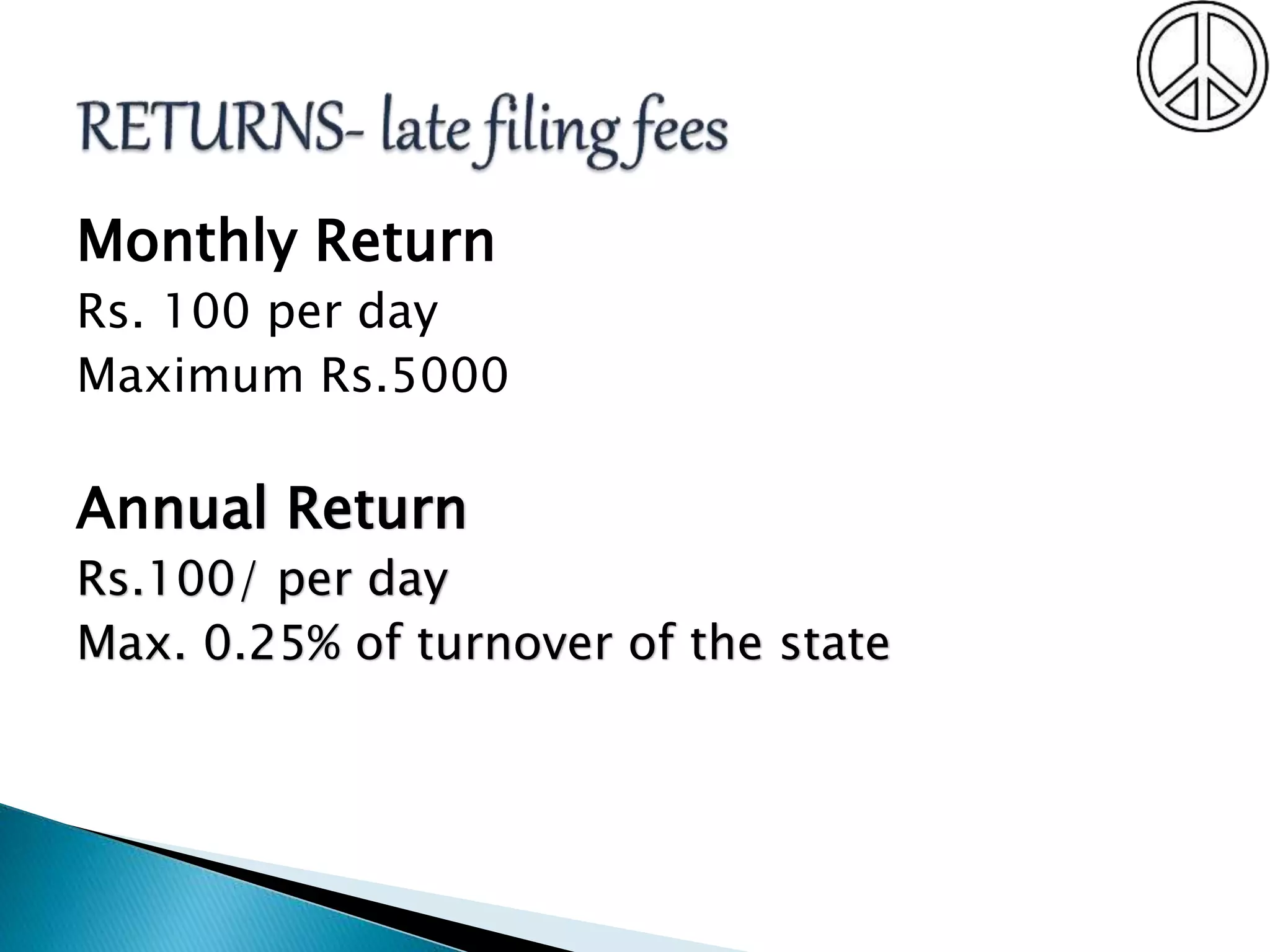

The document discusses Goods and Services Tax (GST) returns that businesses in India are required to file. It states that under GST, businesses must file three monthly returns (GSTR-1, GSTR-2, GSTR-3) and one annual return each year, totaling 37 returns. GSTR-1 contains outward supply/sales details. GSTR-2 contains purchase/input tax credit details. GSTR-3 is a summarized return generated from GSTR-1 and GSTR-2 with tax liability details. Failure to file returns on time results in late fees.