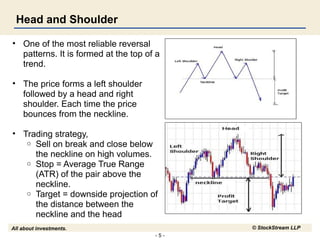

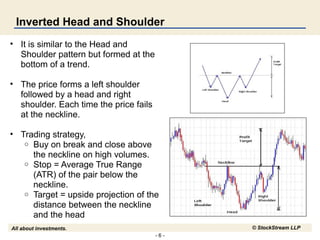

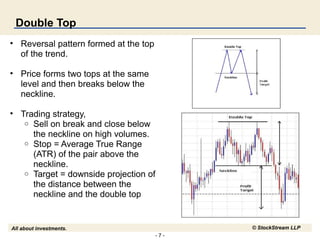

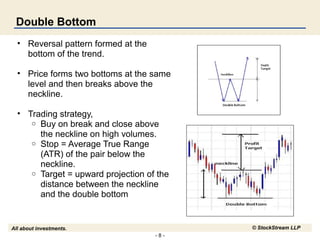

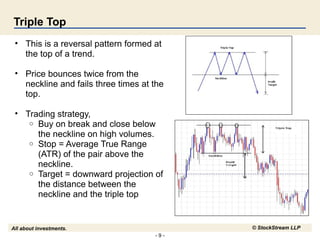

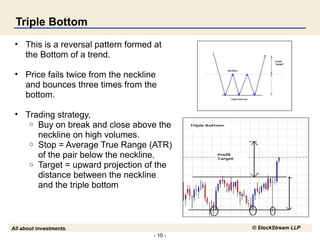

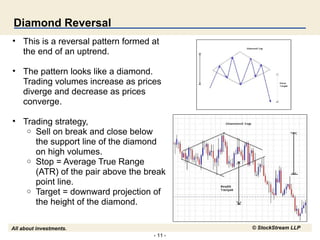

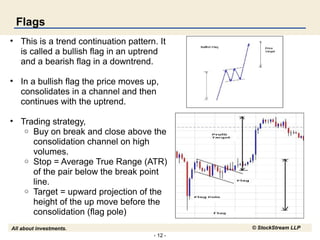

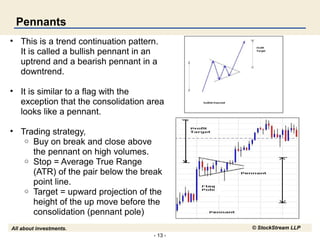

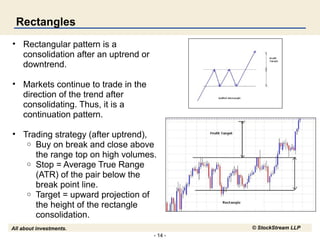

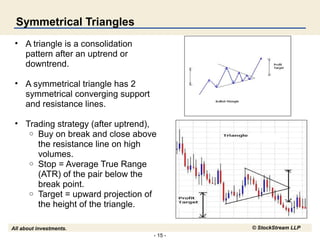

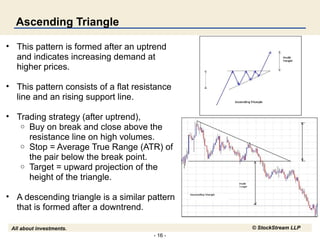

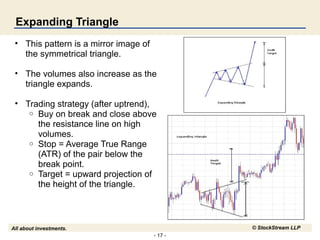

The document provides insights into various chart patterns used in trading, including reversal and continuation patterns such as head and shoulders, double tops and bottoms, and flags. Each pattern is described with a corresponding trading strategy that includes entry points, stop-loss levels, and target projections. It emphasizes the importance of consulting with a financial advisor due to the risks involved in trading.