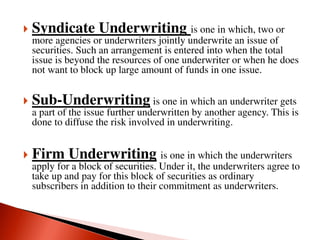

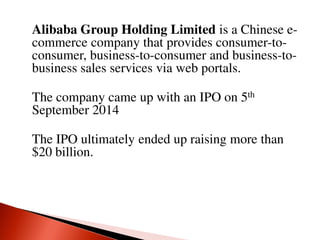

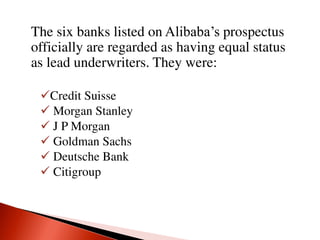

The document discusses underwriting, which is an agreement where underwriters take on the risk of purchasing securities from an issuer in the event that the public demand is insufficient. It describes different types of underwriting arrangements and the roles and responsibilities of underwriters. It also outlines the eligibility criteria, registration process, operational guidelines, and record keeping requirements for underwriters according to SEBI regulations in India. As an example, it summarizes that Alibaba's 2014 IPO raised over $20 billion with six major banks serving as equal lead underwriters.