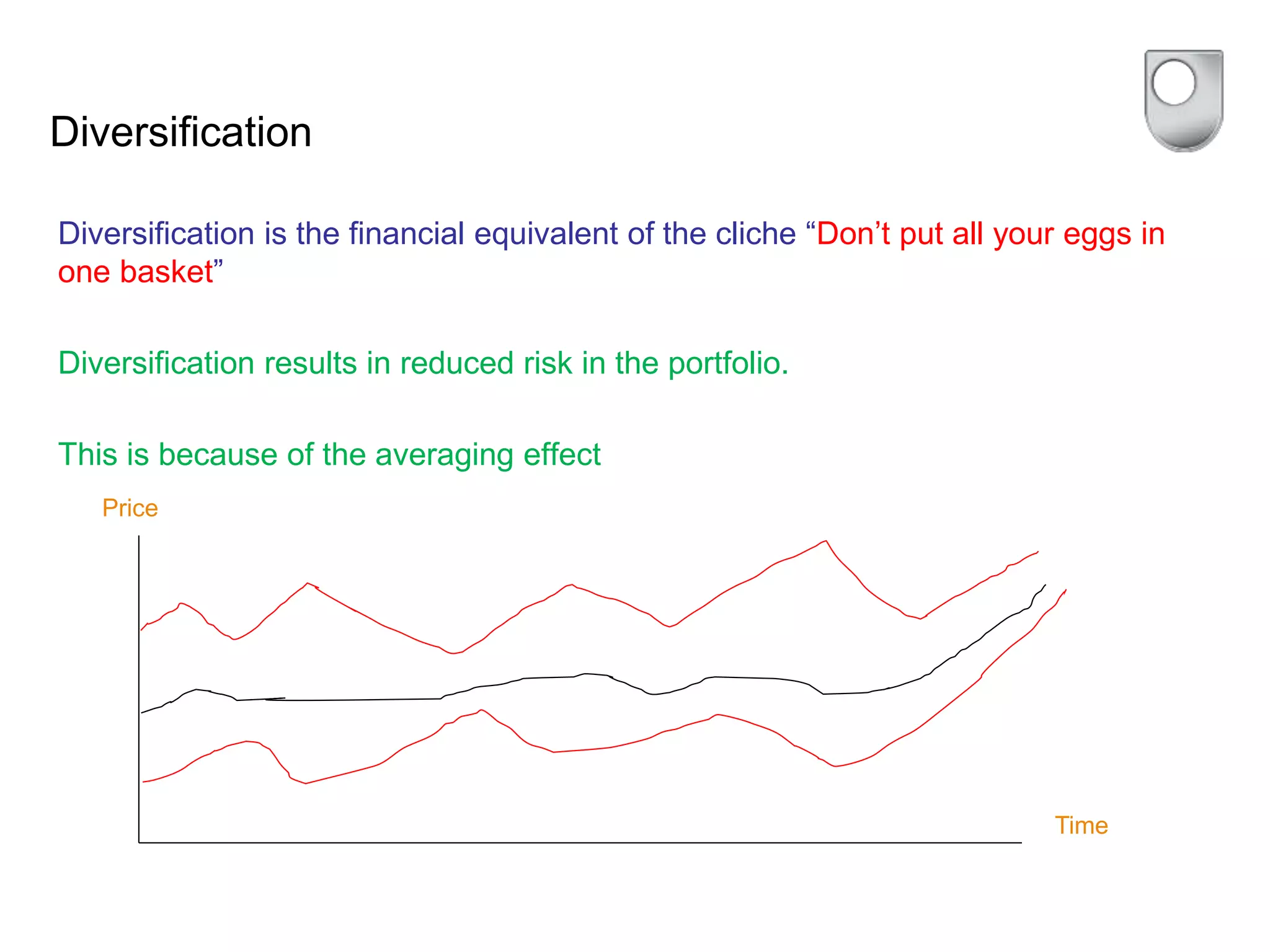

