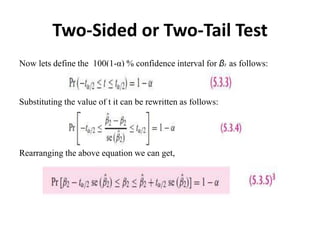

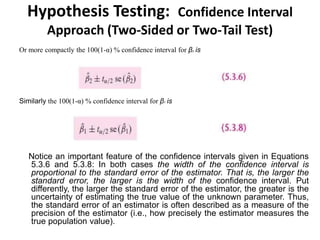

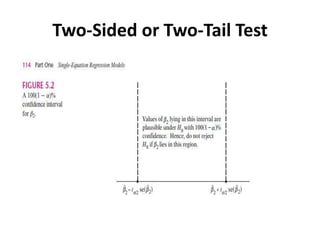

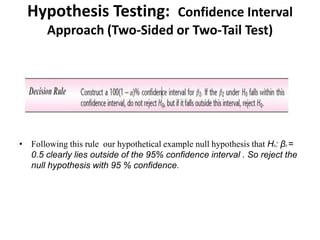

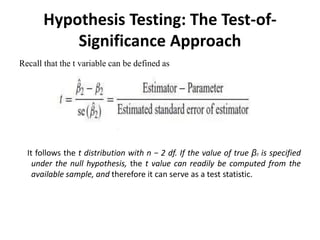

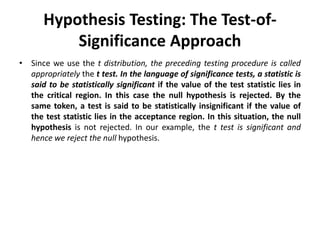

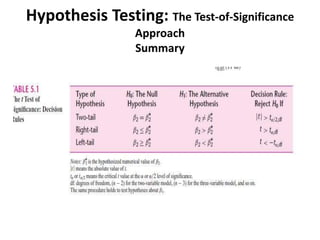

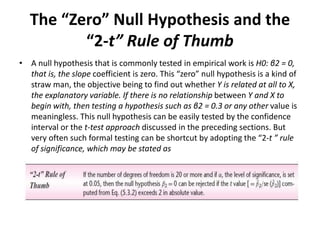

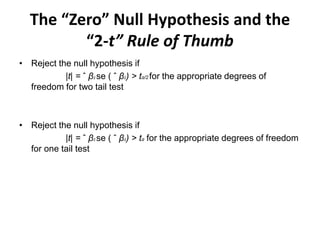

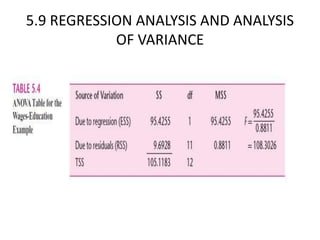

- The document discusses hypothesis testing using regression analysis, focusing on the confidence interval approach and test of significance approach.

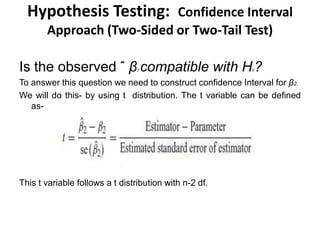

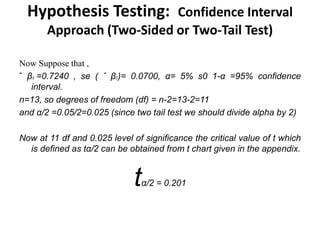

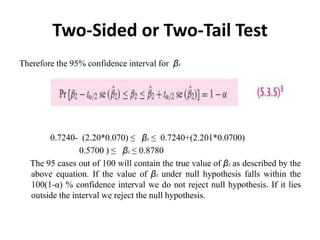

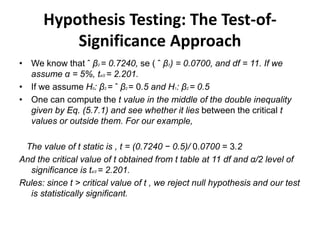

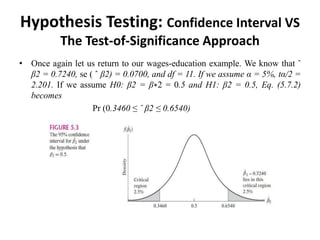

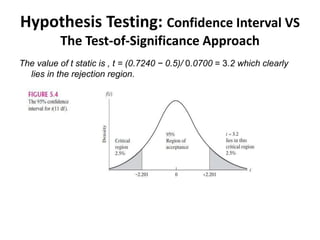

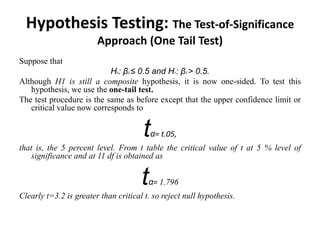

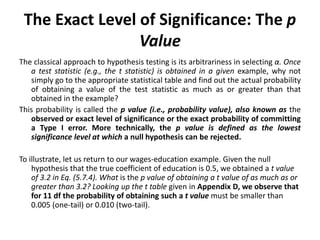

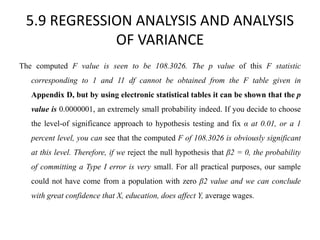

- It provides an example using wage and education data to test the hypothesis that the slope coefficient is equal to 0.5. Both the confidence interval approach and t-test approach are used to reject the null hypothesis.

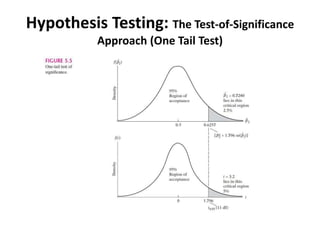

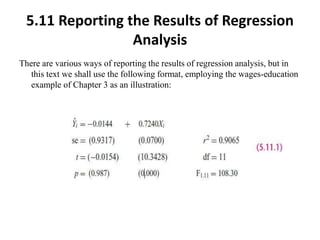

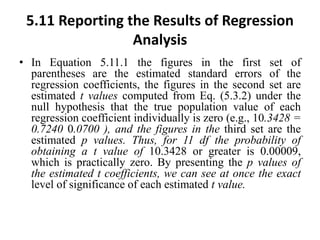

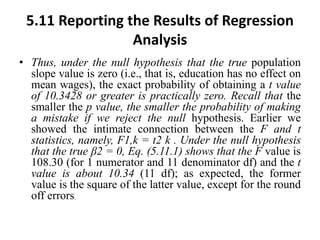

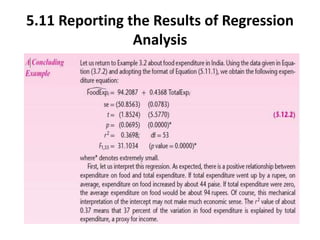

- One-tailed and two-tailed hypothesis tests are explained. Additional topics covered include choosing the significance level, statistical versus practical significance, and reporting the results of regression analysis.