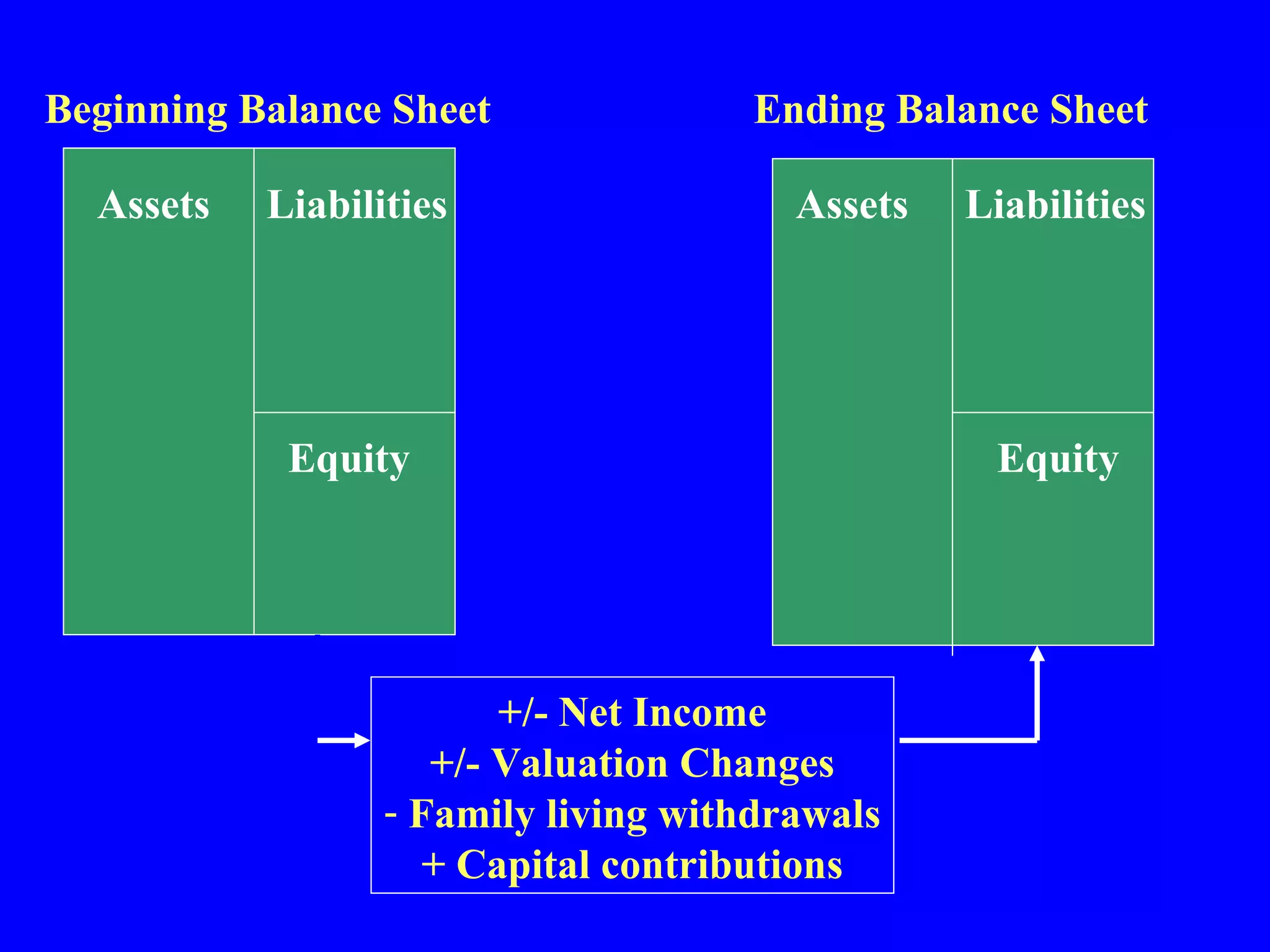

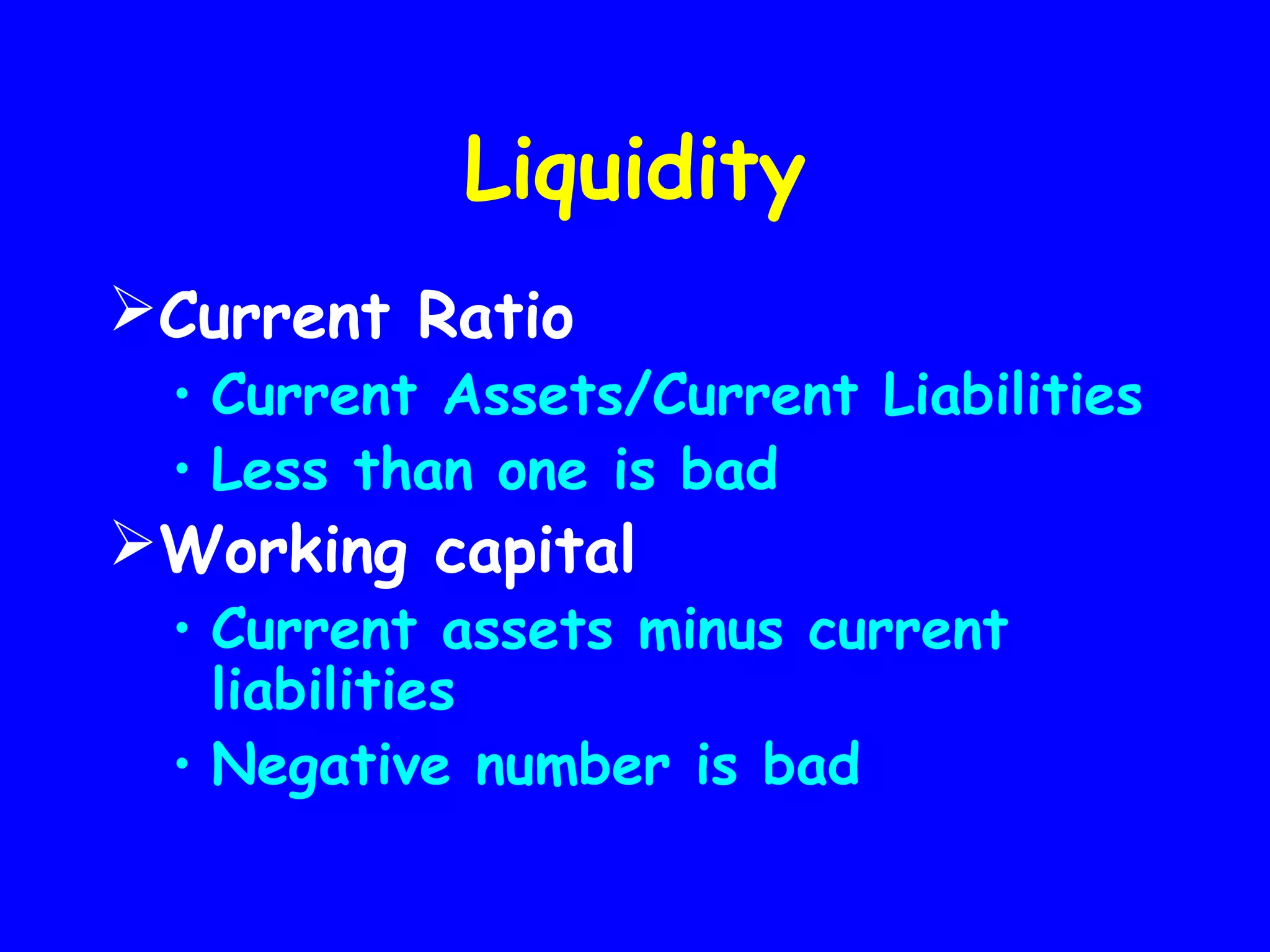

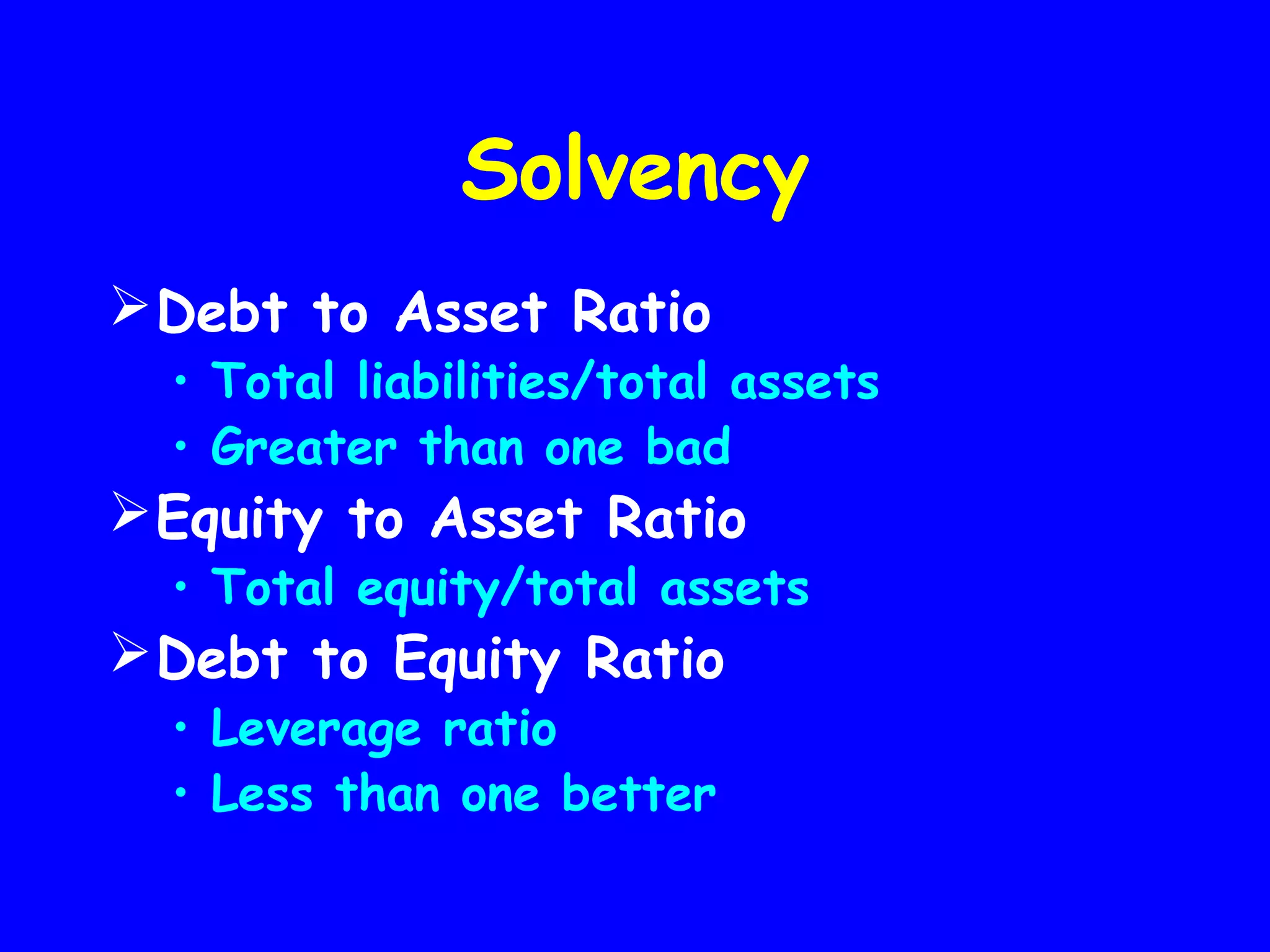

This document provides an overview of basic accounting principles and financial statements. It defines key accounting terms like assets, liabilities, equity, income and expenses. It explains the basic accounting equation that assets must equal liabilities plus equity. It describes the purpose and components of common financial statements like the balance sheet, income statement, statement of cash flows, and statement of owner equity. It also discusses analysis tools like ratio analysis that are used to evaluate the financial health and performance of a business.