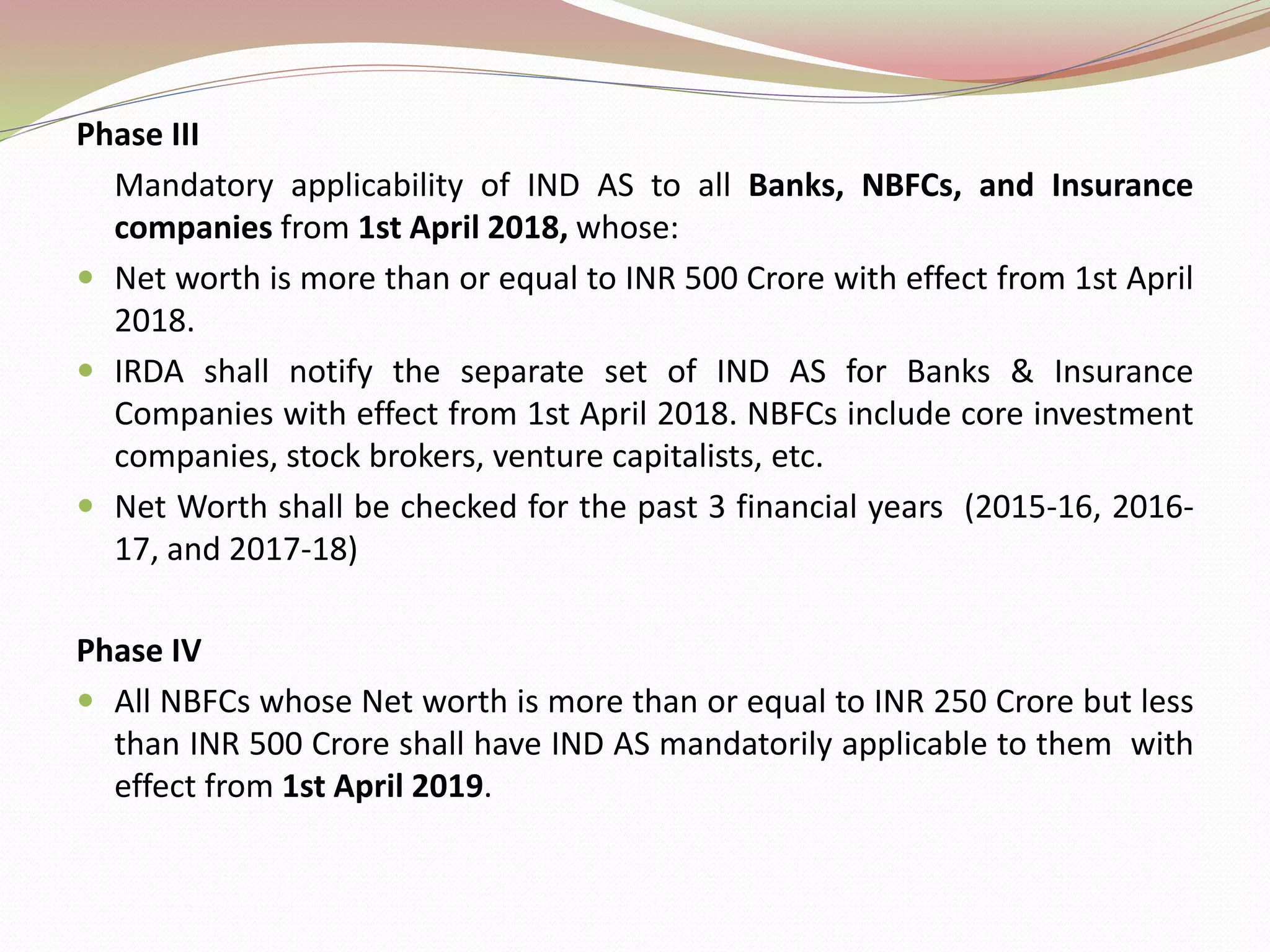

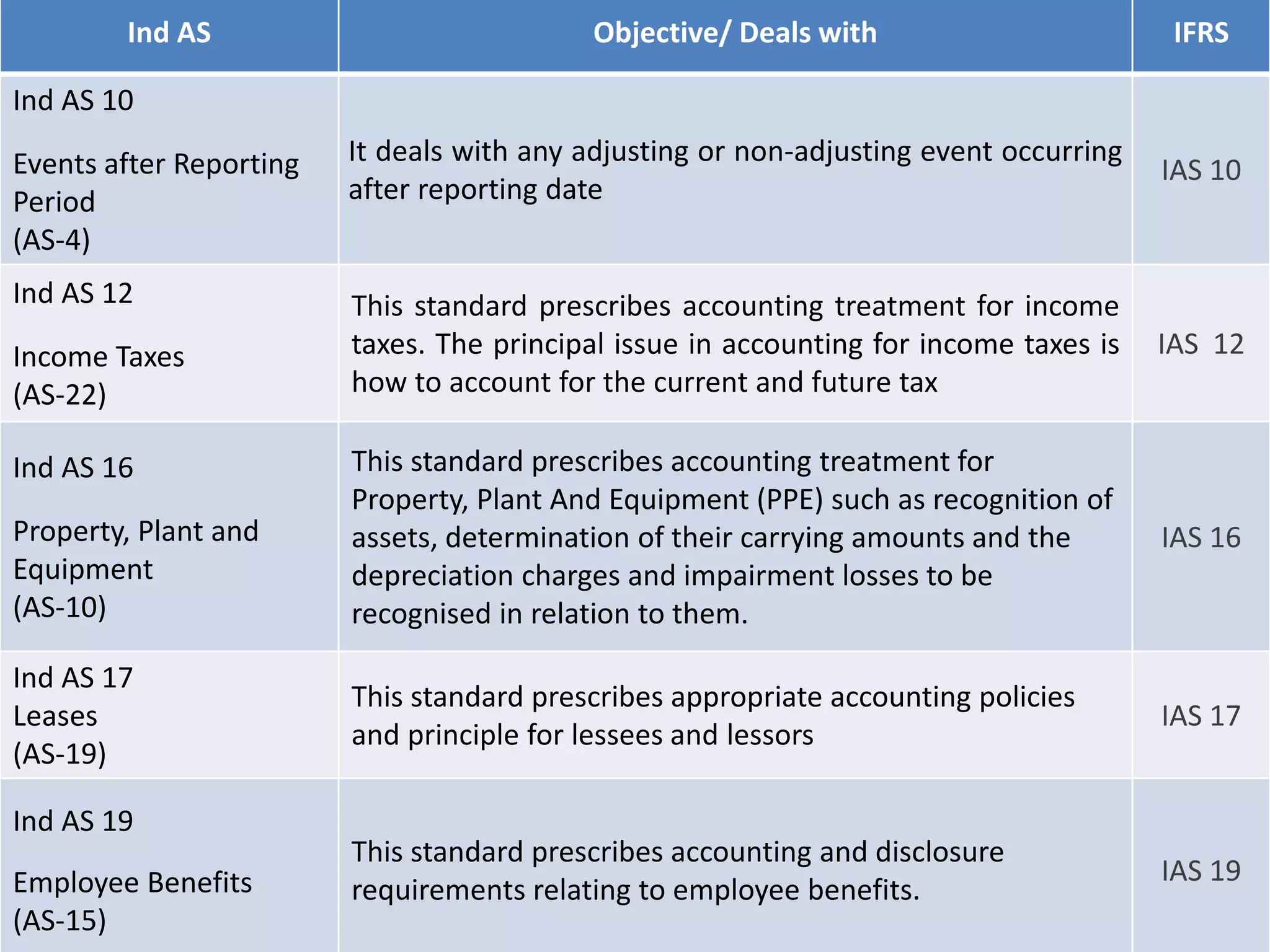

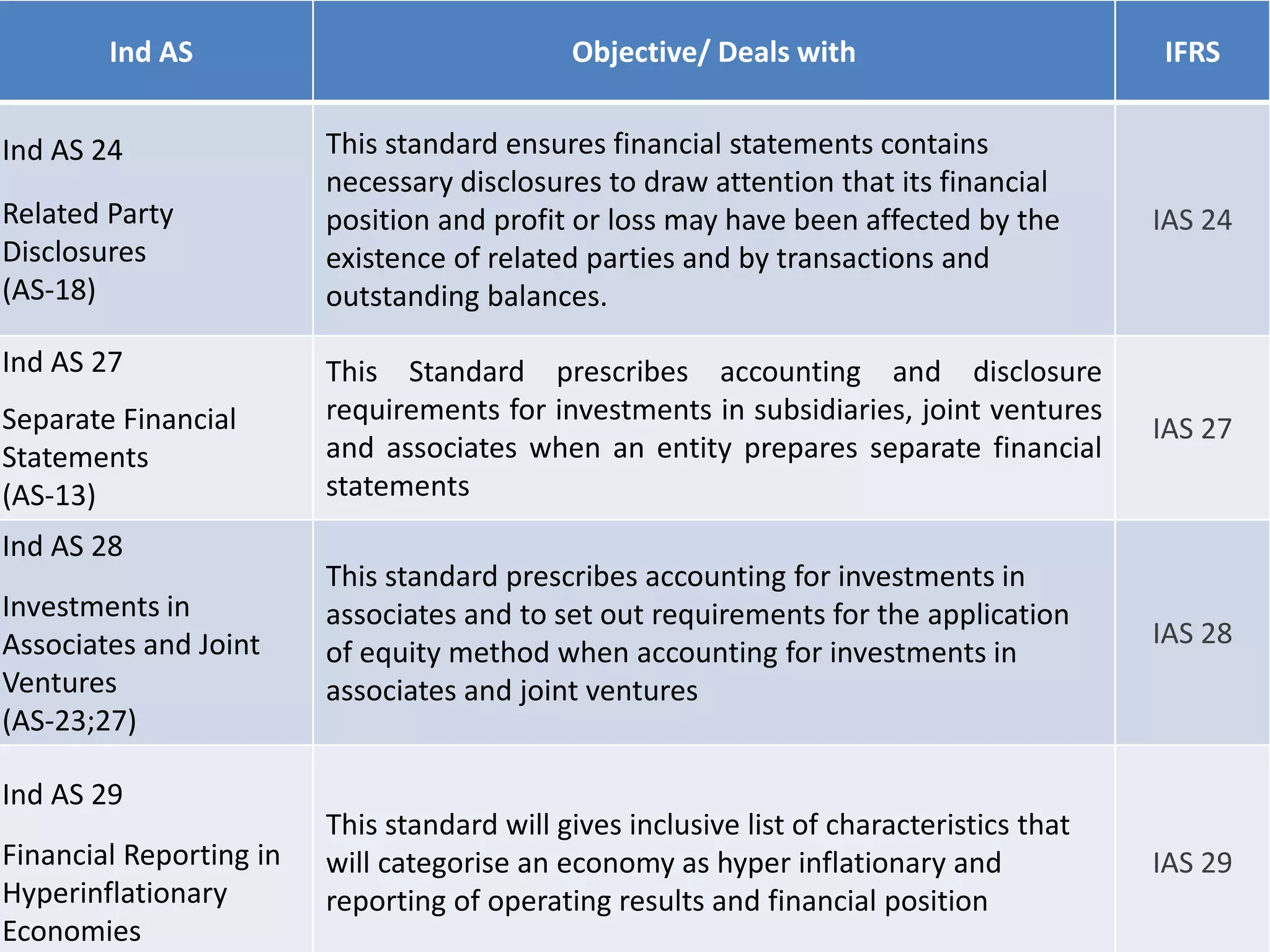

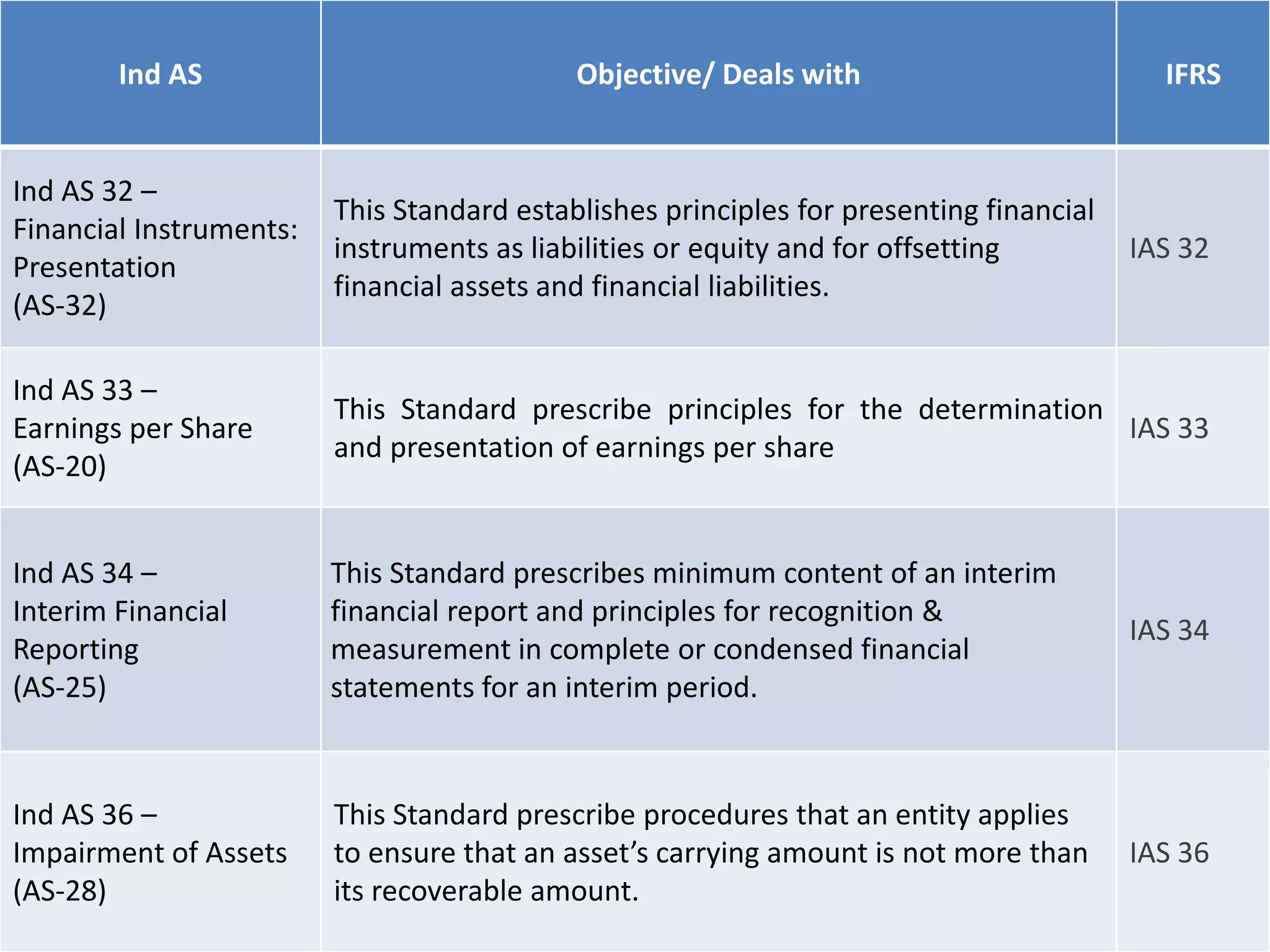

