers-tomorrow-on-GST-roadmap/articleshow/47001725.cms.

[Accessed09 September15].](https://image.slidesharecdn.com/finalsem5-160120130003/85/IMPLEMENTATION-OF-GST-IN-INDIA-1-52-320.jpg)