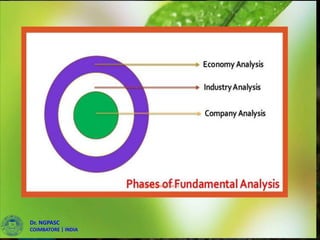

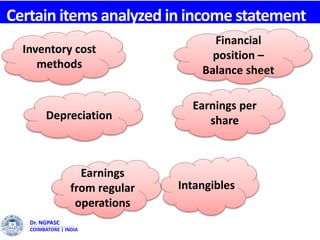

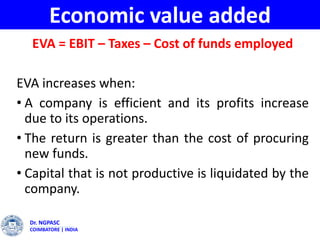

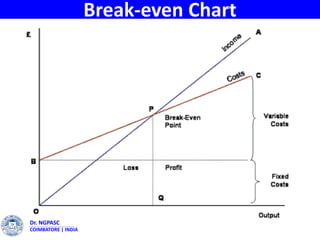

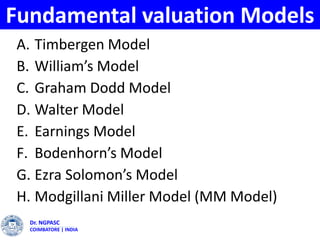

The document discusses fundamental analysis and company analysis. Fundamental analysis studies factors that affect company earnings and dividends, and the relationship between share price and financial performance. Company analysis assesses a firm's competitive position, earnings, profitability, operational efficiency, financial position, and future earnings potential both qualitatively and quantitatively. Key items analyzed include income statements, balance sheets, earnings per share, ratios, economic value added, break-even charts, and sources of financial information. Various fundamental valuation models are also listed.