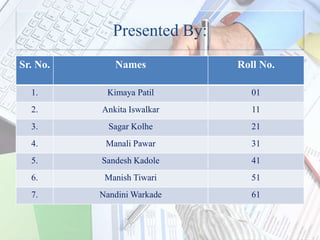

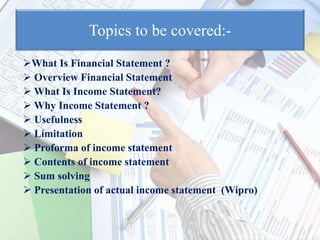

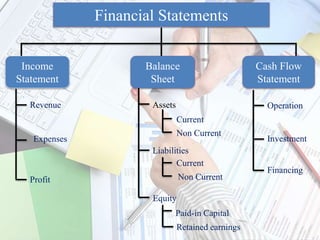

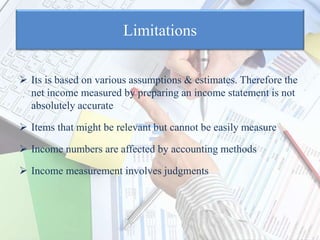

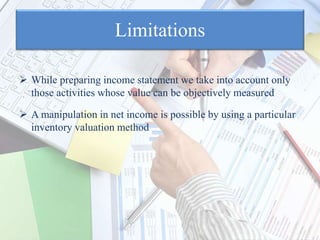

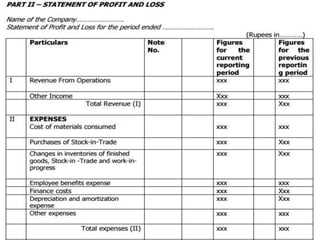

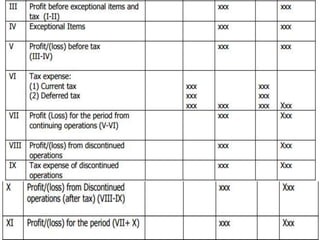

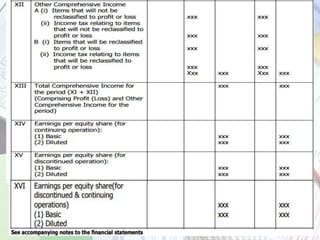

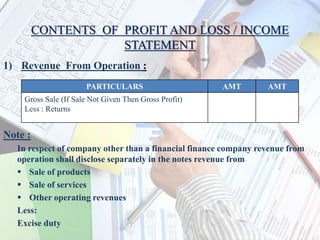

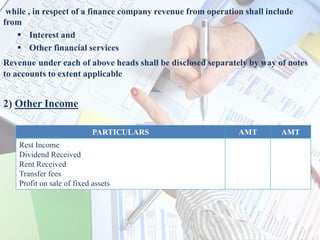

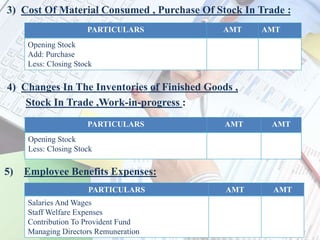

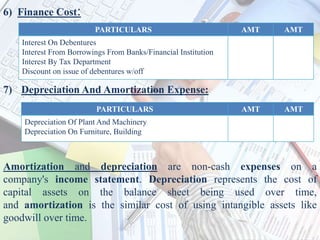

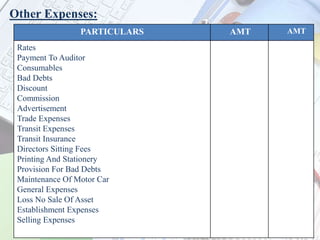

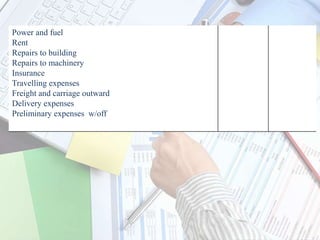

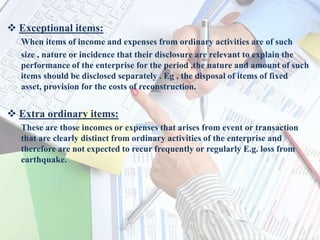

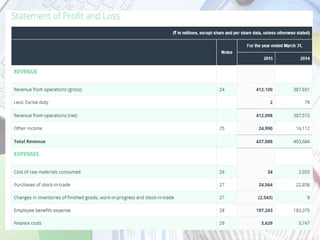

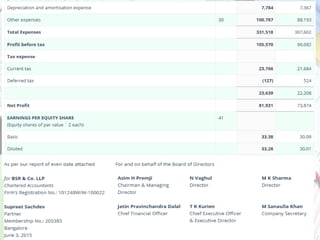

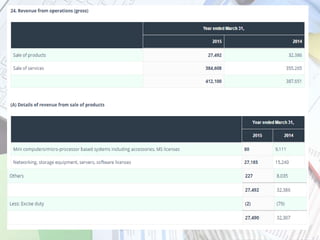

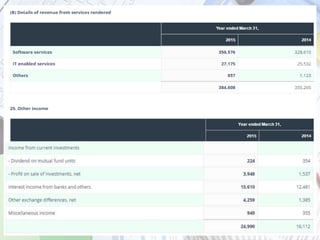

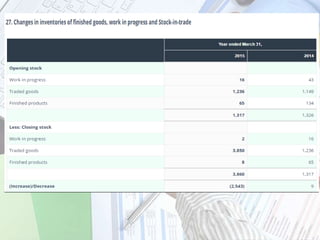

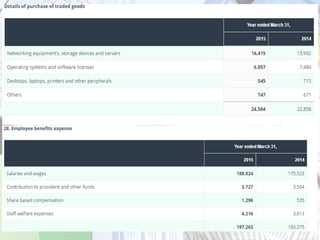

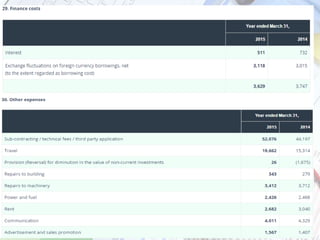

This document contains information about an upcoming presentation on financial statements. It lists the names and roll numbers of 7 presenters and the topics they will cover, including an overview of financial statements, the income statement, its purpose, components and limitations. It provides examples of the components of an income statement, such as revenue, expenses, net income. It concludes by listing an actual income statement from Wipro's 2014-15 annual report.