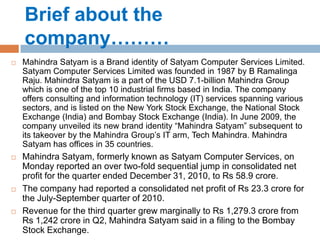

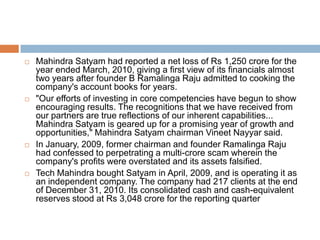

The document discusses the profit and loss statement and balance sheet of Mahindra Satyam. The profit and loss statement summarizes revenues, costs and expenses over a period of time, showing a company's ability to generate profit. The balance sheet summarizes a company's assets, liabilities, and shareholders' equity at a point in time, showing what the company owns, owes, and the amount invested by shareholders. The document then provides examples of key line items in a profit and loss statement and components of the sources and uses of funds in a balance sheet.