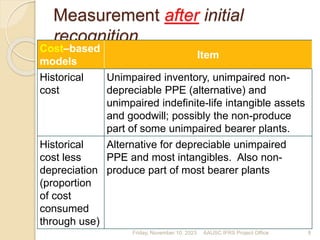

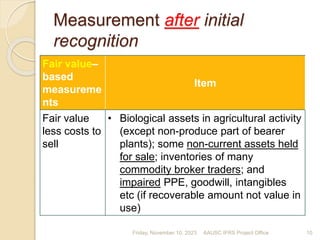

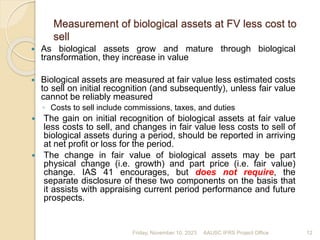

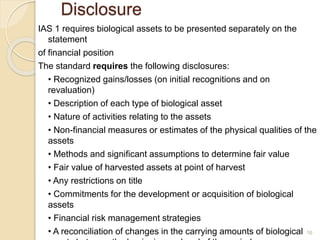

The document summarizes key aspects of IAS 41 Agriculture, which provides the accounting requirements for biological assets and agricultural produce. It defines relevant terms and outlines that biological assets should be initially and subsequently measured at fair value less costs to sell, with changes in fair value recognized in profit or loss. The standard also requires certain disclosures including descriptions of biological assets, methods used to determine fair value, and reconciliations of changes in carrying amounts. An example is provided to illustrate the measurement of biological assets at fair value less costs to sell.