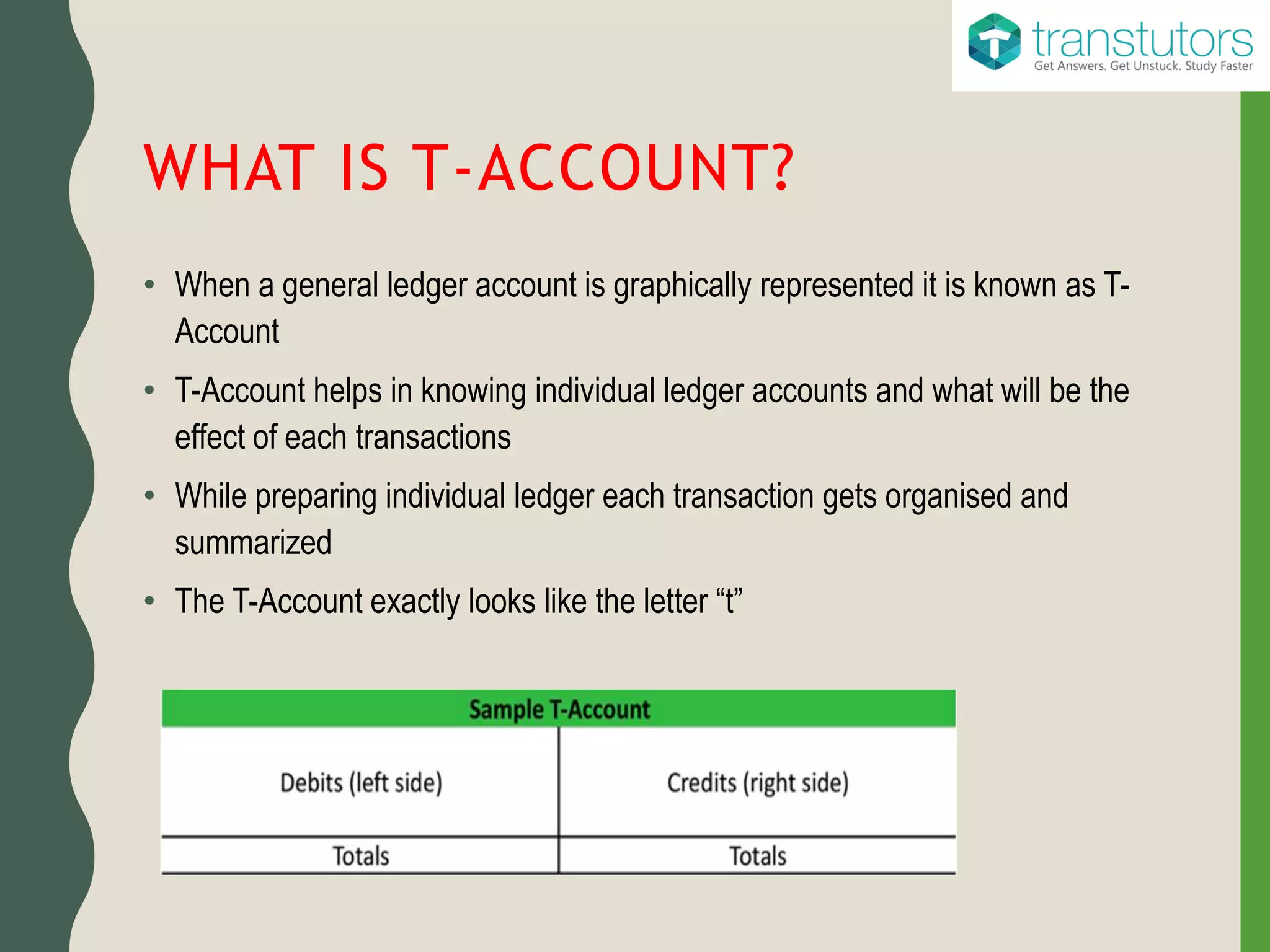

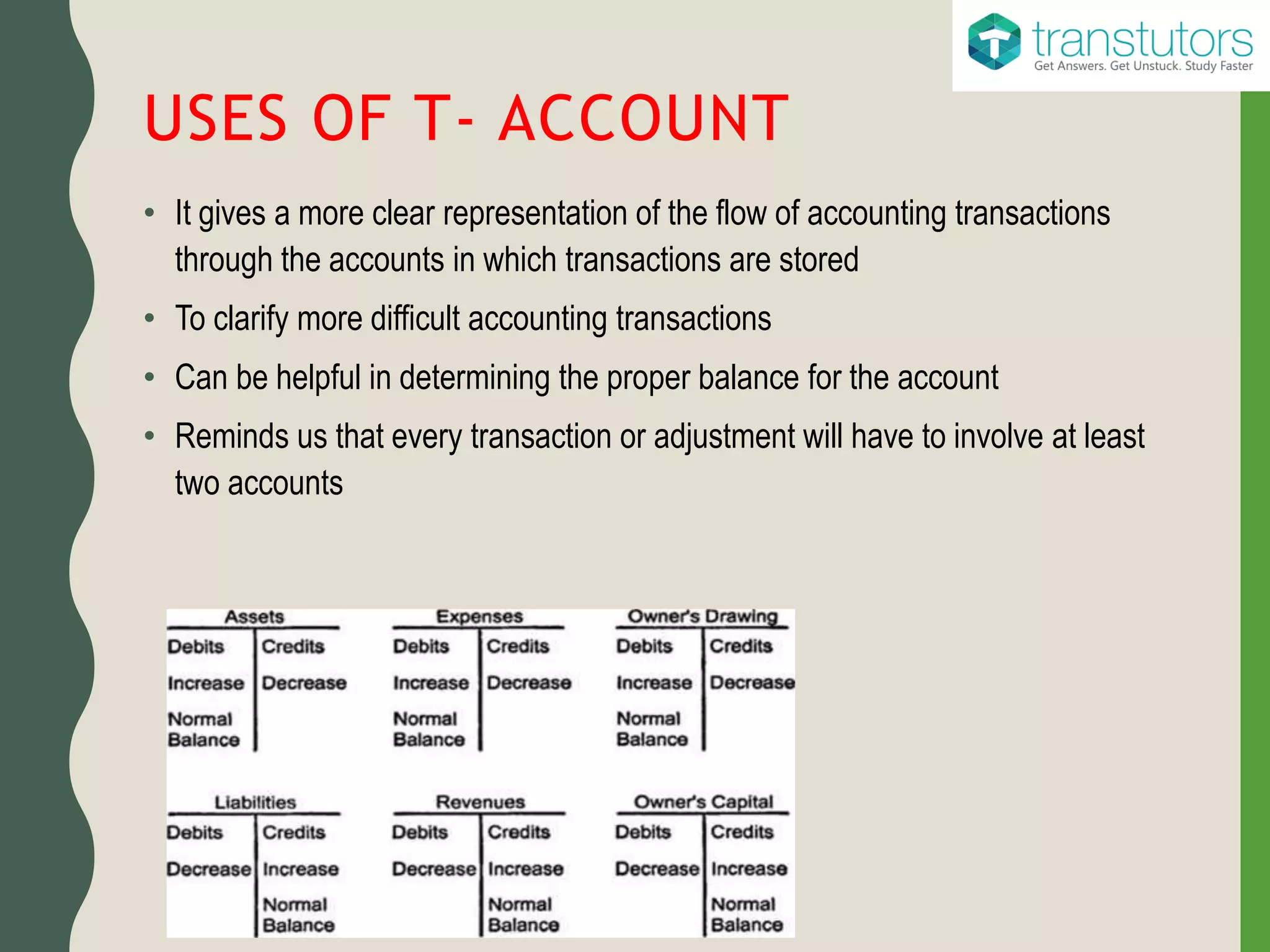

A T-account is a graphical representation of a general ledger account divided into debit and credit columns, used to illustrate the effects of transactions. It is a key tool in double-entry bookkeeping, reflecting that every financial transaction affects at least two accounts to maintain the accounting equation. The T-account includes columns for date, explanation, folio, and the amount to provide clarity on accounting transactions.