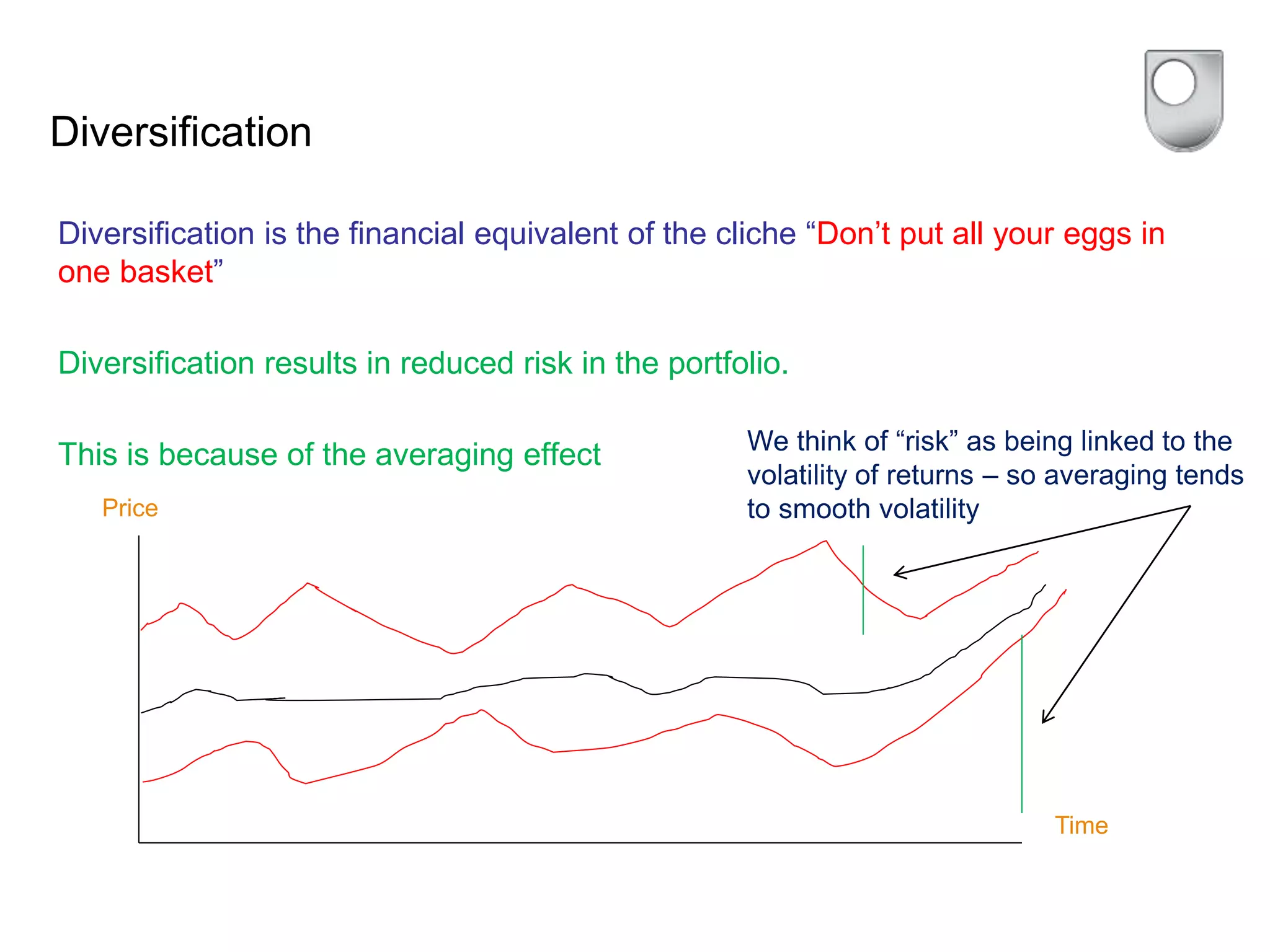

