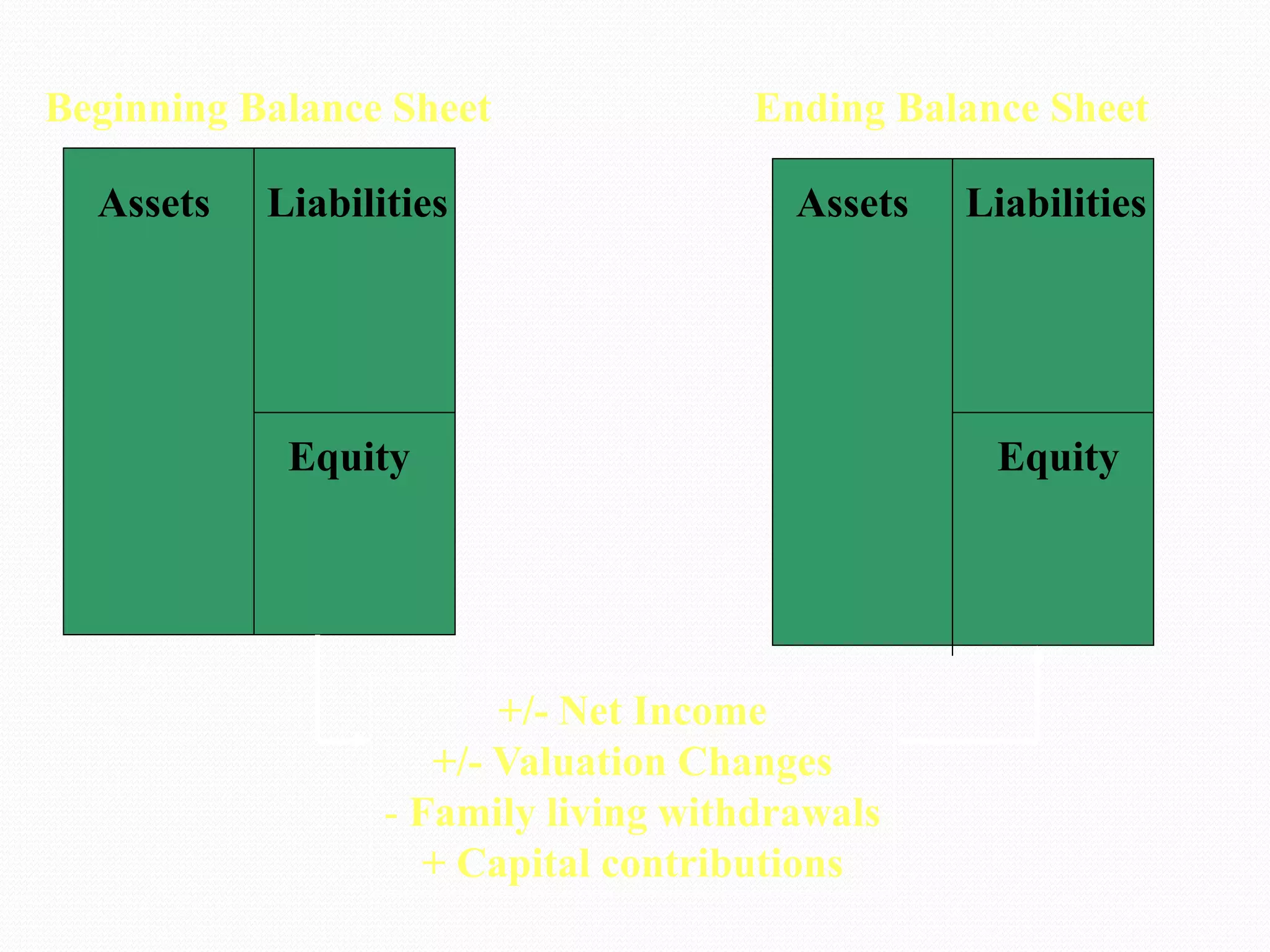

This document defines key accounting terms and concepts related to financial statements. It explains that financial statements like the balance sheet, income statement, and statement of cash flows are used to analyze the financial condition and performance of a business over time. Various types of financial analysis like horizontal analysis, vertical analysis, and financial ratios are used to interpret these statements and evaluate metrics like liquidity, solvency, profitability, financial efficiency, and repayment capacity.