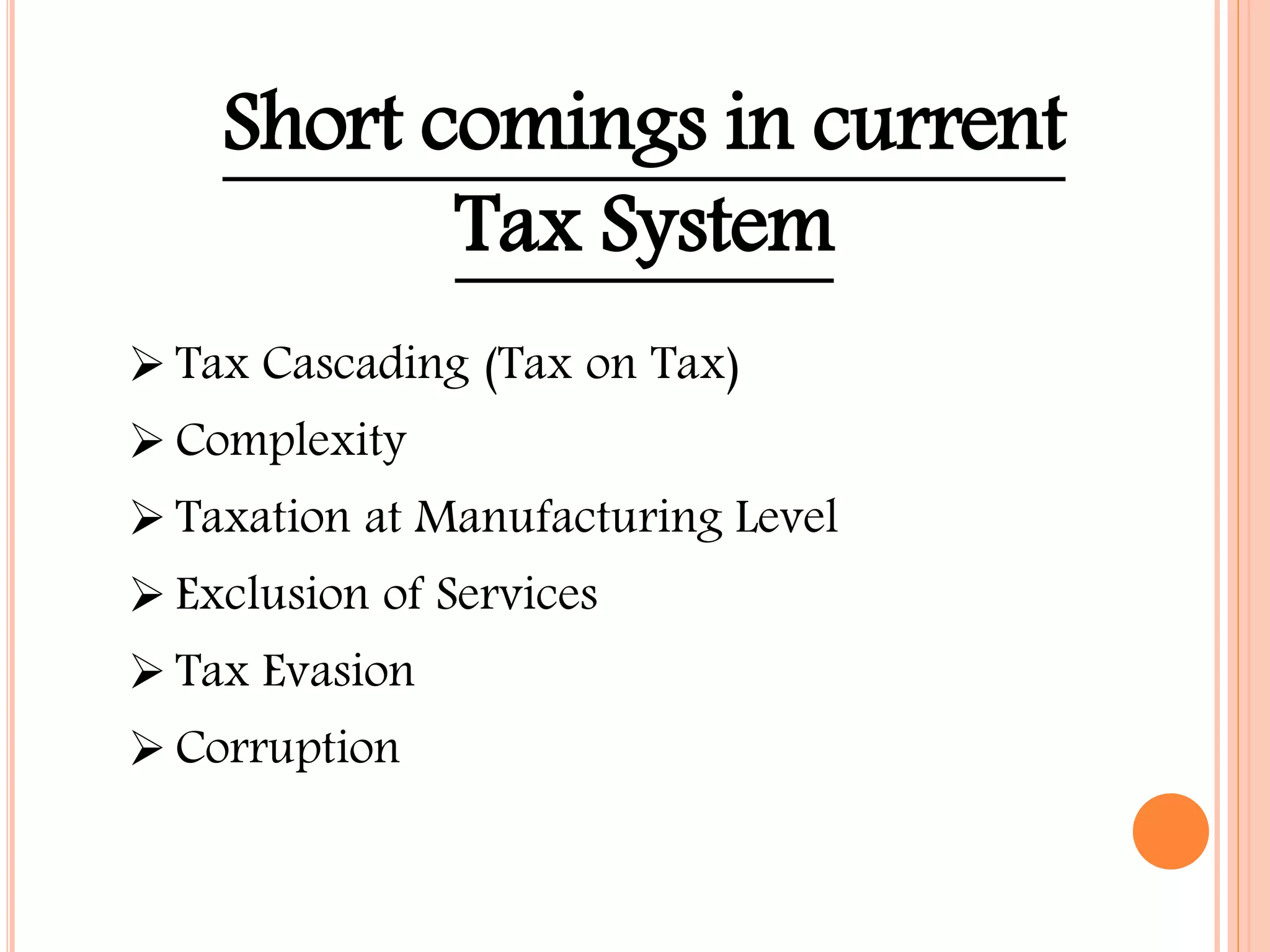

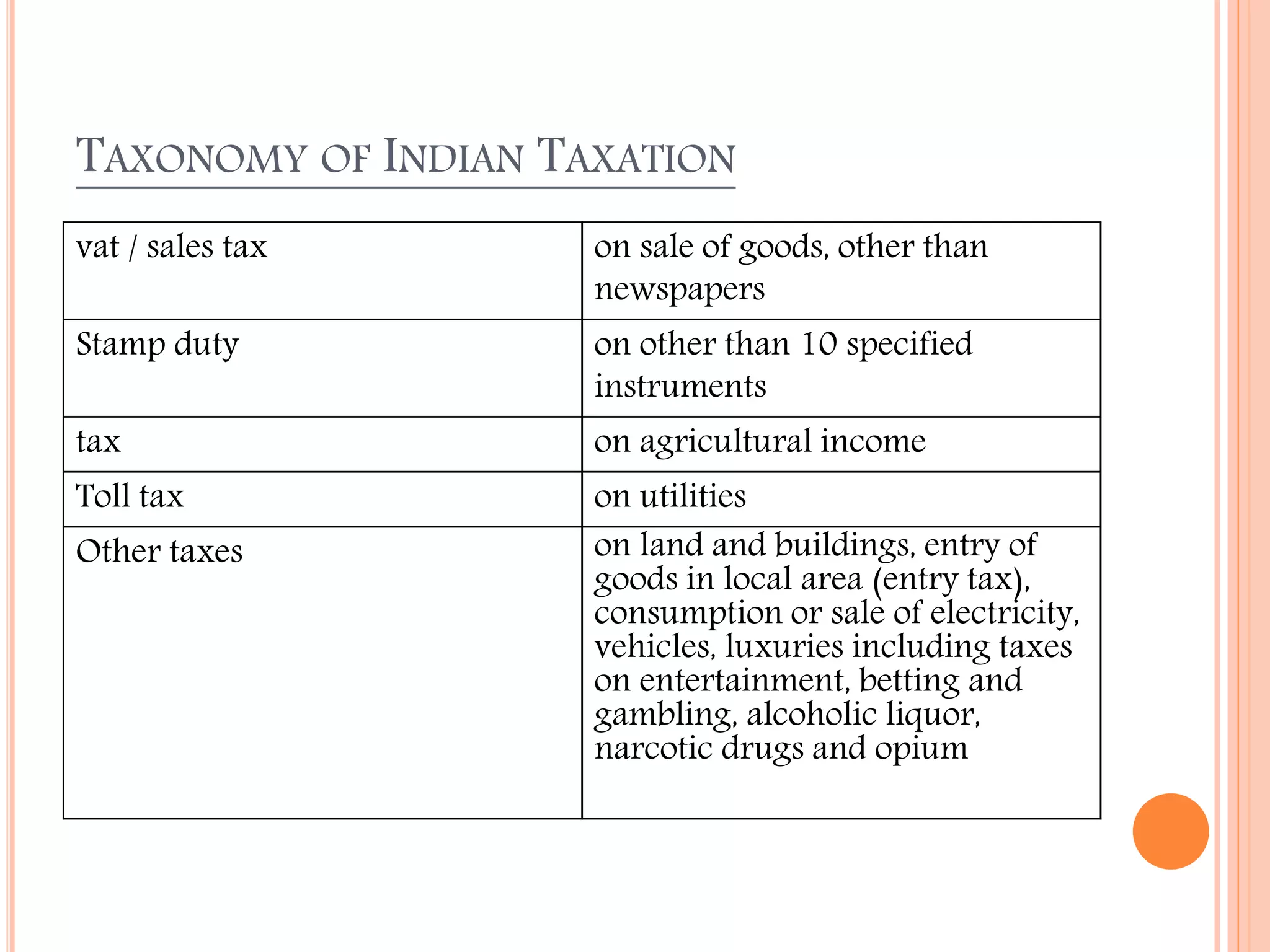

The Goods and Services Tax (GST) is a comprehensive national tax reform in India aimed at consolidating multiple indirect taxes into a single value-added tax on goods and services. It addresses issues like tax cascading, complexity, and evasion by implementing a dual tax structure administered by both central and state governments. While GST promises transparency and efficiency in the tax system, it faces challenges such as administrative coordination and the need for sophisticated IT infrastructure.