The document provides an introduction to behavioral finance, including:

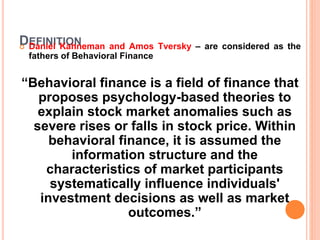

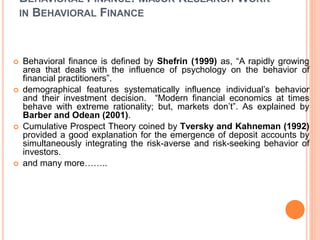

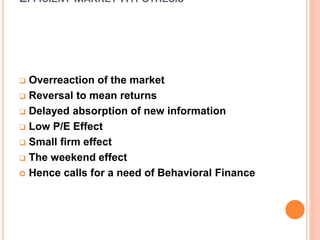

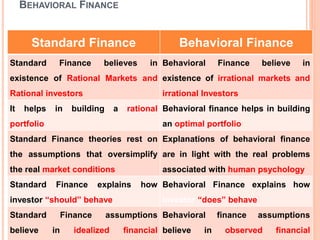

1) Behavioral finance uses insights from psychology to understand puzzling stock market phenomena not explained by traditional finance which assumes rational markets and investors.

2) Some key objectives of behavioral finance are to review issues with standard finance, examine theories of both approaches, and identify investor personalities.

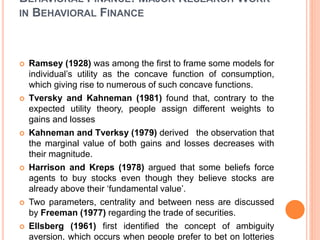

3) Major figures who helped develop behavioral finance include Daniel Kahneman and Amos Tversky who formulated prospect theory as an alternative to models assuming rational choices.