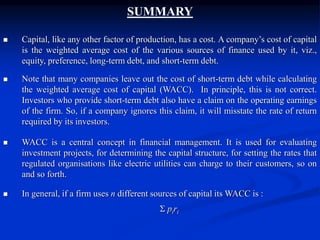

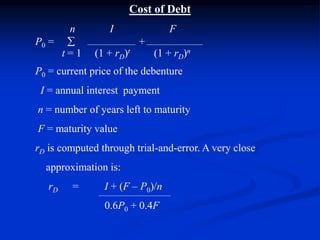

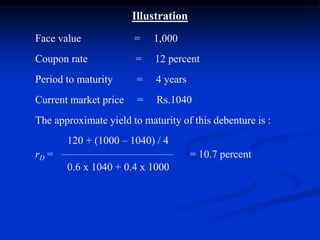

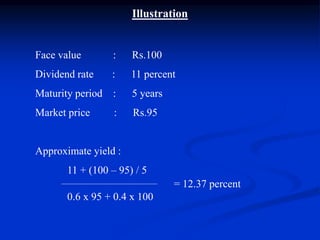

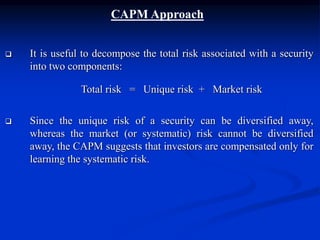

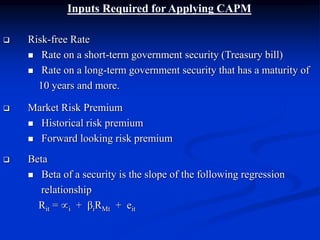

This document discusses methods for calculating the cost of capital, including the cost of debt, equity, and preference shares. It outlines the Capital Asset Pricing Model (CAPM) approach for estimating the cost of equity, as well as other methods like the dividend yield plus risk premium approach and the dividend discount model. It also discusses how to calculate the weighted average cost of capital (WACC) using target capital structure weights. Additionally, it notes some issues that companies face in estimating their cost of capital and common misconceptions about the concept.

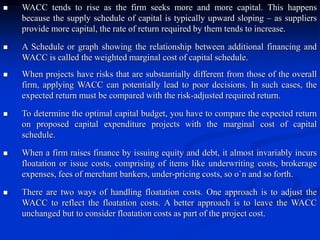

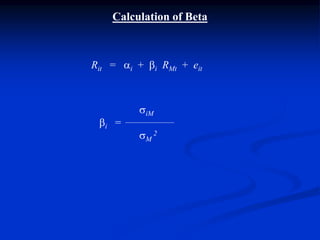

![CAPM

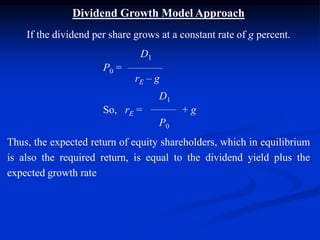

The CAPM is reflected in the following equation that relates the

expected return on an investment to its systematic risk.

E(Ri) = Rf + [ E(RM) – Rf] βi

where: E(Ri) = expected return on security i

Rf = risk-free rate

E (RM) = expected return on the market portfolio

βi = the systematic risk of the security](https://image.slidesharecdn.com/chapter10thecostofcapital-191118042139/85/Chapter10-thecostofcapital-11-320.jpg)

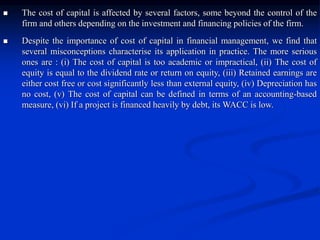

![WACC

Source of Capital Proportion Cost Weighted Cost

(1) (2) [(1) x (2)]

Debt 0.60 16.0% 9.60%

Preference 0.05 14.0% 0.70%

Equity 0.35 8.4% 2.94%

WACC = 13.24%](https://image.slidesharecdn.com/chapter10thecostofcapital-191118042139/85/Chapter10-thecostofcapital-23-320.jpg)