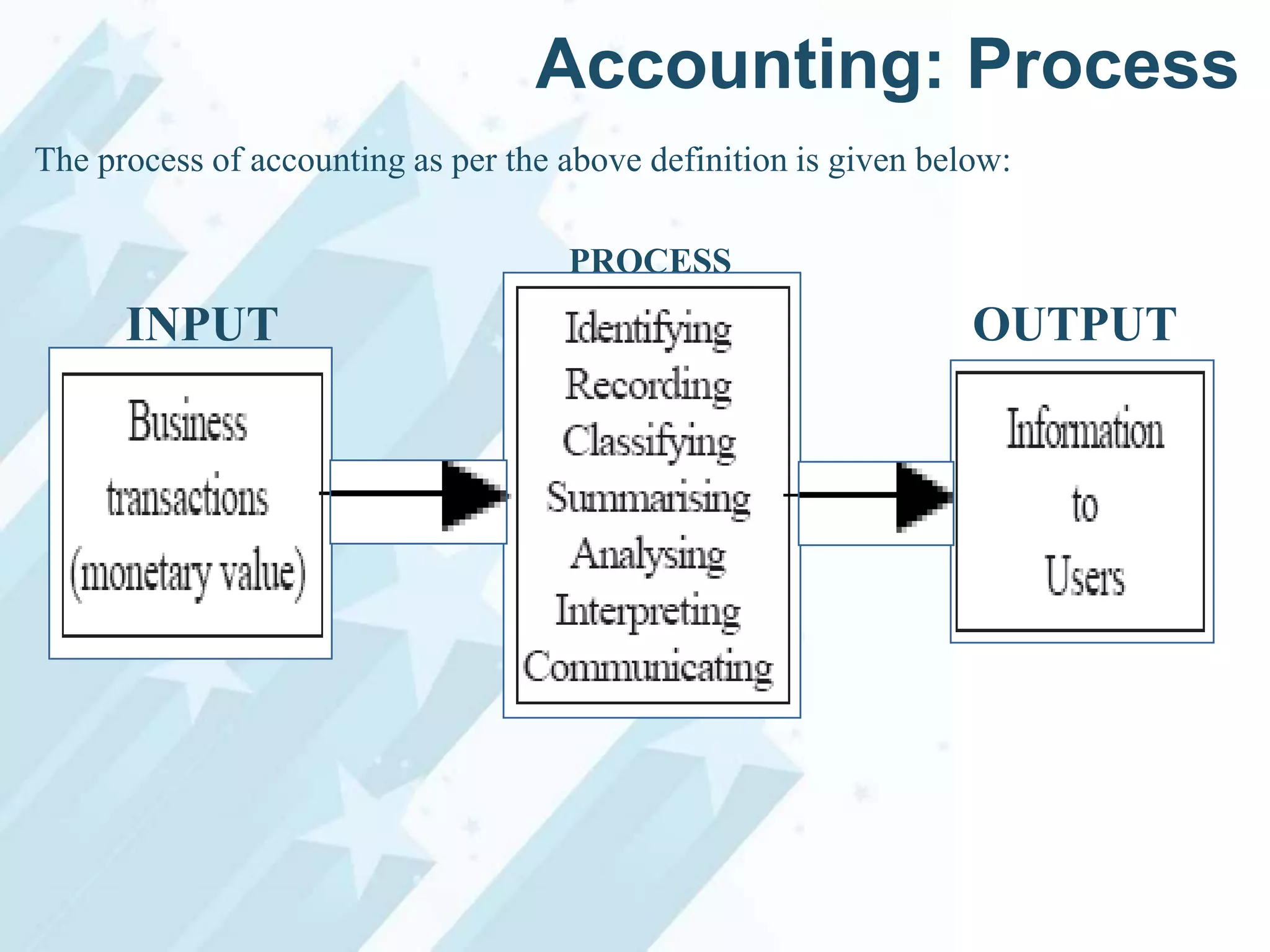

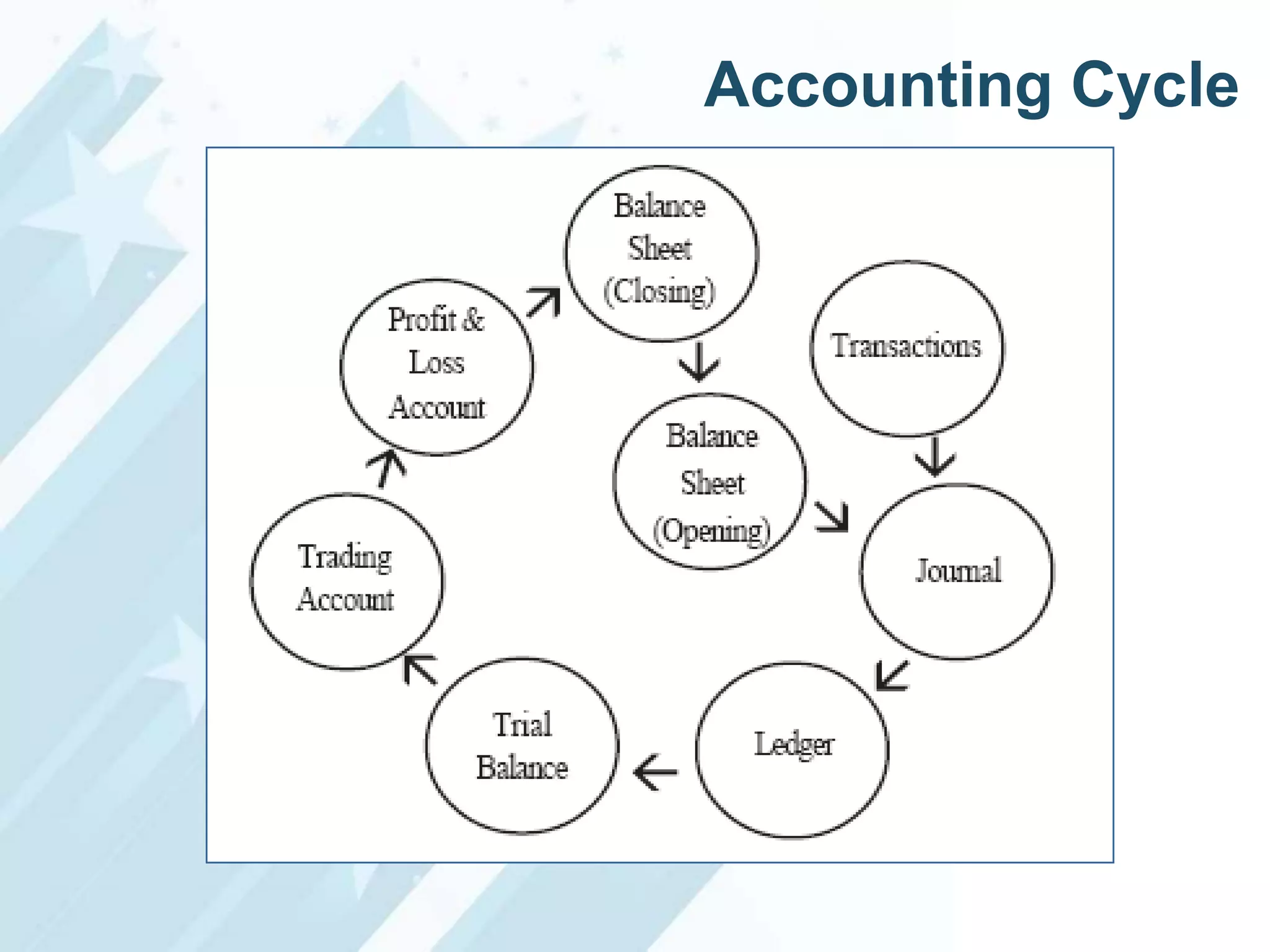

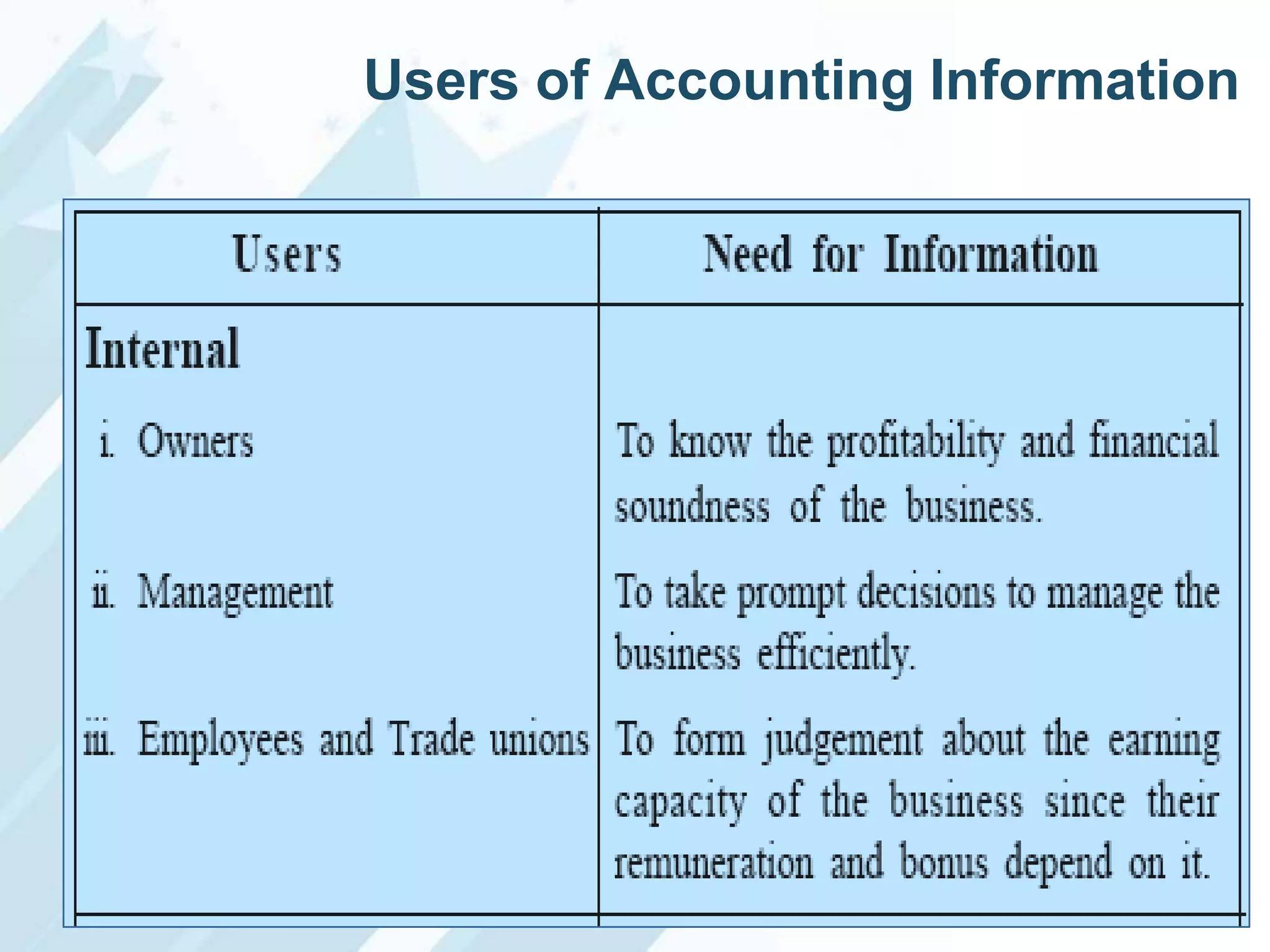