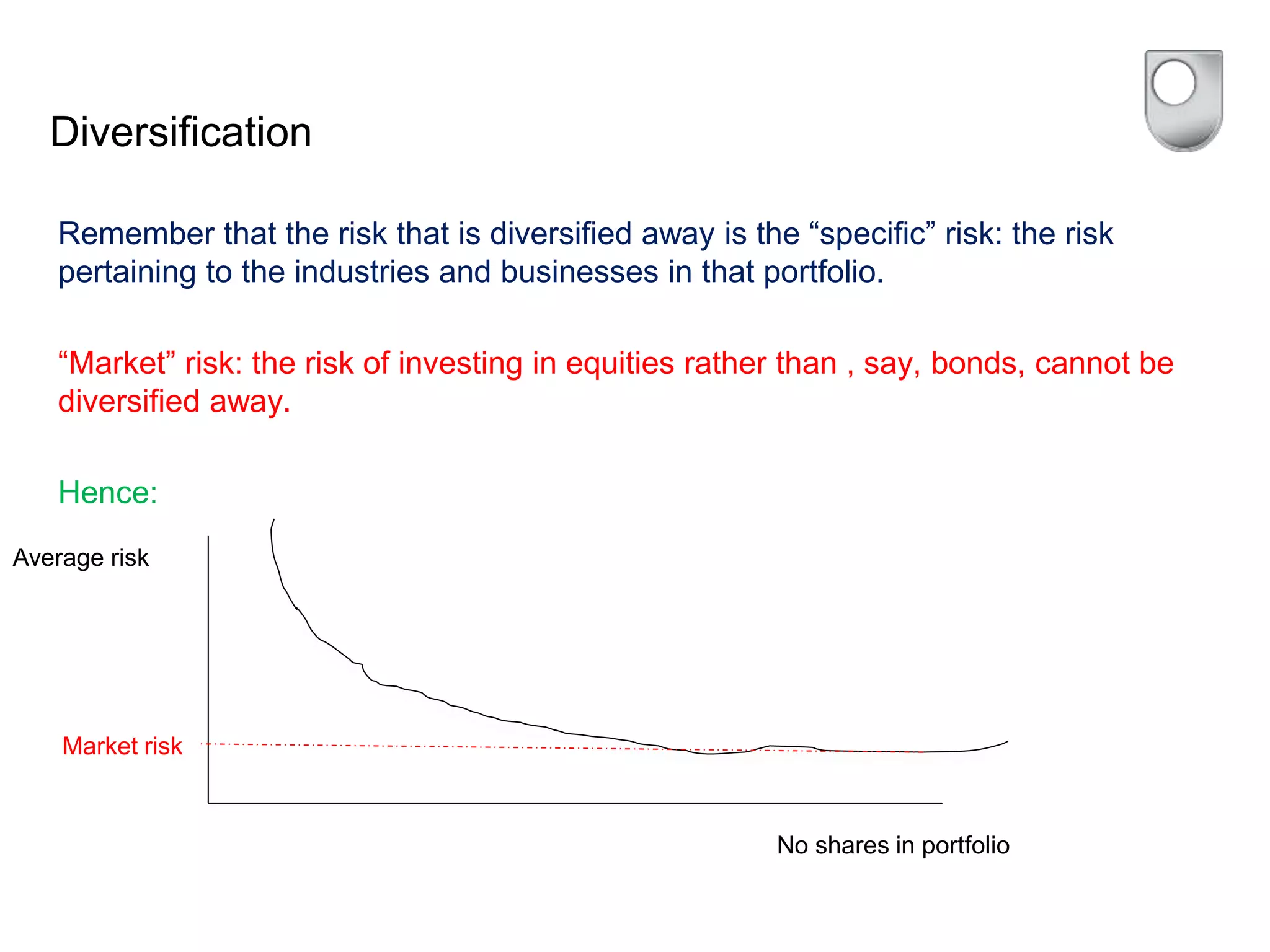

