This document provides an overview of key financial statements and how to read them, including:

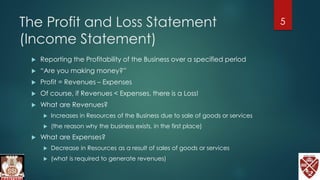

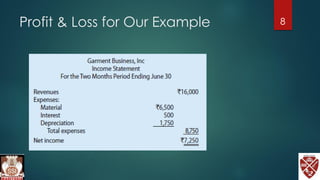

- The profit and loss statement (income statement) shows profitability over time by outlining revenues and expenses. It answers whether a business is making money.

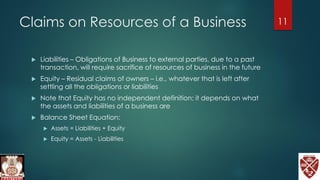

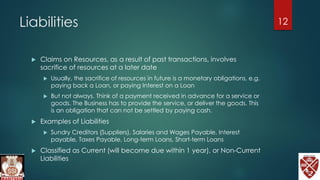

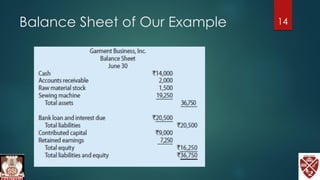

- The balance sheet presents the financial position at a point in time by listing assets, liabilities, and equity (owner's claim on assets). Assets must equal liabilities plus equity.

- The cash flow statement tracks cash inflows and outflows from operating, investing and financing activities to determine if adequate cash is available.

- Financial statements communicate important information to owners, lenders, and investors to assess performance, risks and future potential.