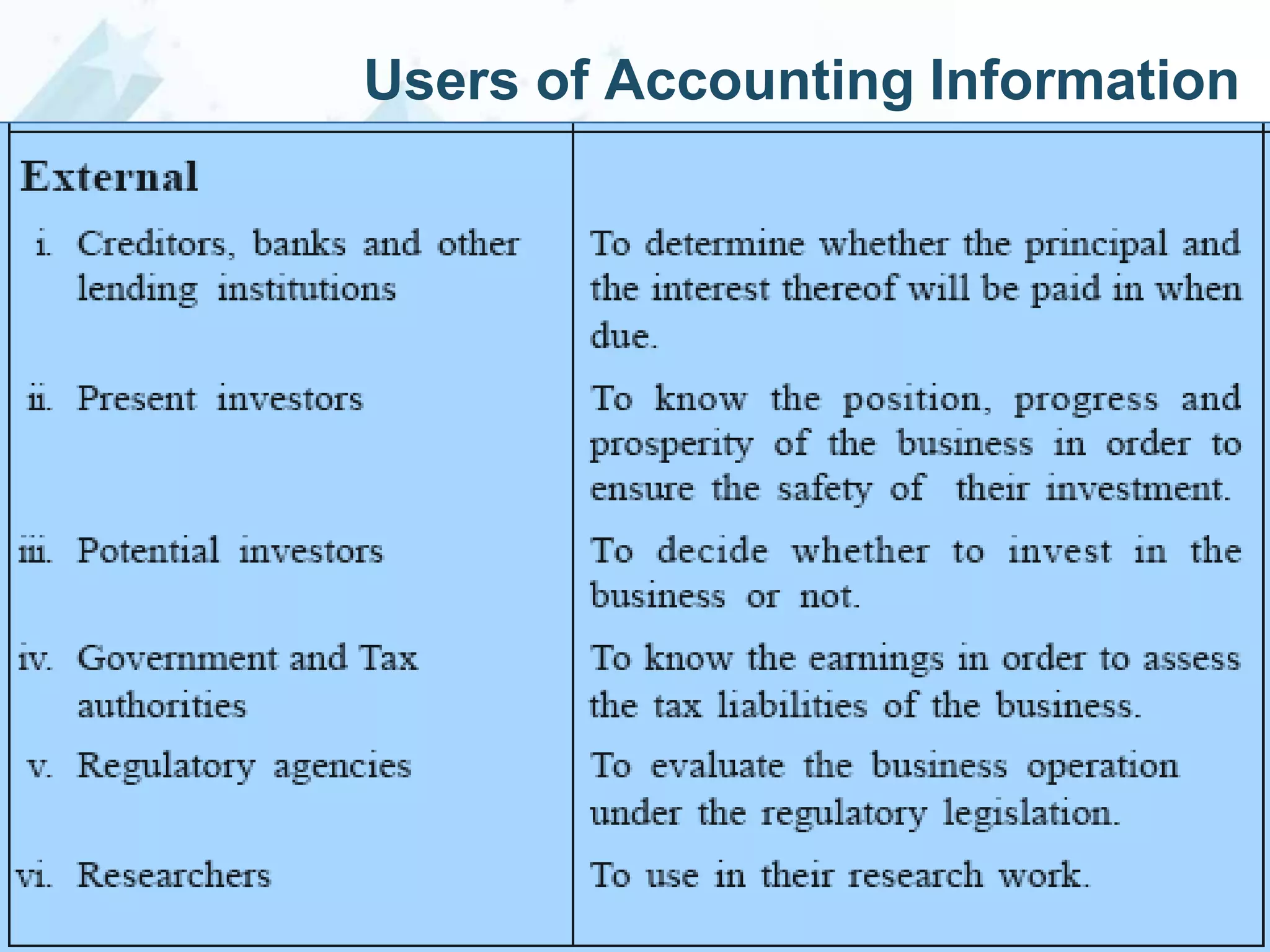

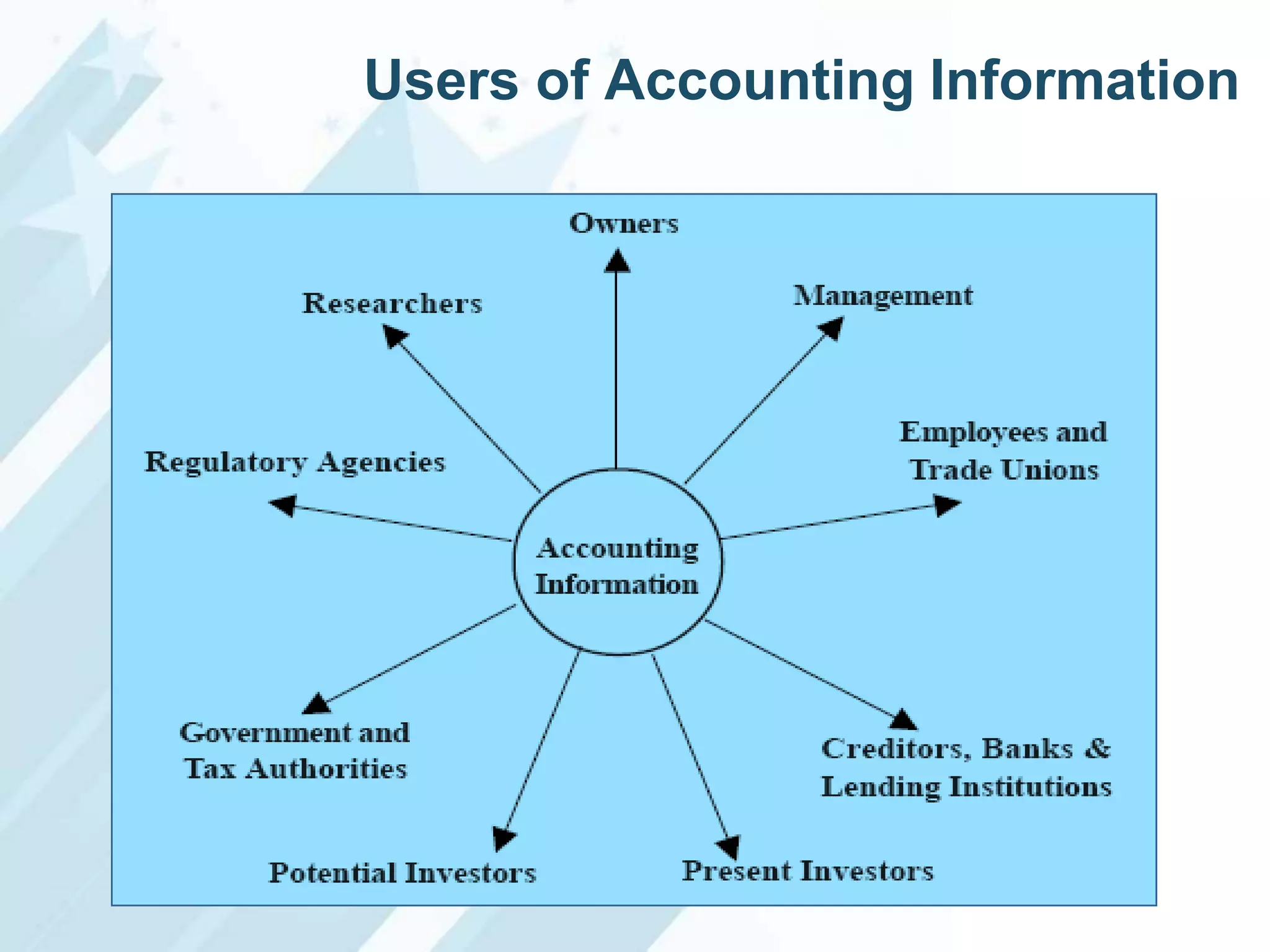

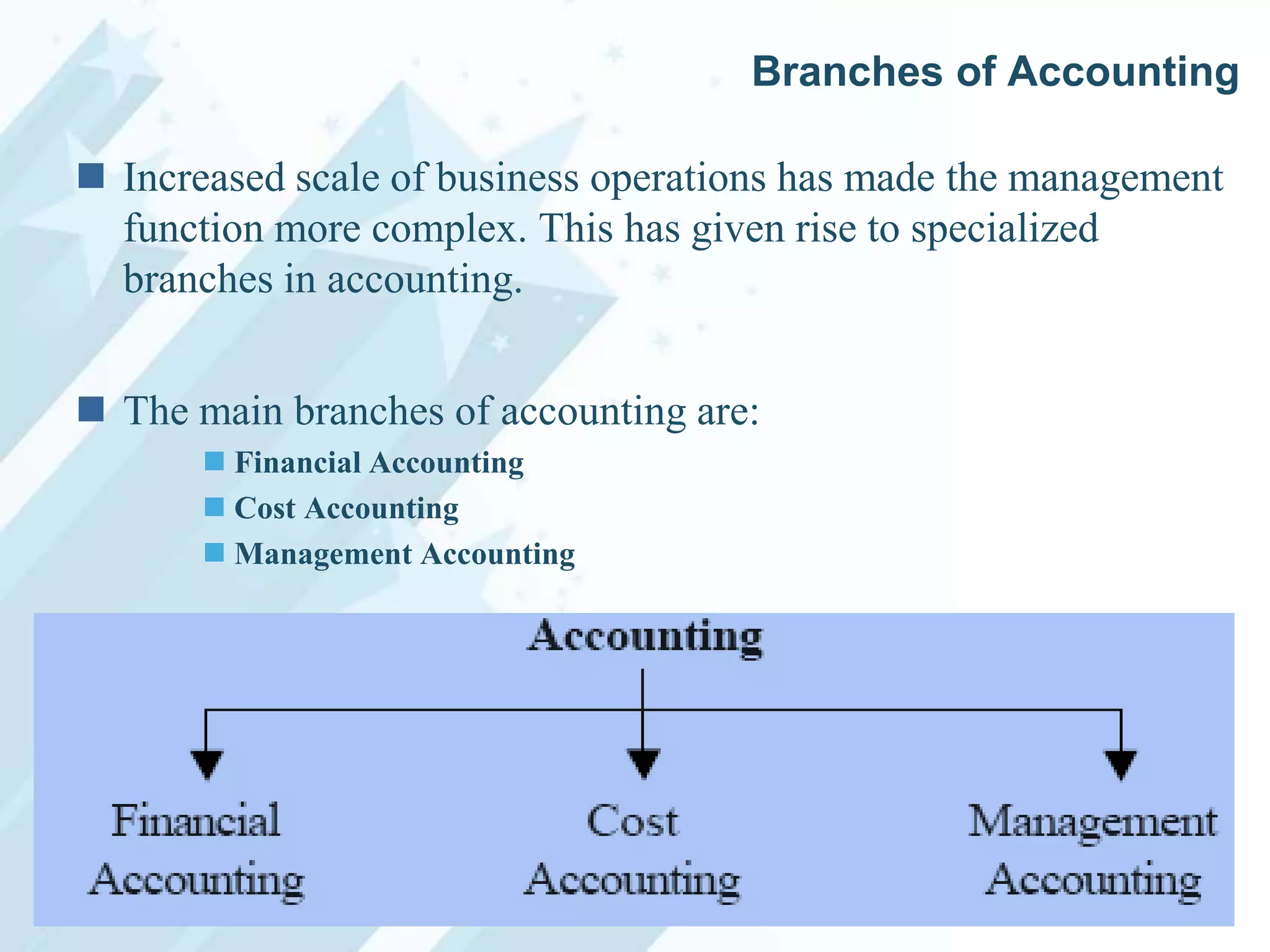

