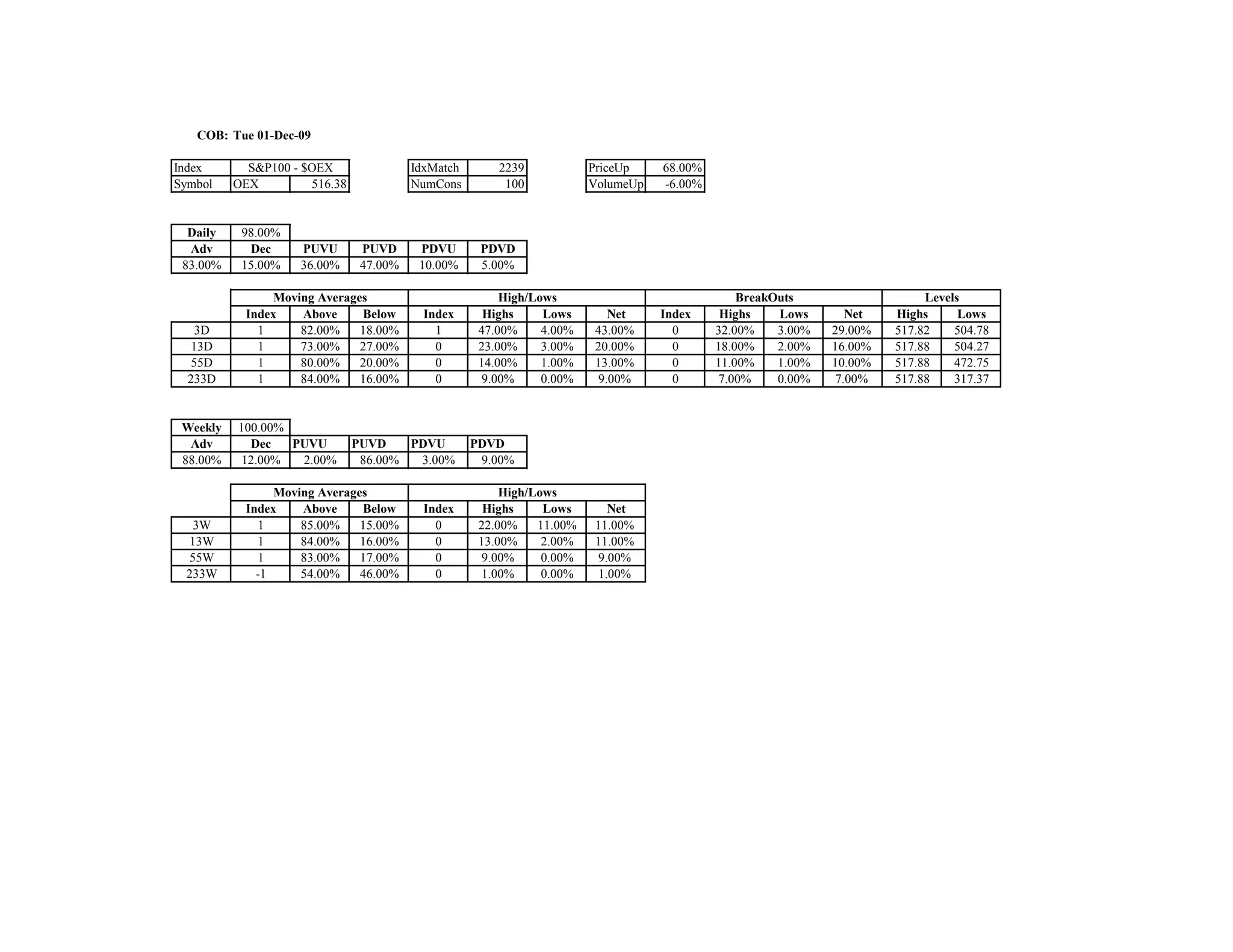

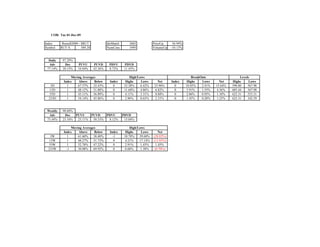

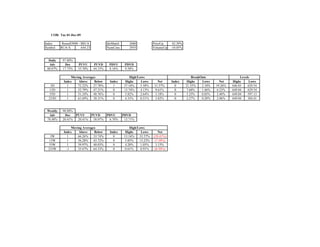

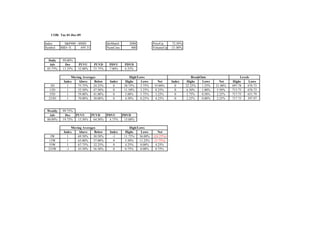

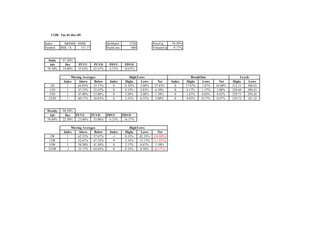

The document provides stock market index data for several major US stock indexes as of December 1, 2009. It includes daily and weekly performance statistics as well as information on moving averages and highs/lows for indexes such as the S&P 500, Nasdaq 100, Russell 1000 and 2000, and S&P 100 over various periods from 3 days to over 200 weeks. All indexes showed strong positive performance over the past week and month according to the data presented.