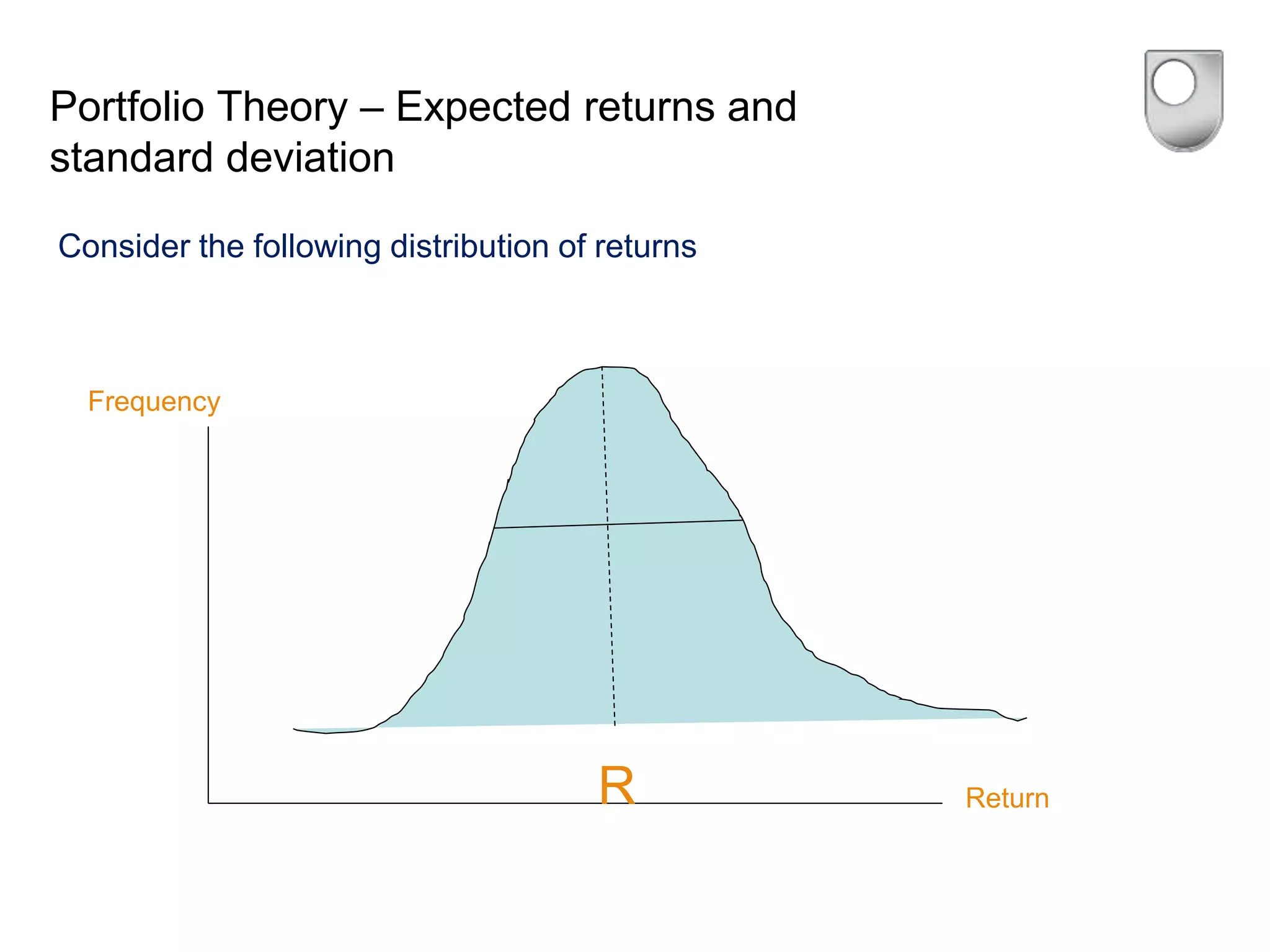

