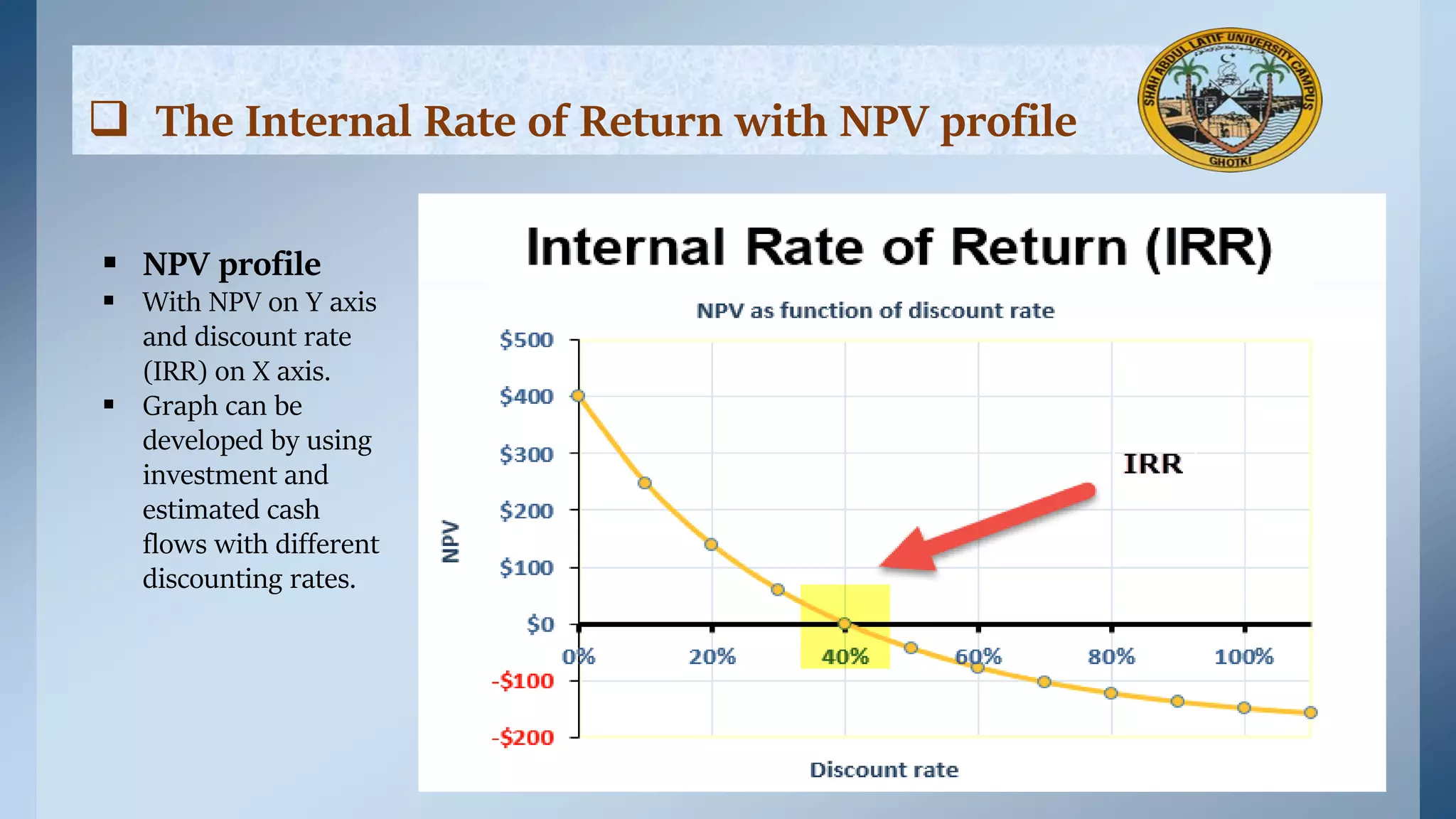

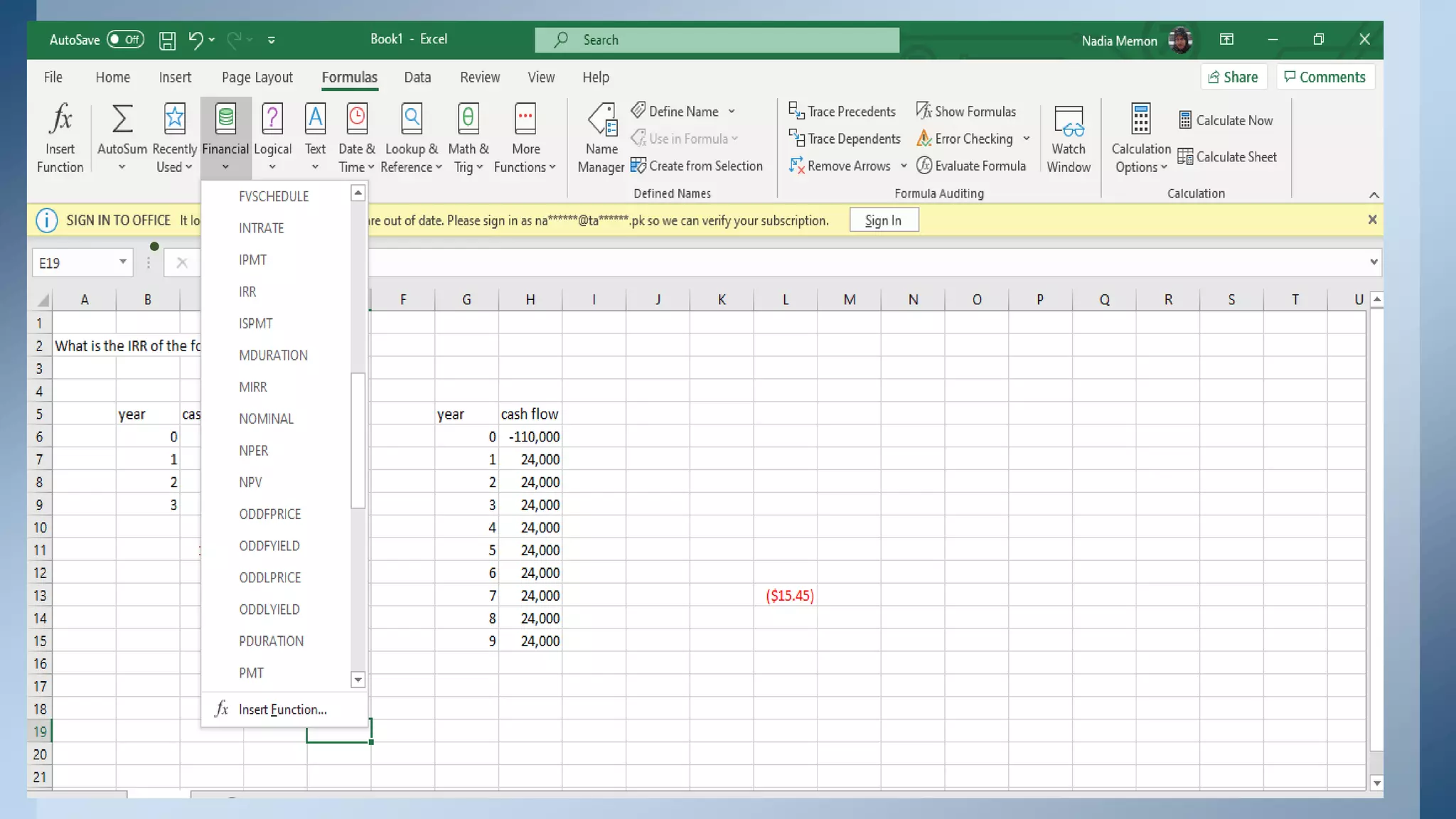

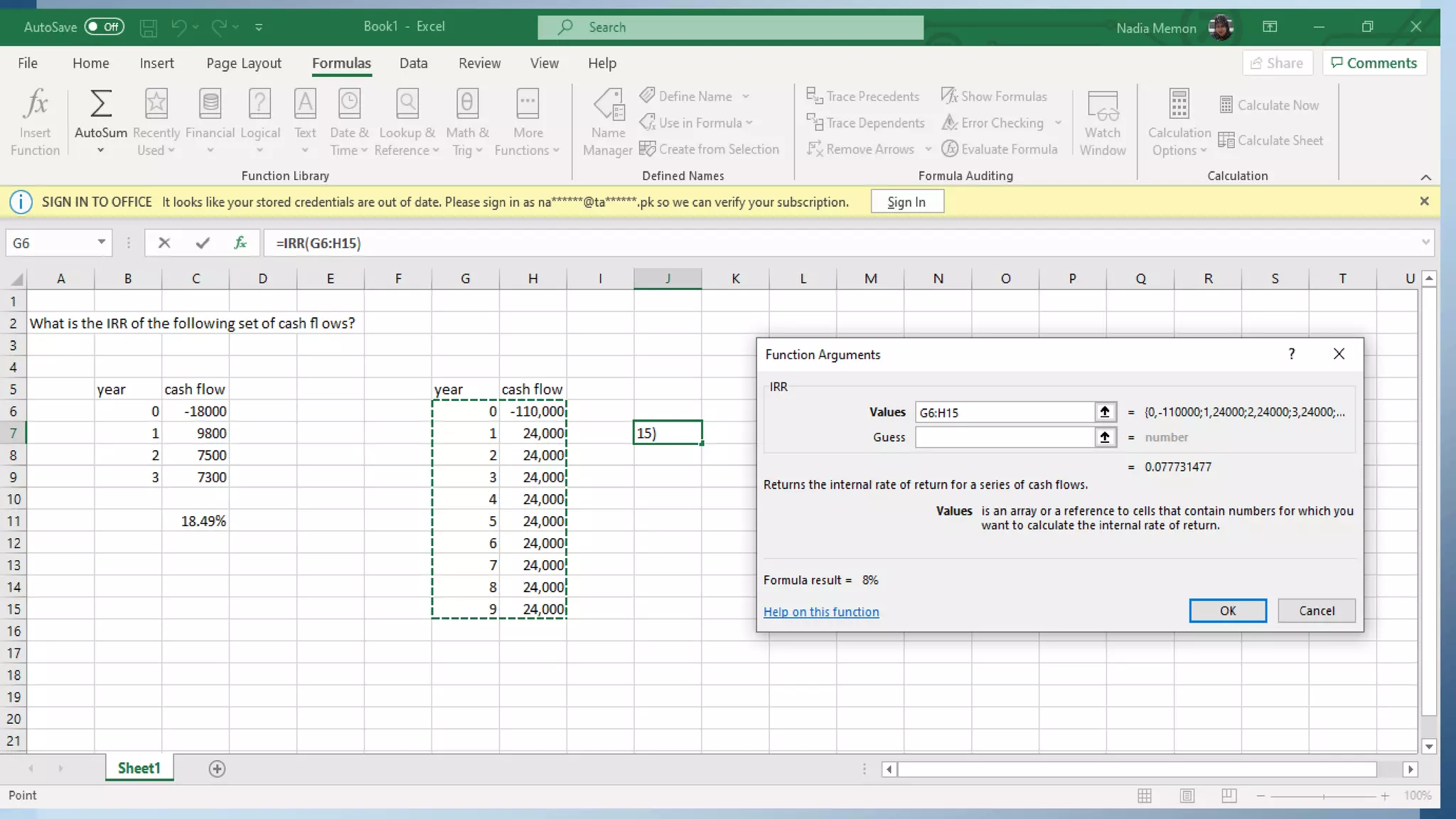

