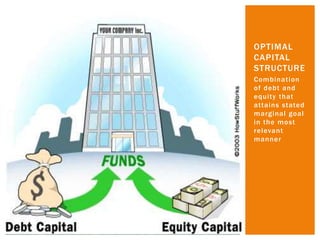

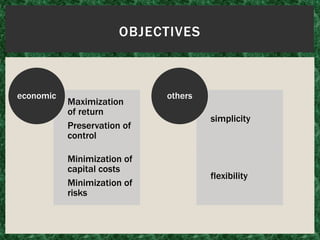

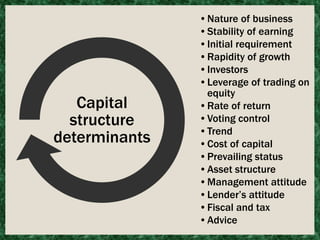

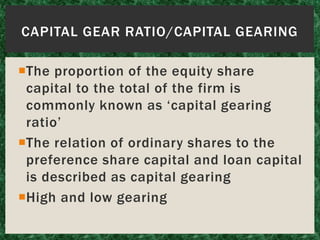

The document discusses capital structure, asset structure, financial structure, and optimal capital structure. It defines capital structure as the permanent financing of a firm through long-term debt, preferred stock, and net worth. Financial structure includes current liabilities in addition to capital structure. Optimal capital structure is the combination of debt and equity that achieves goals like maximizing returns in the most effective way. Determinants of capital structure include the nature of business, stability of earnings, growth rate, and costs of capital.