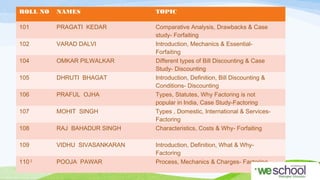

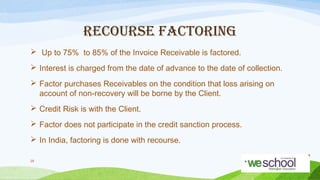

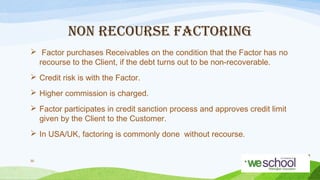

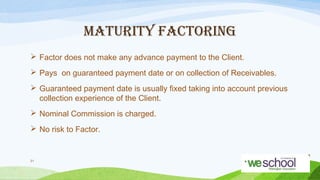

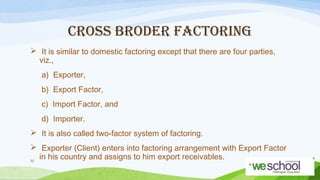

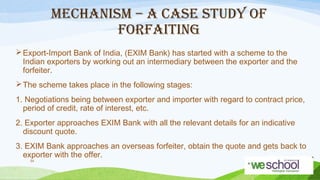

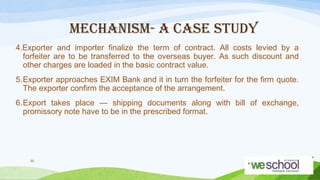

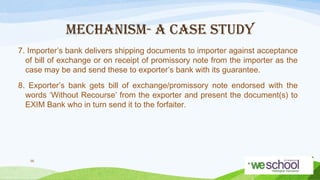

This document provides an overview of discounting, factoring, and forfaiting. It includes a table assigning topics to different students for research projects. The introduction defines discounting as converting future values to present values. Bill discounting involves a bank buying a bill from a customer before its due date and crediting the customer's account, less a discount charge. Factoring involves a financial organization purchasing a manufacturer's receivables and assuming credit and collection responsibilities. Forfaiting specifically deals with receivables related to deferred payment exports, where the exporter surrenders rights to payment to a forfaiter in exchange for upfront cash.