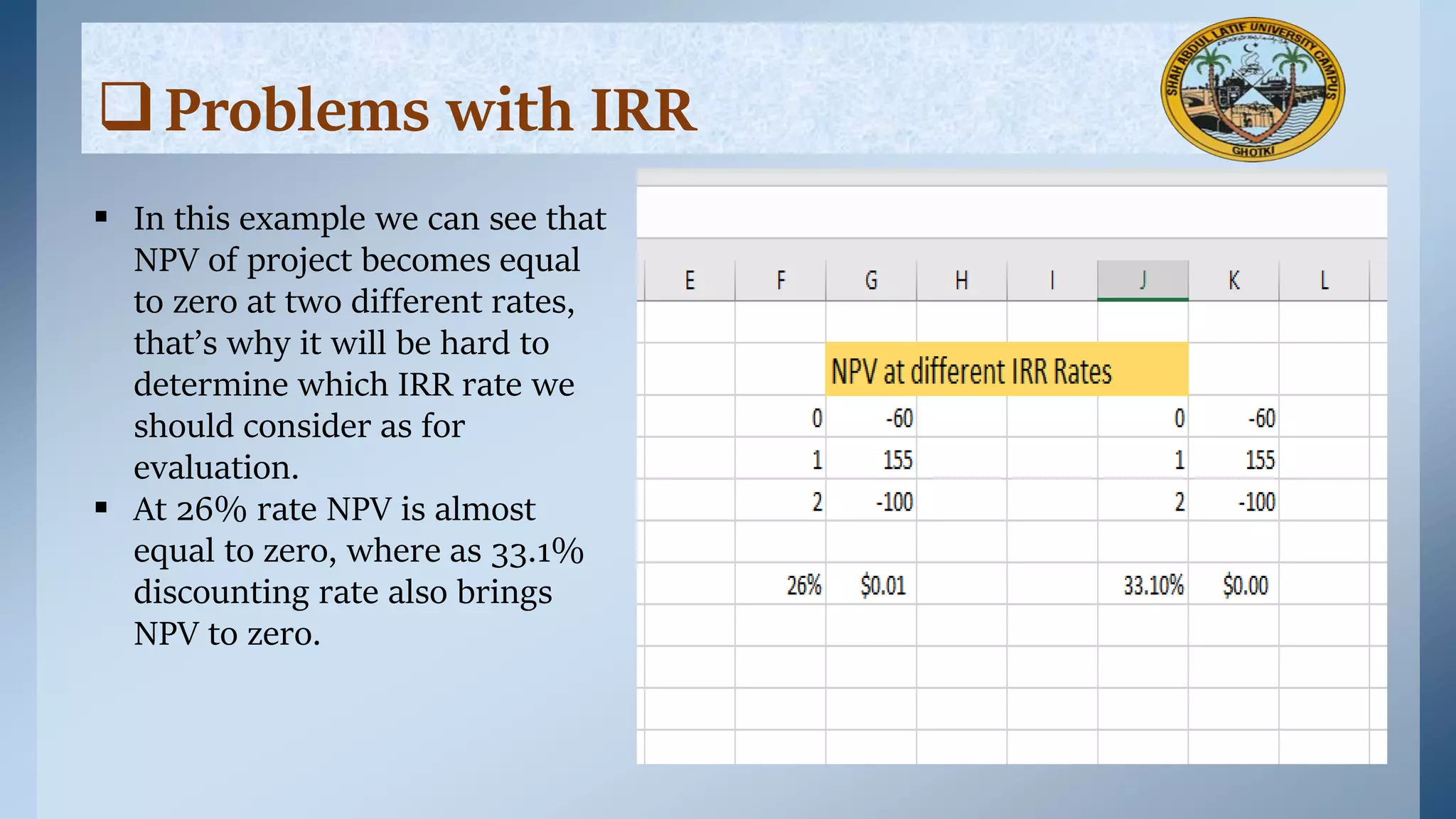

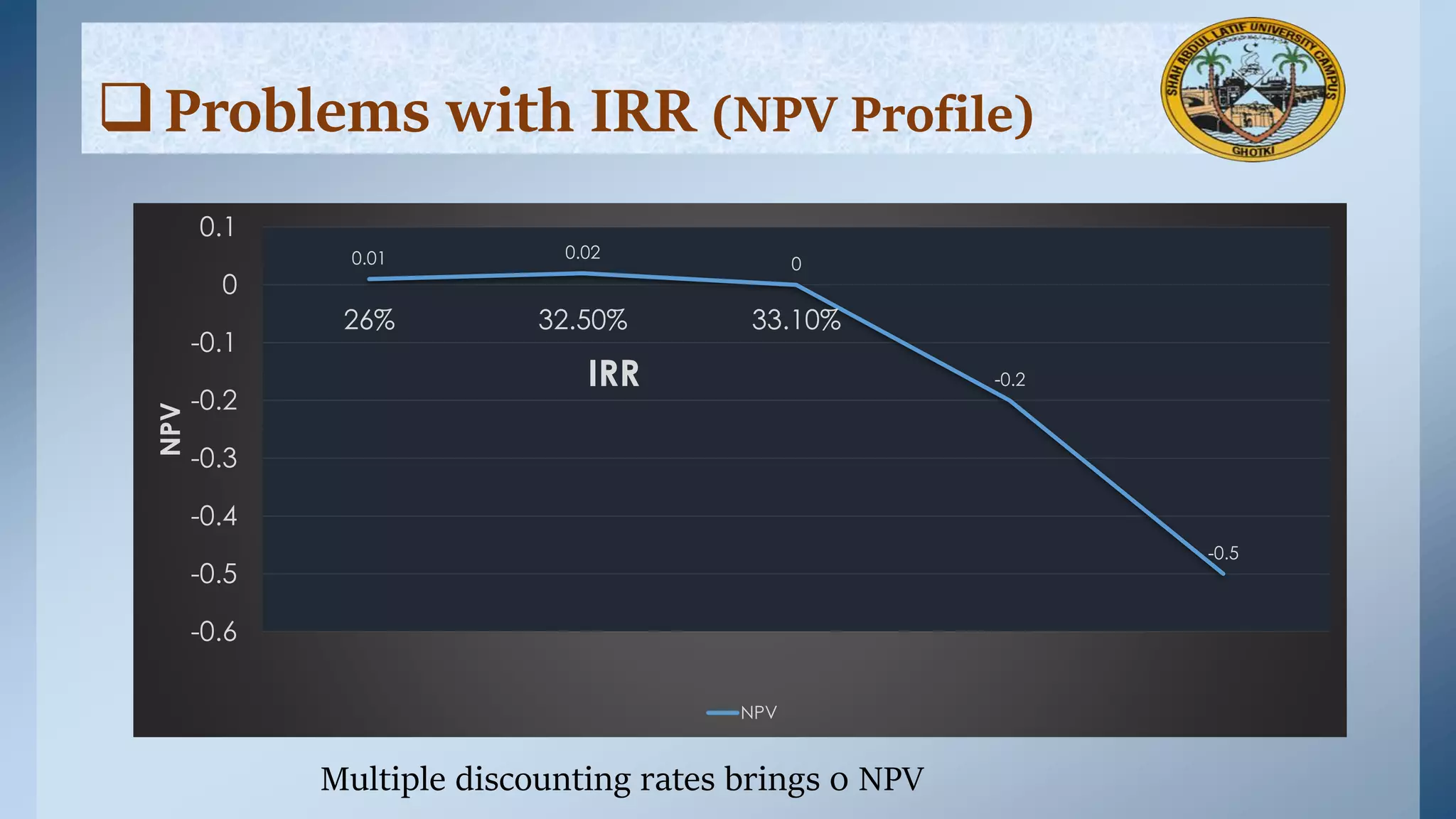

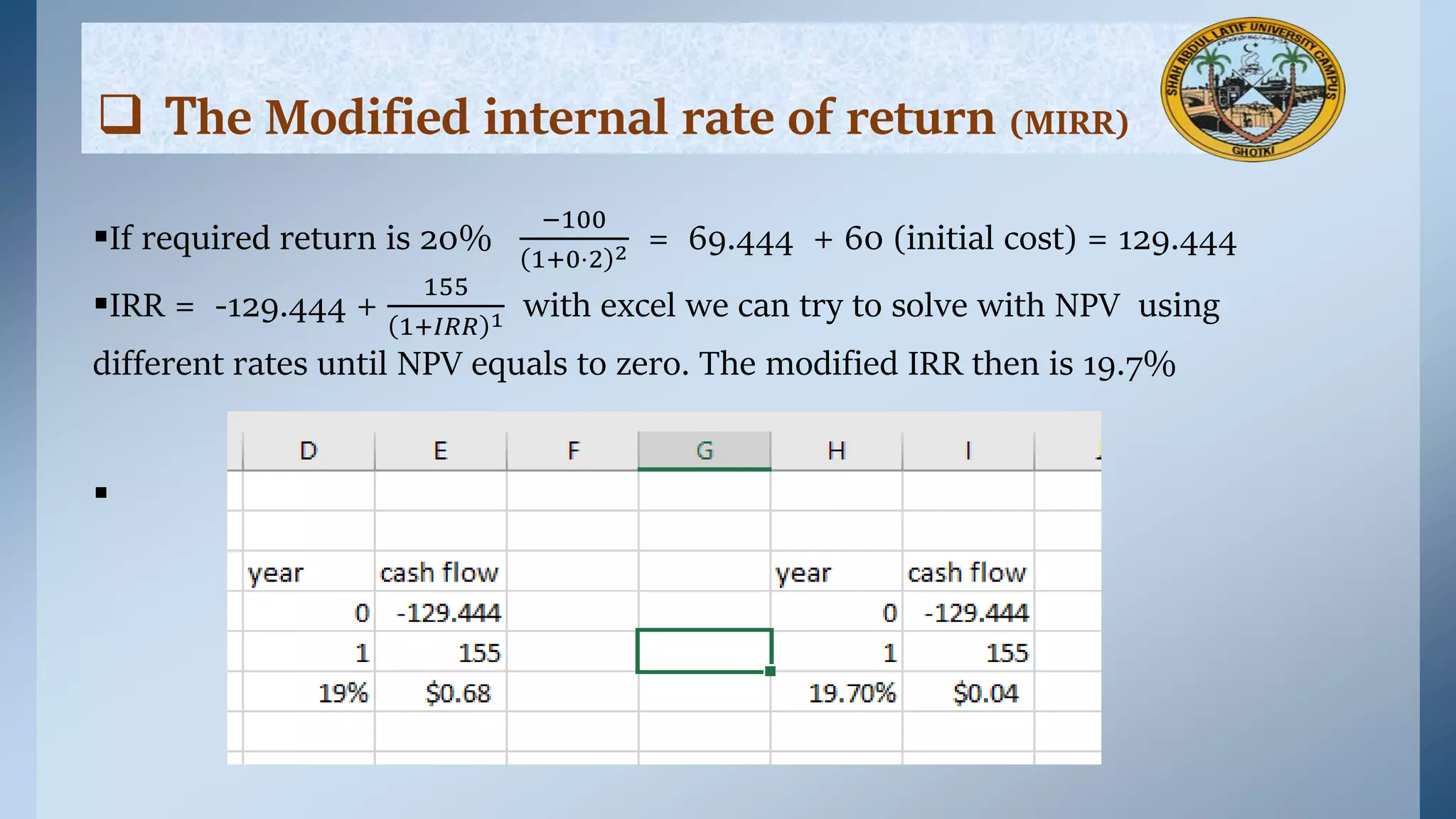