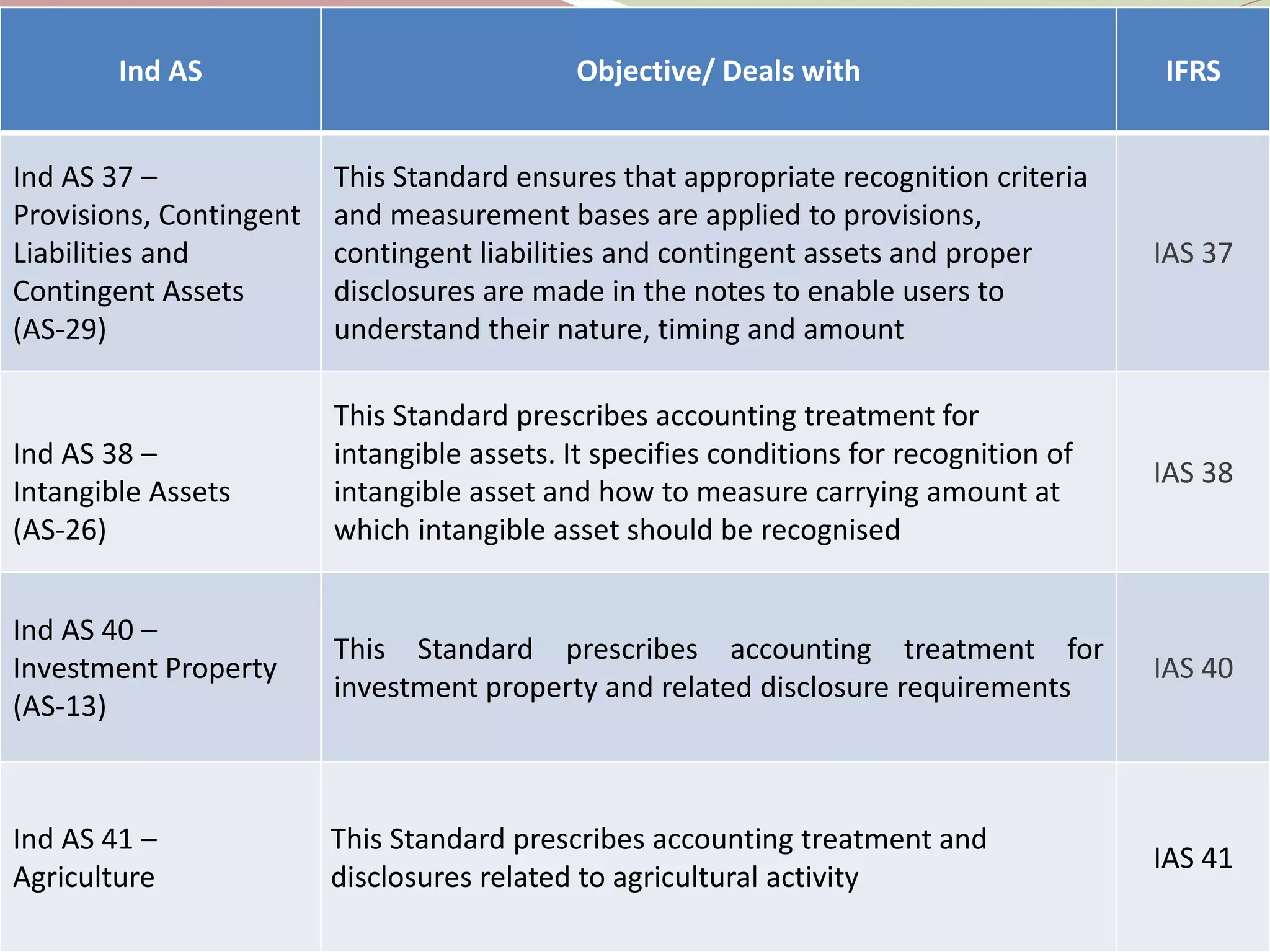

The document discusses the phases of adoption of Indian Accounting Standards (Ind AS) in India. It explains that Ind AS are converged standards based on International Financial Reporting Standards (IFRS) applicable from April 1, 2016. It outlines the phases of mandatory applicability for different types of companies based on net worth and listing status. Phase I made Ind AS mandatory for listed/unlisted companies with net worth over Rs. 500 crore from 2016-17. Phase II applies to listed companies and those in the listing process with net worth between Rs. 250-500 crore from 2017-18. Phase III covers banks, NBFCs and insurance companies with over Rs. 500 crore net worth from 2018-19. Phase IV