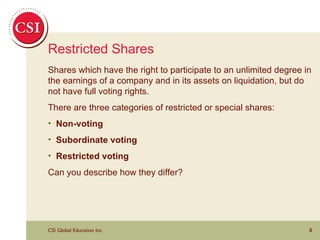

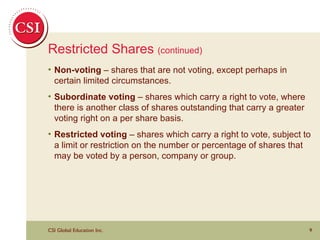

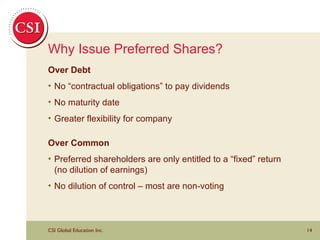

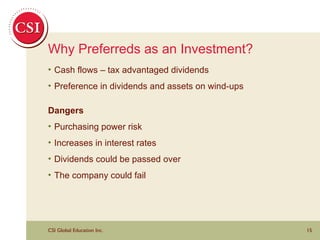

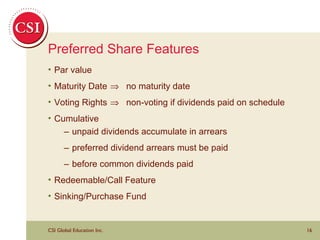

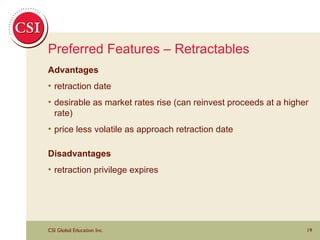

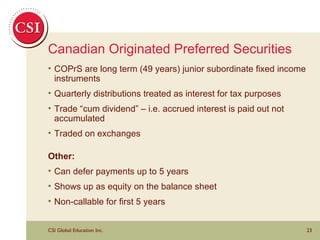

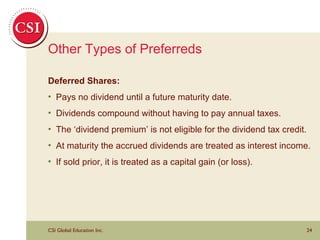

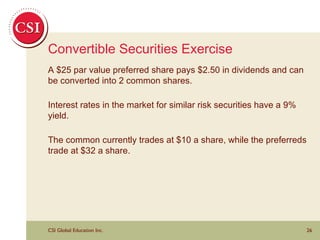

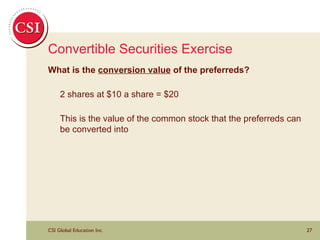

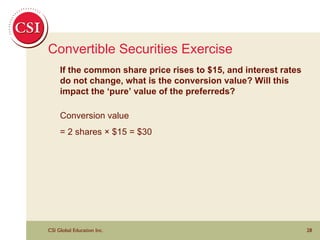

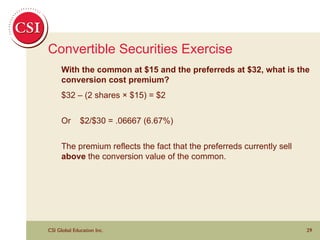

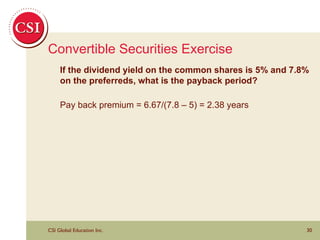

The document discusses various types of equity securities including common shares, preferred shares, and convertible securities. Common shares provide potential capital appreciation and dividends but come with more risk than preferred shares. Preferred shares entitle holders to fixed dividends that are paid out before common dividends but offer less upside potential. Convertible securities can be exchanged for common shares at a predetermined price and trade at the higher of their conversion value or pure investment value.