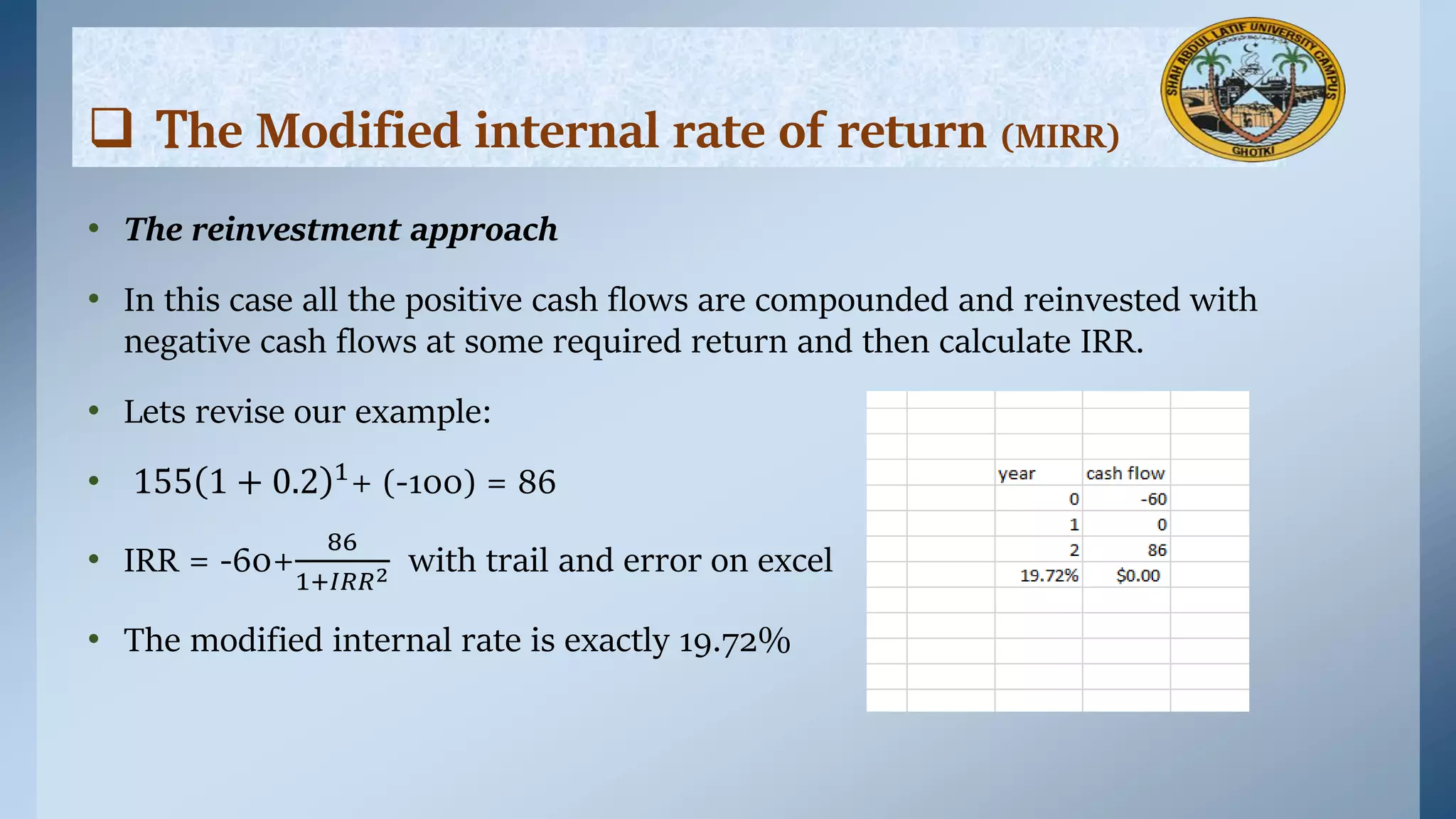

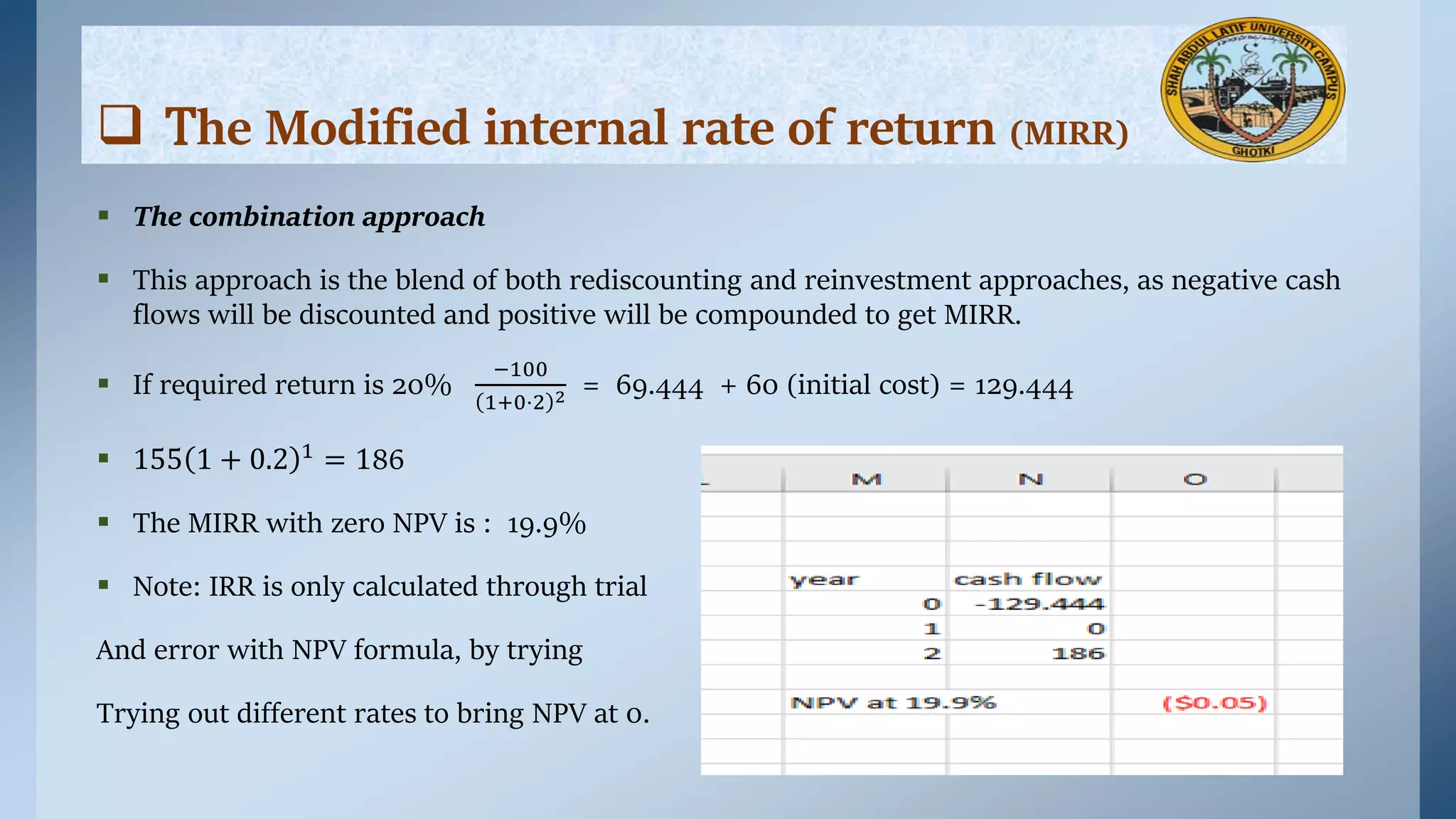