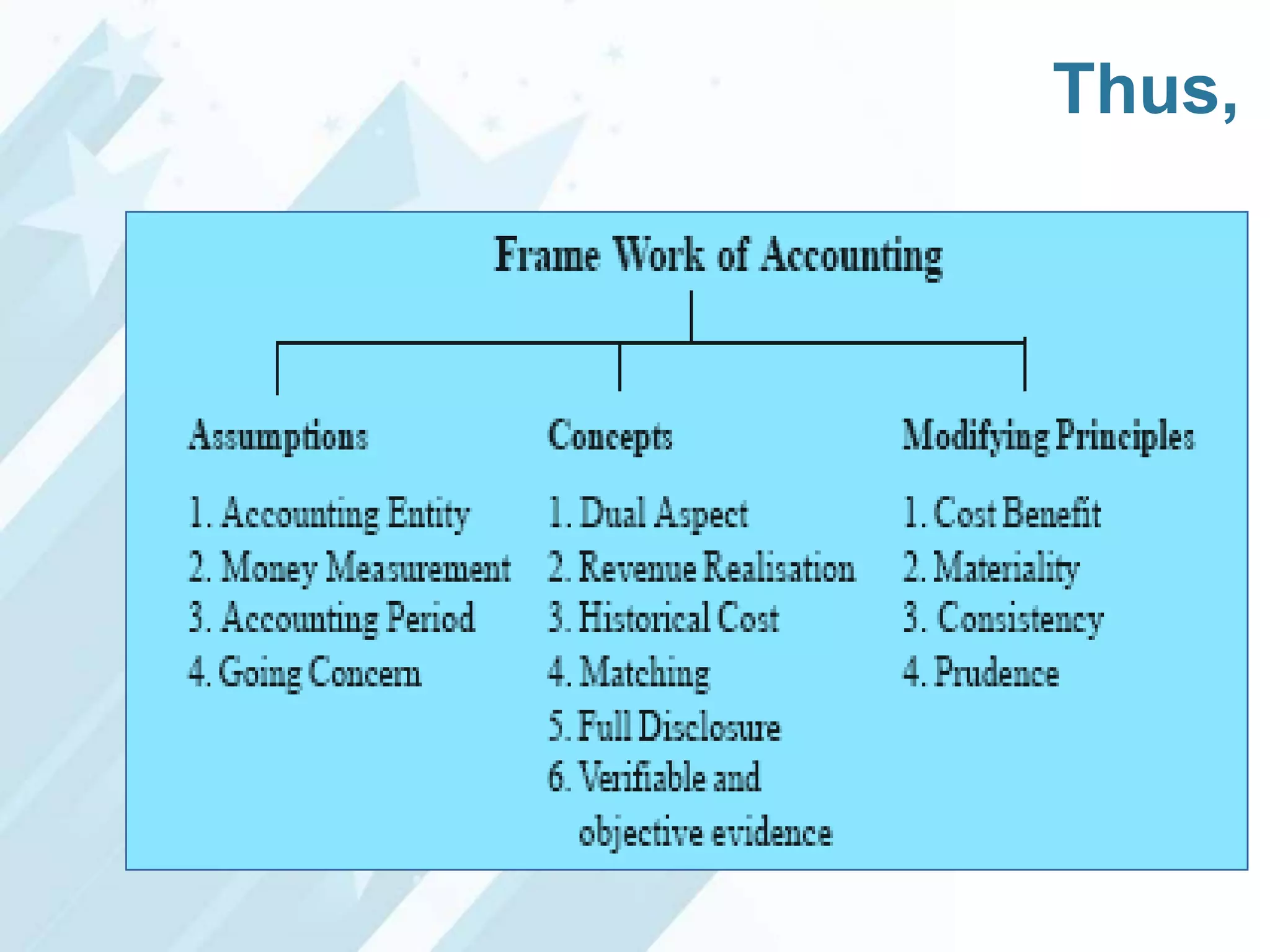

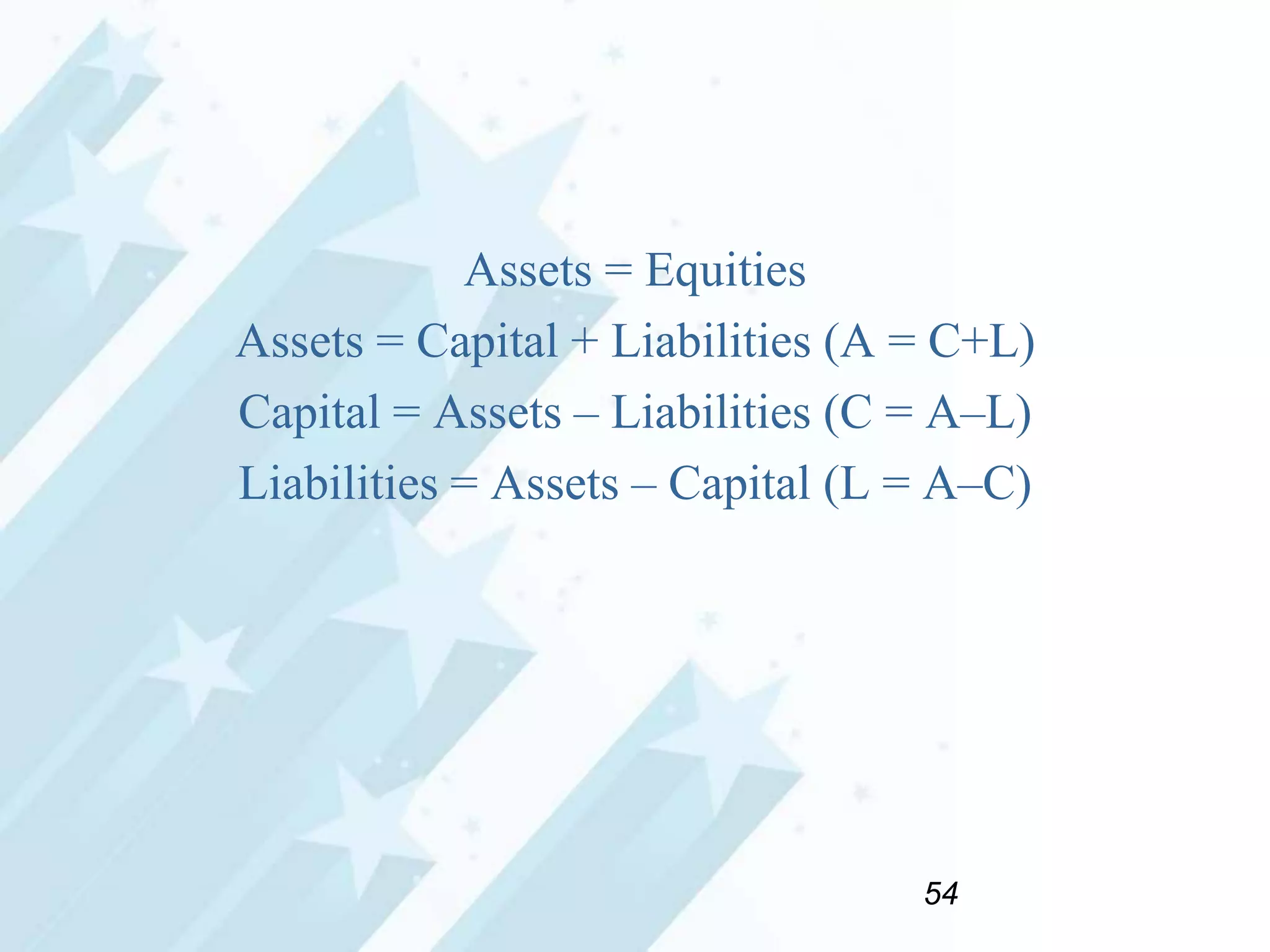

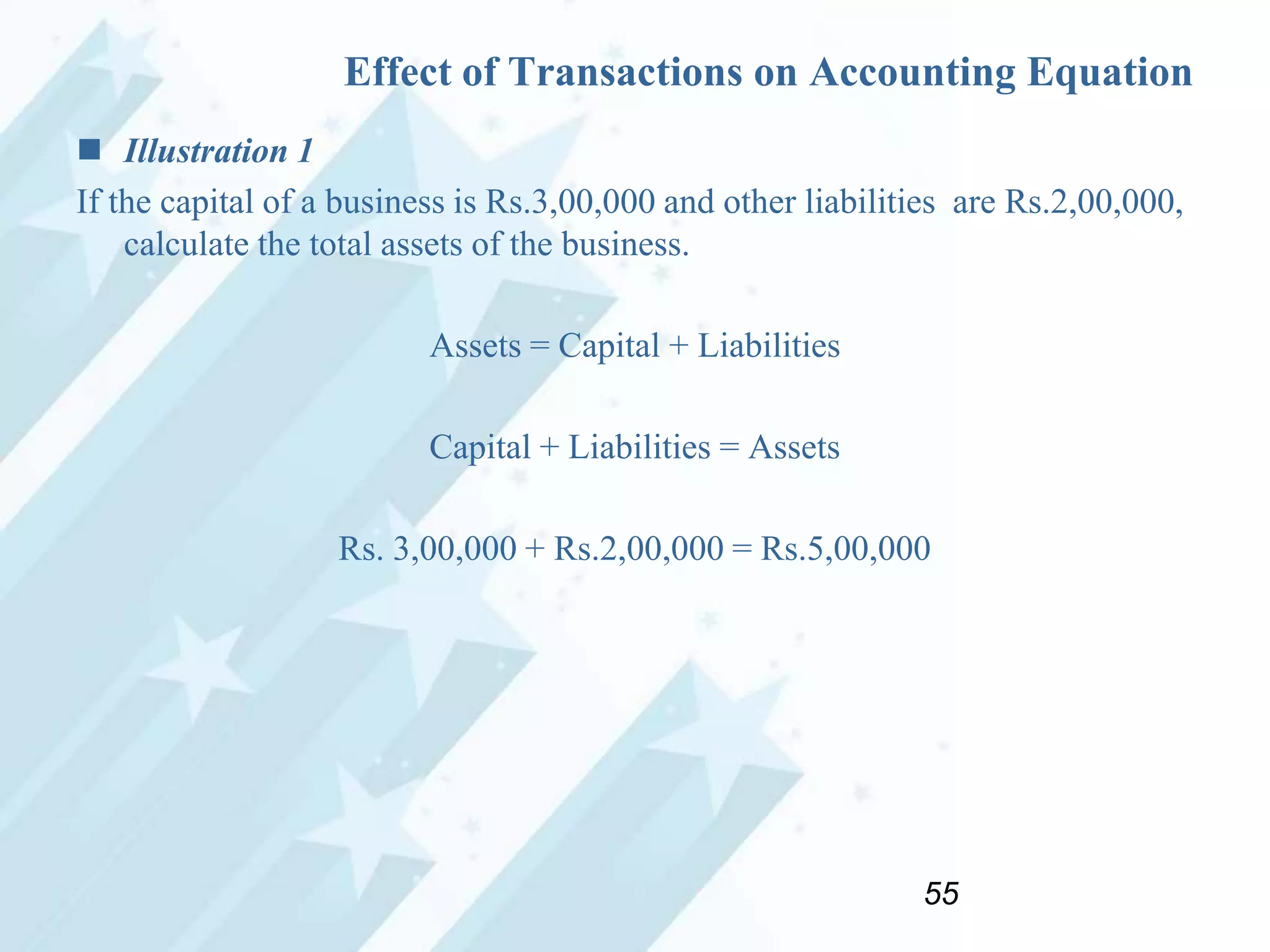

