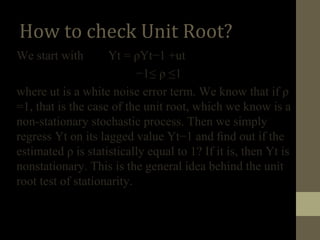

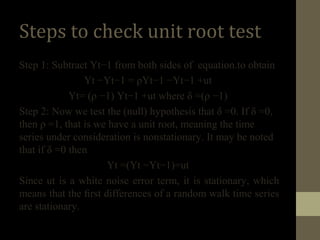

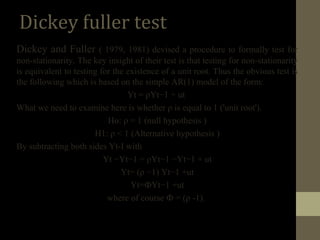

The document provides an overview of unit root tests in time series analysis, explaining the concept of a unit root, how to check for it, and detailing three types of tests: Dickey-Fuller, Augmented Dickey-Fuller, and Phillips-Perron. It outlines the procedure to test for non-stationarity in autoregressive models and offers a step-by-step guide on conducting unit root tests using E-Views software. The referenced materials suggest further reading in applied and basic econometrics.