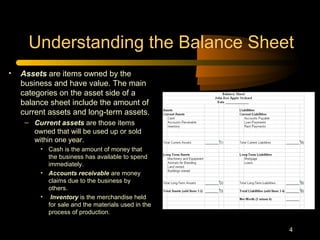

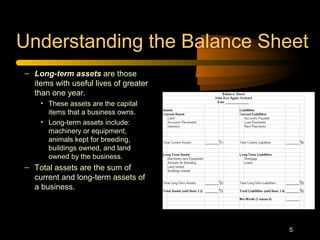

1. The document discusses key financial statements - balance sheets, income statements, and cash flow statements - that are used to understand the financial health and performance of agribusinesses.

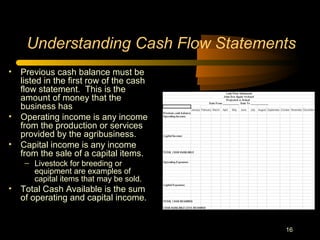

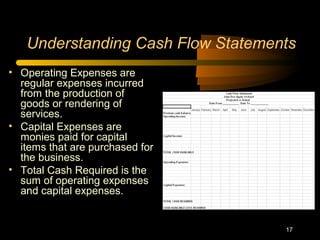

2. Balance sheets summarize assets, liabilities, and net worth on a given date. Income statements show profits and losses over a period of time. Cash flow statements indicate cash inflows and outflows.

3. The financial statements are used to analyze the feasibility, risk, and profitability of agribusinesses through liquidity ratios (like current ratio), solvency ratios (like debt-to-asset ratio), and profitability ratios (like return on assets). High liquidity, solvency, and profit