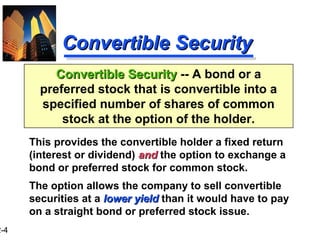

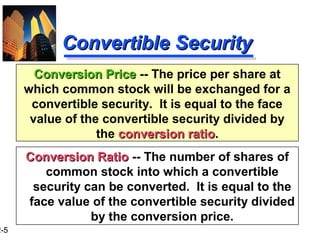

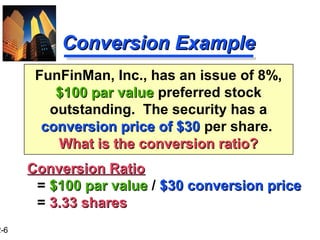

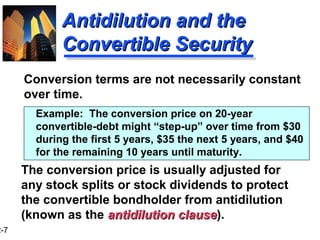

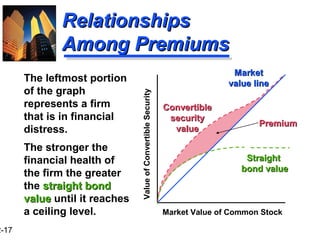

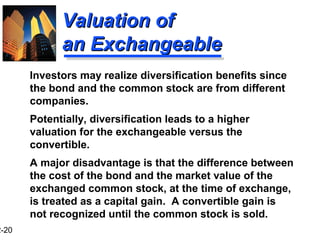

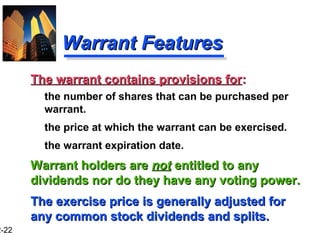

This document defines and discusses various types of derivative securities, including convertible securities, exchangeable bonds, and warrants. Convertible securities provide holders with a fixed return like interest or dividends, as well as the option to exchange the security for common stock. Exchangeable bonds allow holders to exchange the bond for stock in another company. Warrants are long-term options to purchase common stock at a specified price. The value of these securities depends on factors like the value of the underlying stock, volatility, and time to expiration. Convertible securities in particular offer downside protection as well as participation in stock upside.

![2-26

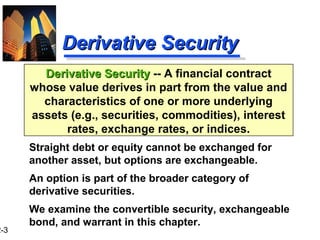

Valuation of a WarrantValuation of a Warrant

Theoretical value of aTheoretical value of a

warrant:warrant:

maxmax [ (NN)(PPss) - EE, 00]

N = number of shares perN = number of shares per

warrantwarrant

PPss = market price of one= market price of one

share of stockshare of stock

E = exercise priceE = exercise price

associated with theassociated with the

purchase of N sharespurchase of N shares

WarrantValue

Associated Common Stock Price

TheoreticalTheoretical

value linevalue line

45o

MarketMarket

value linevalue line

ExerciseExercise

priceprice](https://image.slidesharecdn.com/ch22-180315073237/85/Financial-Management-Slides-Ch-22-26-320.jpg)

![2-27

Example of theExample of the

Valuation of a WarrantValuation of a Warrant

Theoretical value of aTheoretical value of a

warrant:warrant:

maxmax [ (NN)(PPss) - EE, 00]

N = 1N = 1, PPss = $10= $10 , E = $5E = $5

maxmax[(11)($10$10)-$5$5, 00] = $5$5

N = 1N = 1, PPss = $15= $15 , E = $5E = $5

maxmax[(11)($15$15)-$5$5, 00] =$10$10

WarrantValue

Associated Common Stock Price

$5$5

$10$10

Stock appreciates 50%Stock appreciates 50%

Theoretical warrantTheoretical warrant

value appreciates 100%value appreciates 100%

MinimumMinimum

value is 0.value is 0.](https://image.slidesharecdn.com/ch22-180315073237/85/Financial-Management-Slides-Ch-22-27-320.jpg)