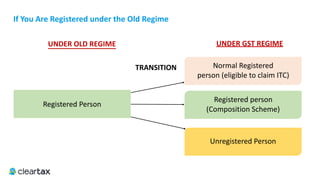

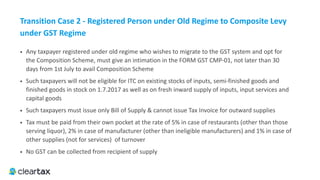

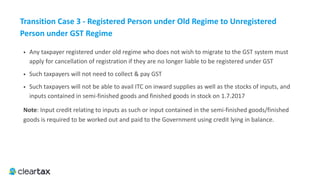

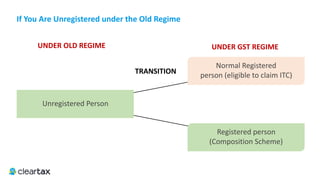

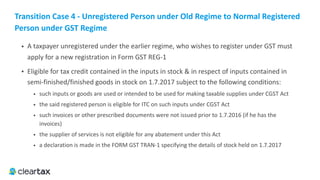

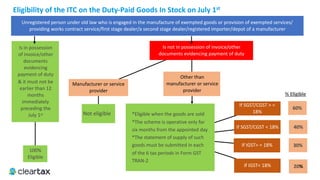

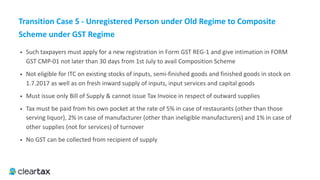

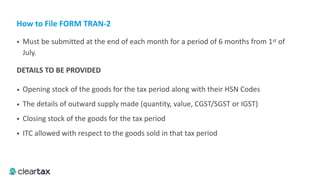

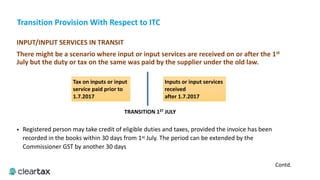

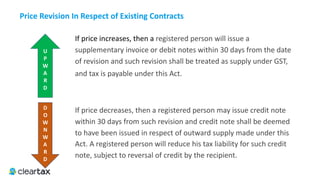

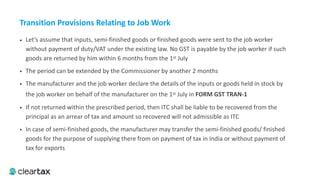

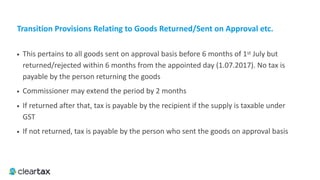

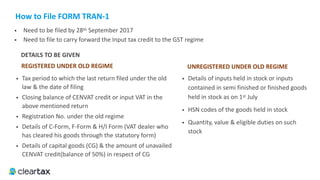

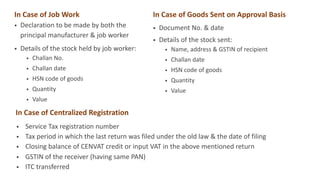

The document outlines transition provisions for taxpayers migrating from the old taxation regime to the GST regime, detailing processes for different types of registered and unregistered persons. Key points include eligibility for input tax credit (ITC), necessary declarations, and filing requirements for stock and credit under the new GST framework. It also covers scenarios for composition schemes, cancellation of registration for non-compliance, and special conditions for job work and goods sent on approval.