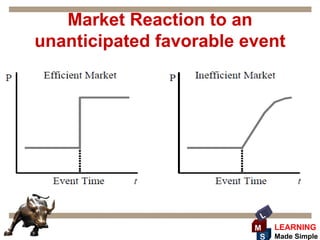

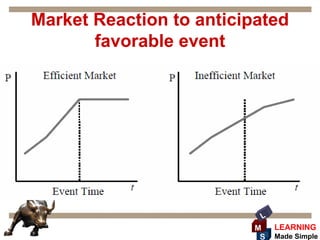

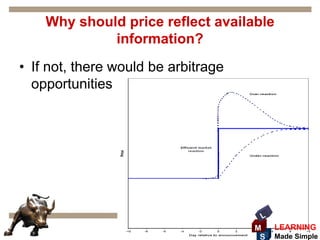

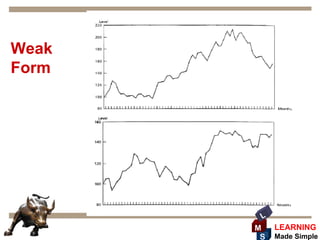

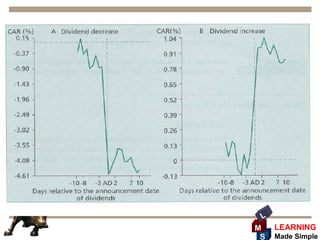

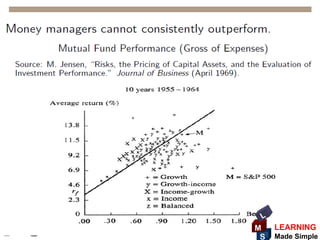

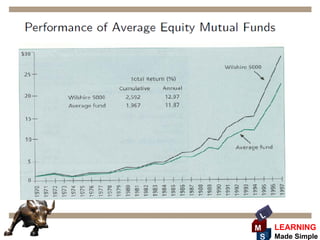

The efficient market hypothesis proposes that security prices reflect all available information. It comes in three forms: weak (only past prices), semi-strong (all public information) and strong (all information). Evidence supports weak and semi-strong forms, showing prices adjust to new public information. The hypothesis implies that fundamental analysis and technical analysis may not identify mispriced securities. It also provides support for low-cost index funds. While influential, the hypothesis makes assumptions and some strategies have achieved above-average returns.