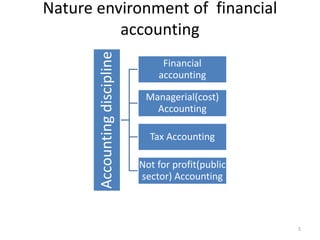

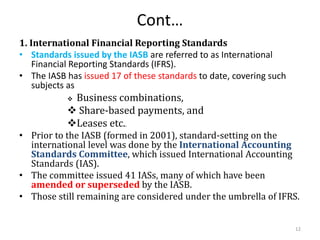

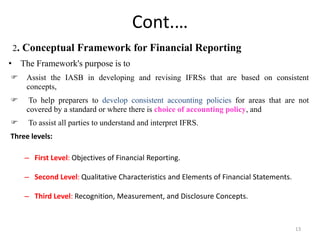

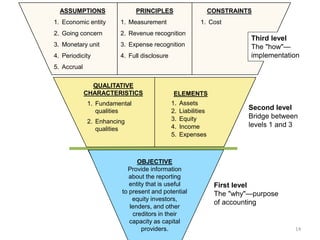

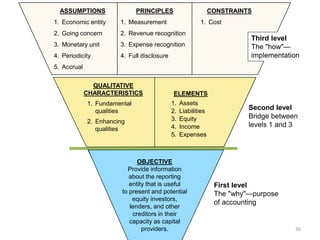

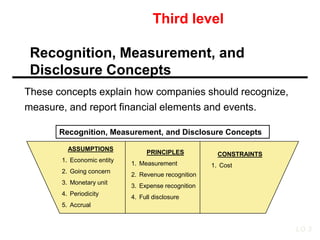

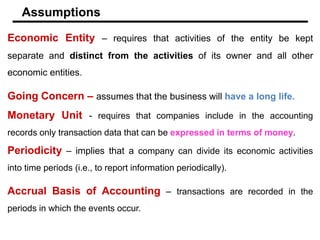

The document provides an overview of the development of accounting principles and professional practice. It discusses how the environment of accounting has evolved over time to meet changing demands and influences. Three key influences are: 1) recognizing scarce resources, 2) current concepts of property rights and equity, and 3) measuring information for absentee investors. The document also describes the objectives of financial reporting, key qualitative characteristics of accounting information, elements of financial statements, and basic principles of accounting including measurement, revenue/expense recognition, and full disclosure.

![Cont…

• Objective of financial statements

• The objective of general purpose financial statements is to provide

information about the financial position, financial performance, and

cash flows of an entity

• To meet that objective, financial statements provide

information about an entity's: [IAS 1.9]

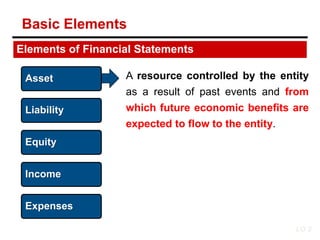

• Assets

• Liabilities

• Equity

• Income and expenses, including gains and losses

• Contributions by and distributions to owners (in their capacity as

owners)

• Cash flows.

45](https://image.slidesharecdn.com/chapter1fai-211227073156/85/Chapter-1-45-320.jpg)

![• Components of financial statements

• A complete set of financial statements includes: [IAS 1.10]

1. A statement of financial position (balance sheet) at the end of the period

2. A statement of profit or loss and other comprehensive income for the period

(Income statement)

3. A statement of changes in equity for the period a statement of cash flows for

the period

4. Notes to the financial statement, comprising a summary of significant

accounting policies and other explanatory notes

5. Comparative information prescribed by the standard.

46](https://image.slidesharecdn.com/chapter1fai-211227073156/85/Chapter-1-46-320.jpg)