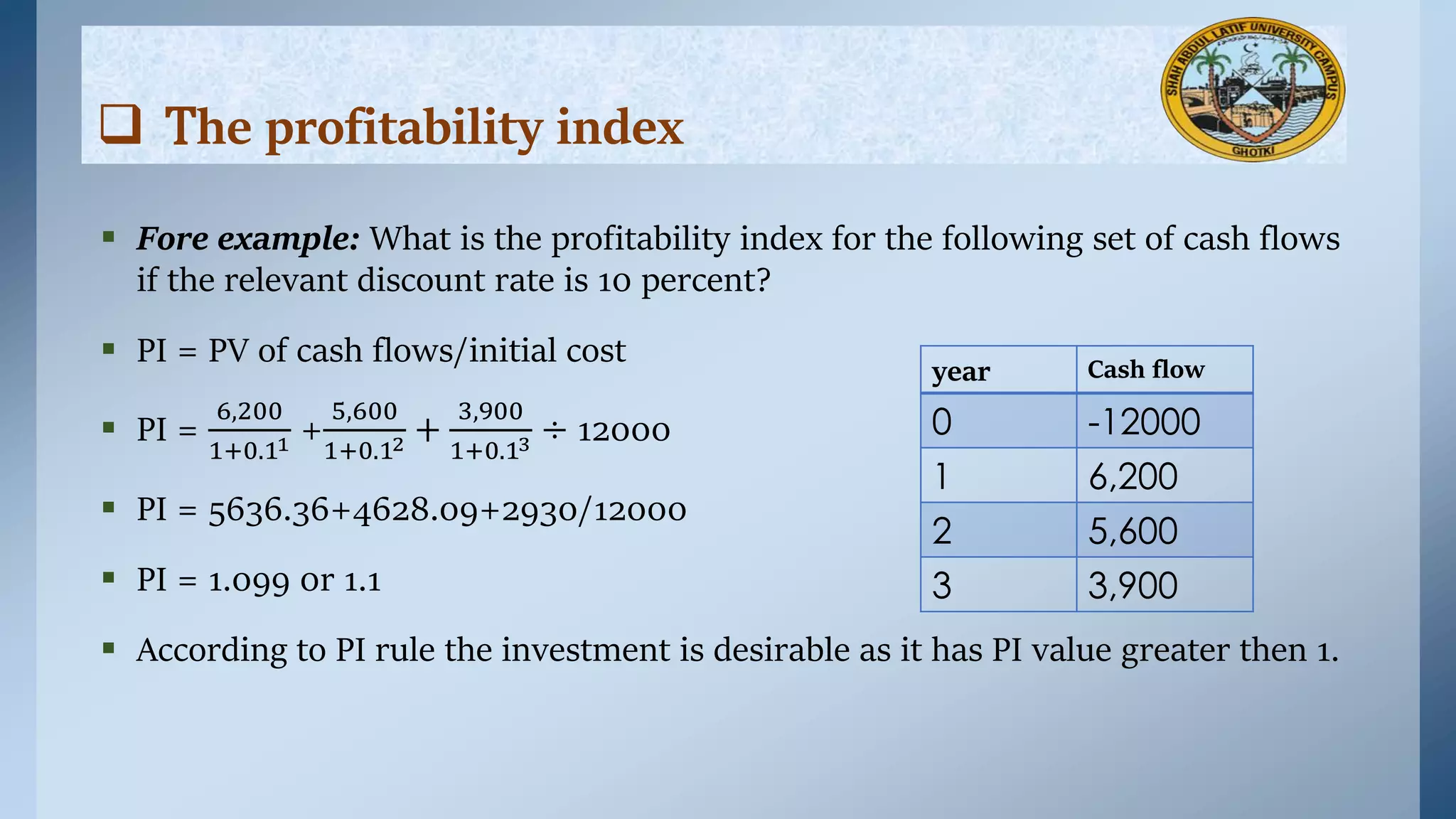

The document discusses various investment evaluation criteria, focusing on the Internal Rate of Return (IRR) and its applications in project evaluation. It explains concepts such as the IRR rule, its calculation for different cash flow scenarios, problems associated with using IRR, and introduces the Modified Internal Rate of Return (MIRR) and Profitability Index (PI) as alternative measures. The overarching theme emphasizes the importance of selecting appropriate financial metrics based on specific project requirements and investment scenarios.