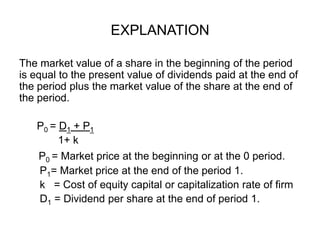

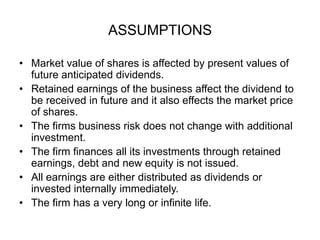

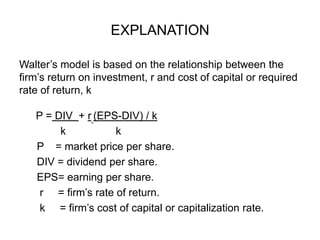

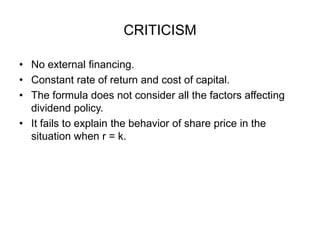

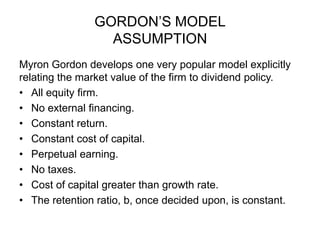

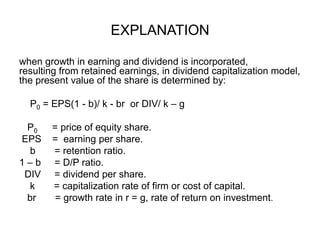

The document discusses different dividend theories and models, including the Miller and Modigliani approach, Walter's approach, and Gordon's model. The Miller and Modigliani approach states that dividend decisions do not impact firm value. Walter's approach argues that dividend policy can affect share prices. Gordon's model relates the market value of a firm to its dividend policy using assumptions of constant growth and costs.