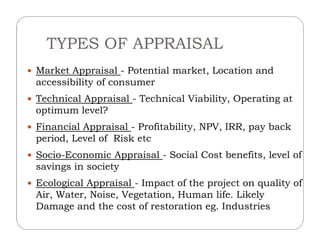

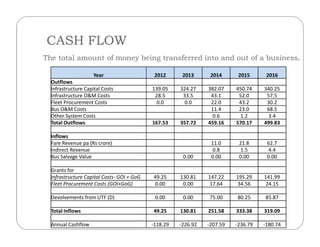

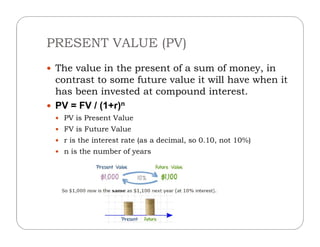

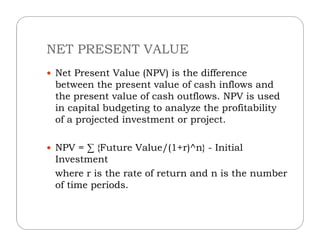

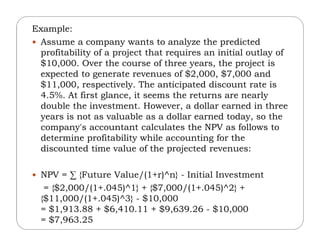

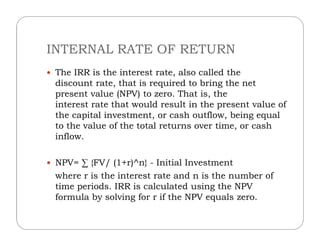

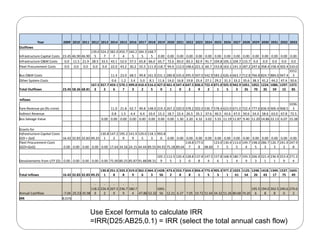

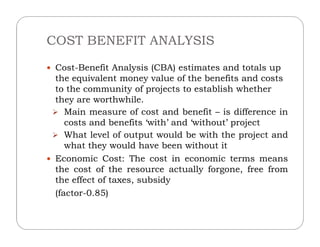

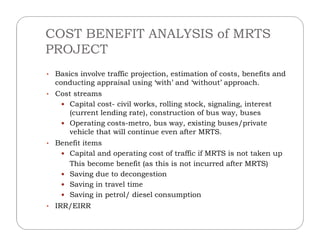

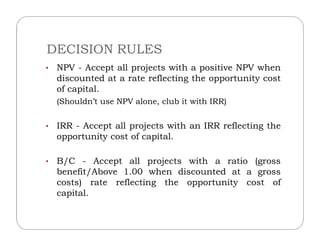

The document provides an overview of various appraisal methods used to evaluate financial viability in urban finance, including market, technical, financial, socio-economic, and ecological appraisals. It emphasizes the importance of financial appraisal techniques such as net present value (NPV) and internal rate of return (IRR) to assess potential investments and their risks. Additionally, it outlines the process of conducting a cost-benefit analysis for investments, particularly in transportation projects, to determine their overall value to the community.