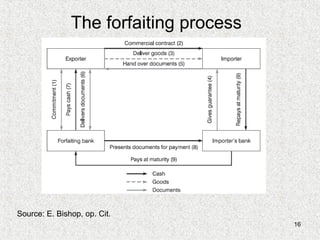

This document provides an overview of factoring and forfaiting as methods of trade finance. It defines factoring as the sale of receivables to a factoring institution without recourse. Forfaiting involves the sale of long-term debt resulting from export contracts to forfaiting institutions. Both methods allow exporters to convert credit transactions into cash flows. Factoring is used for short-term receivables, while forfaiting finances medium-term capital goods through the purchase of debt instruments.