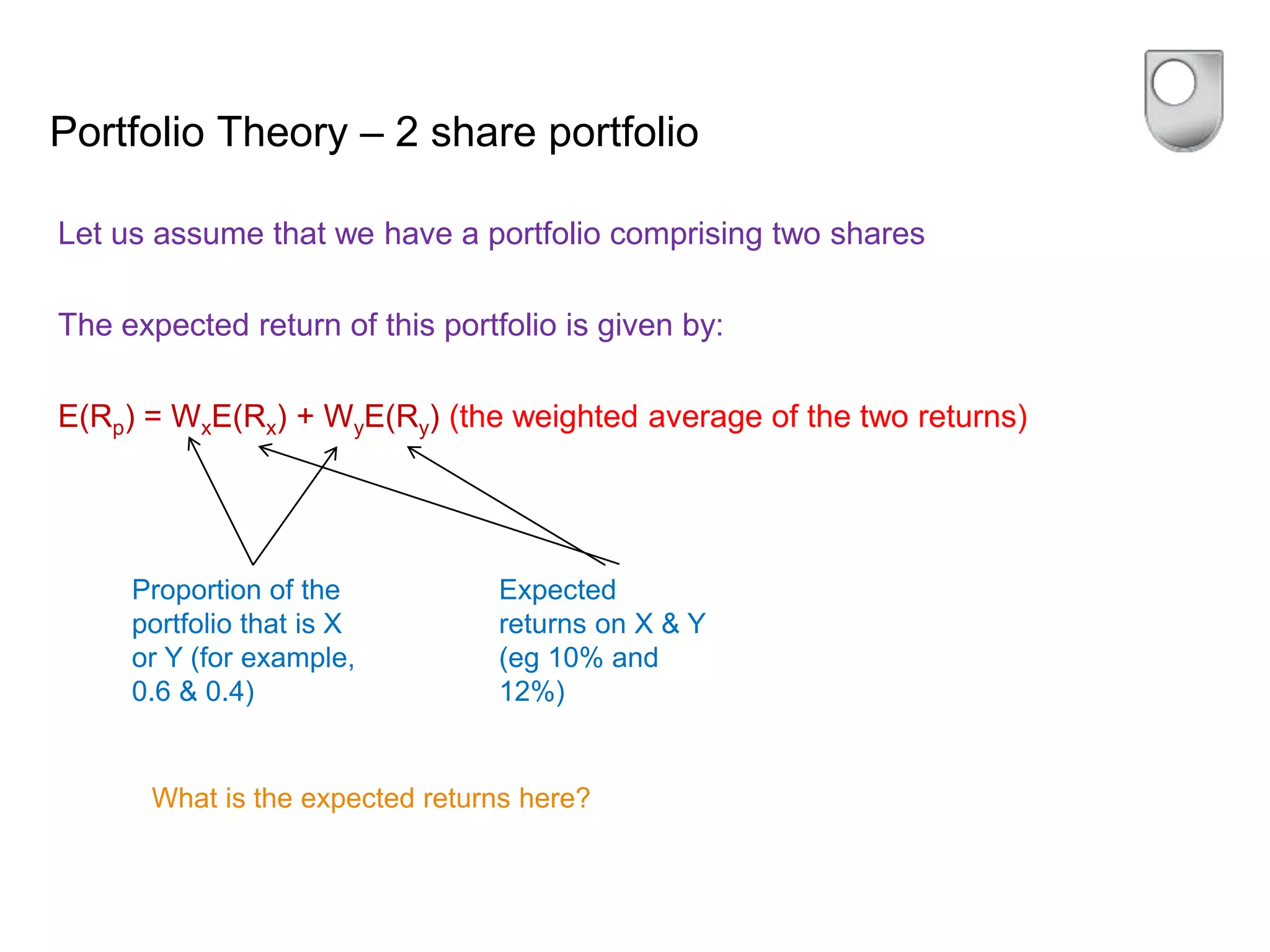

