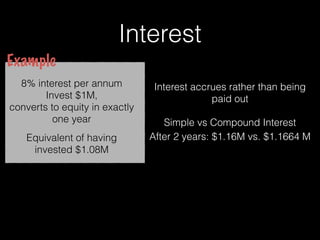

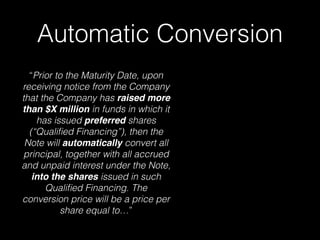

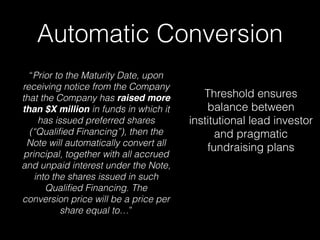

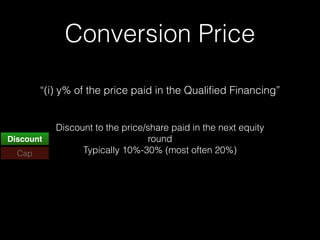

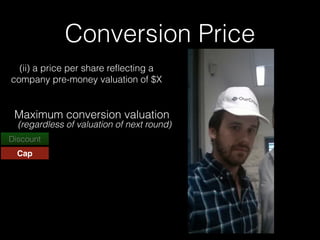

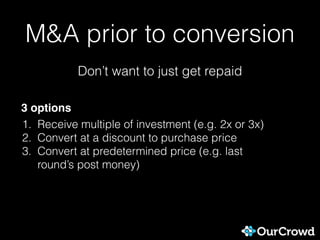

This document provides an overview of key concepts related to term sheets in equity crowdfunding, focusing on aspects such as liquidation preferences, pro rata rights, and convertible notes. It outlines the benefits and considerations for both investors and entrepreneurs regarding convertible loans, detailing mechanisms for automatic conversion, interest rates, and conversion pricing strategies. The importance of terms like discount caps and maintaining control during fundraising is emphasized to secure favorable outcomes for investors.