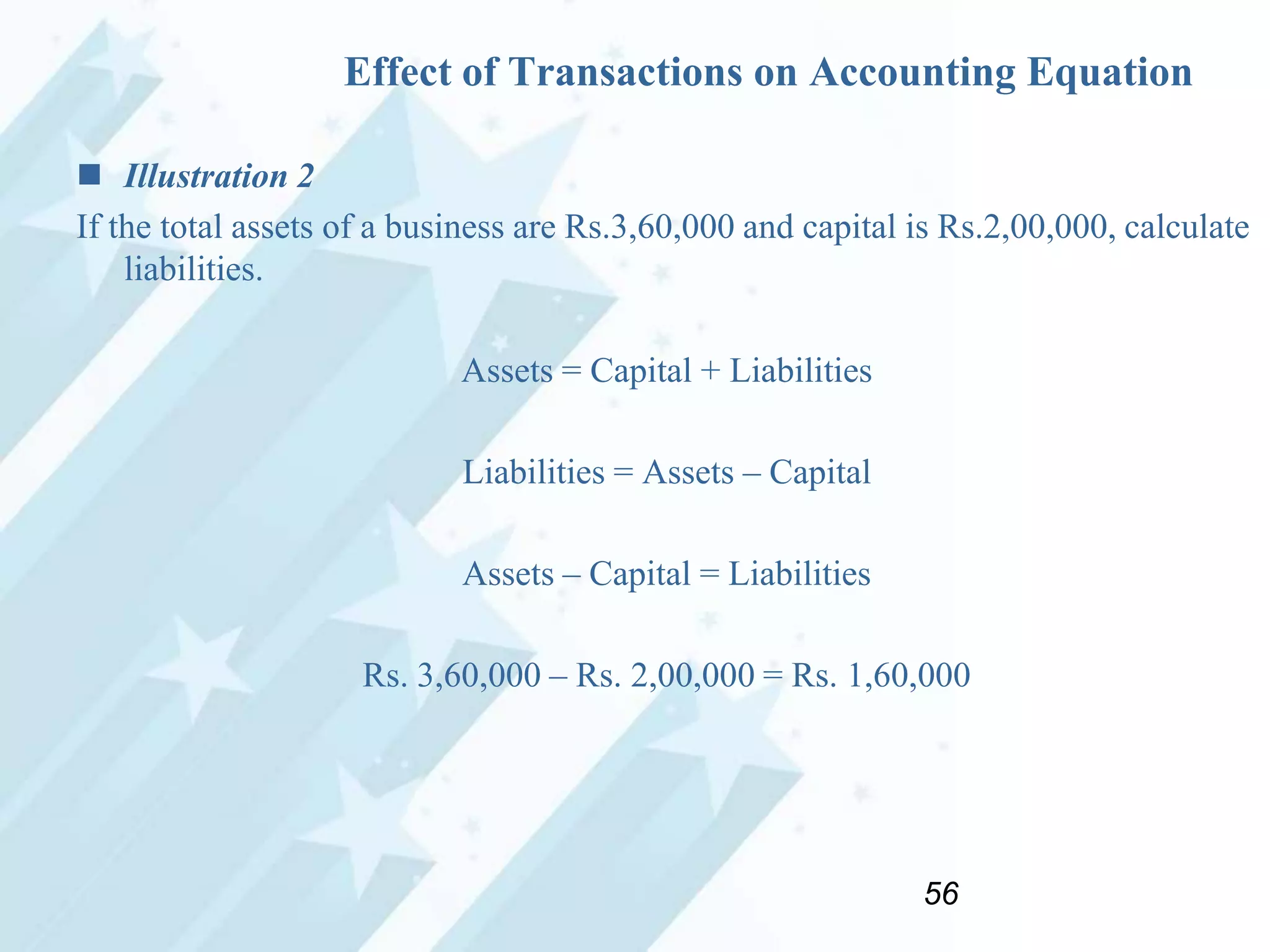

This document provides an introduction to the concepts of accounting. It defines accounting as a system that collects and processes financial information to allow informed decisions by users. It discusses the need for accounting to determine results of business transactions and the financial position. It outlines the key functions of accounting like identifying, recording, classifying, summarizing, analyzing, interpreting and communicating financial information. It also discusses the accounting cycle and different branches and users of accounting information. Finally, it provides definitions of some basic accounting terms.