1. The document discusses various aspects of dividend policy including definitions, significance, factors affecting decisions, and types of dividend payments.

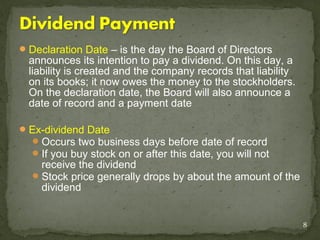

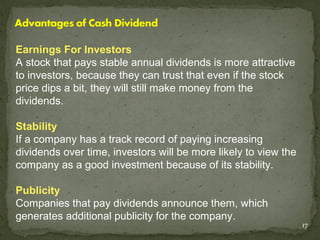

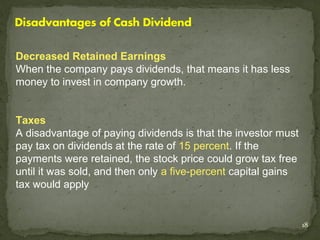

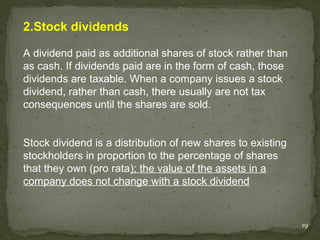

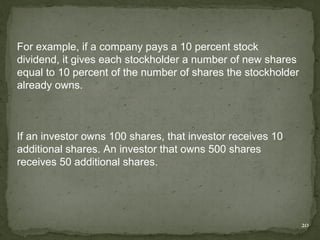

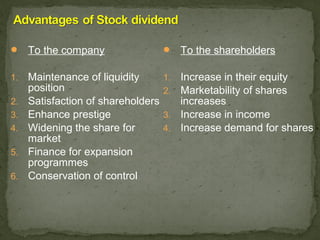

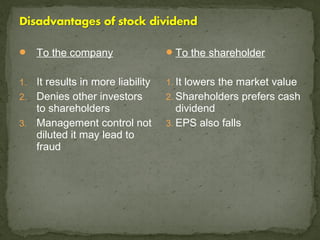

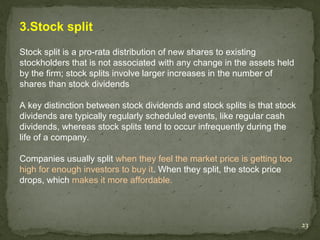

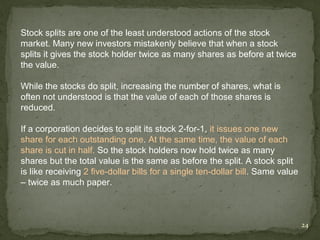

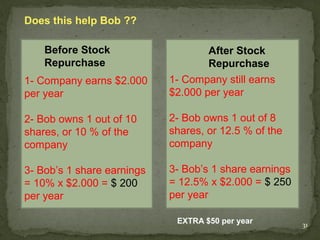

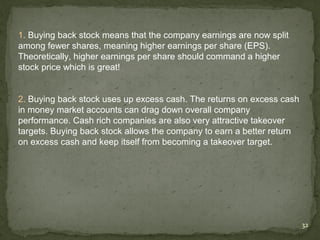

2. It provides details on cash dividends, stock dividends, and stock splits - the main types of dividend payments. Cash dividends directly pay out profits to shareholders, stock dividends distribute additional shares, and stock splits proportionally increase the number of shares at a reduced price per share.

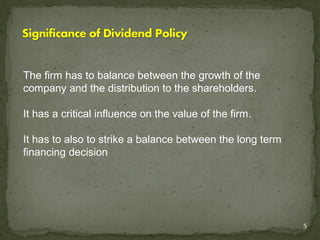

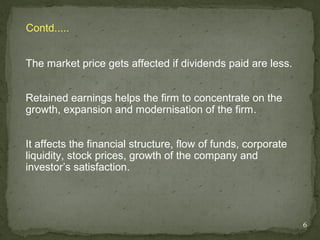

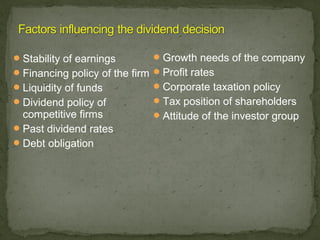

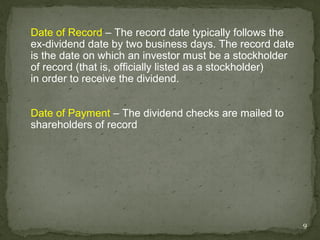

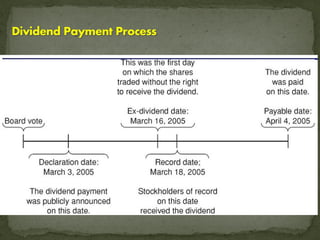

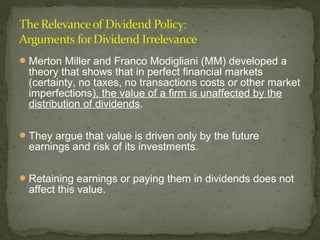

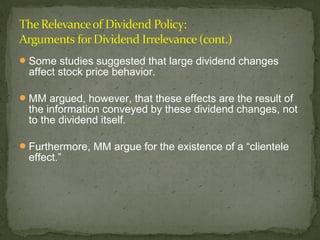

3. The relevance and impact of dividend policy on both companies and shareholders is analyzed, noting theories on both sides of the debate around whether dividends affect firm value. Factors considered in dividend decisions and the process for distributing payments are also outlined.