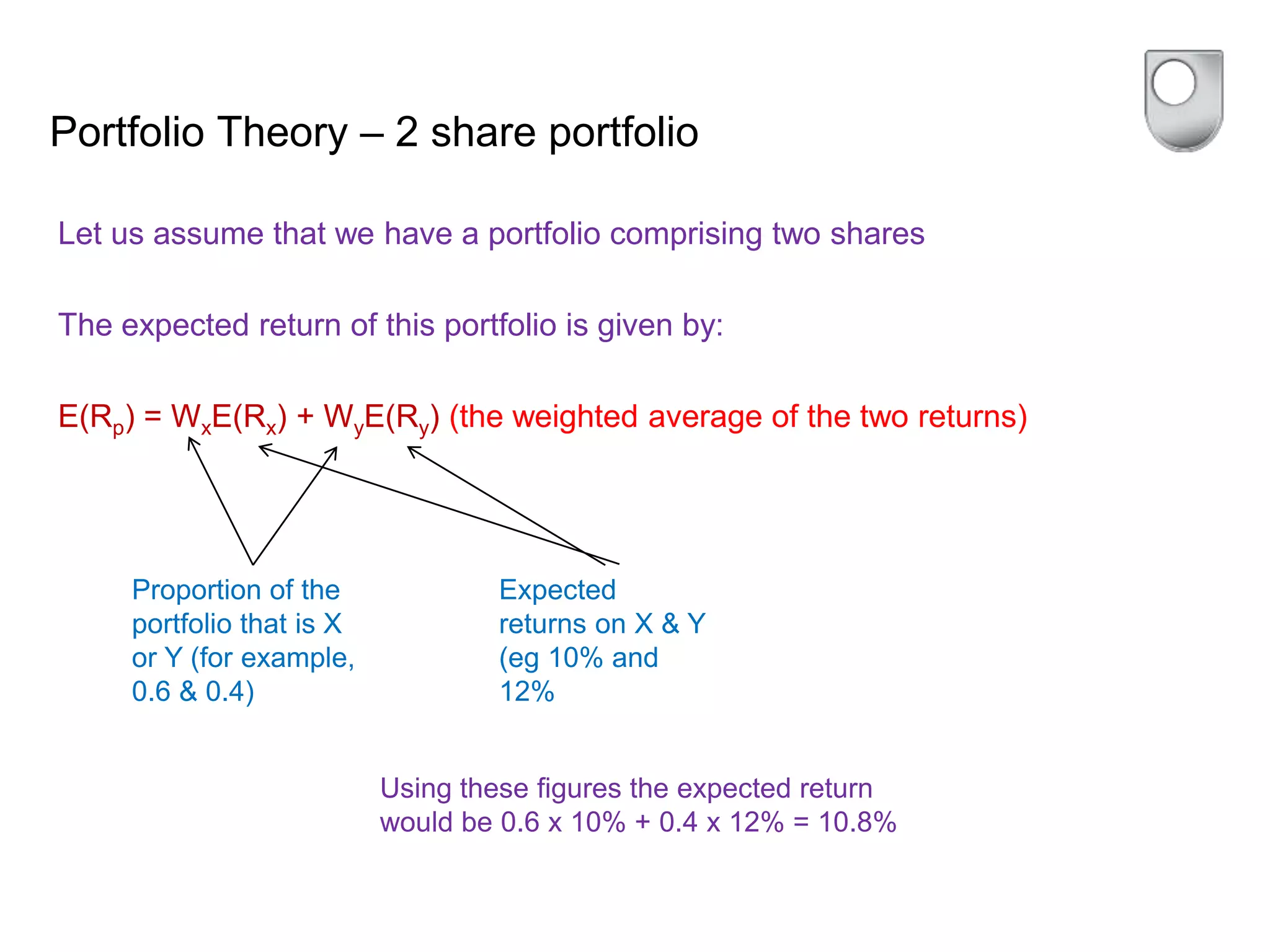

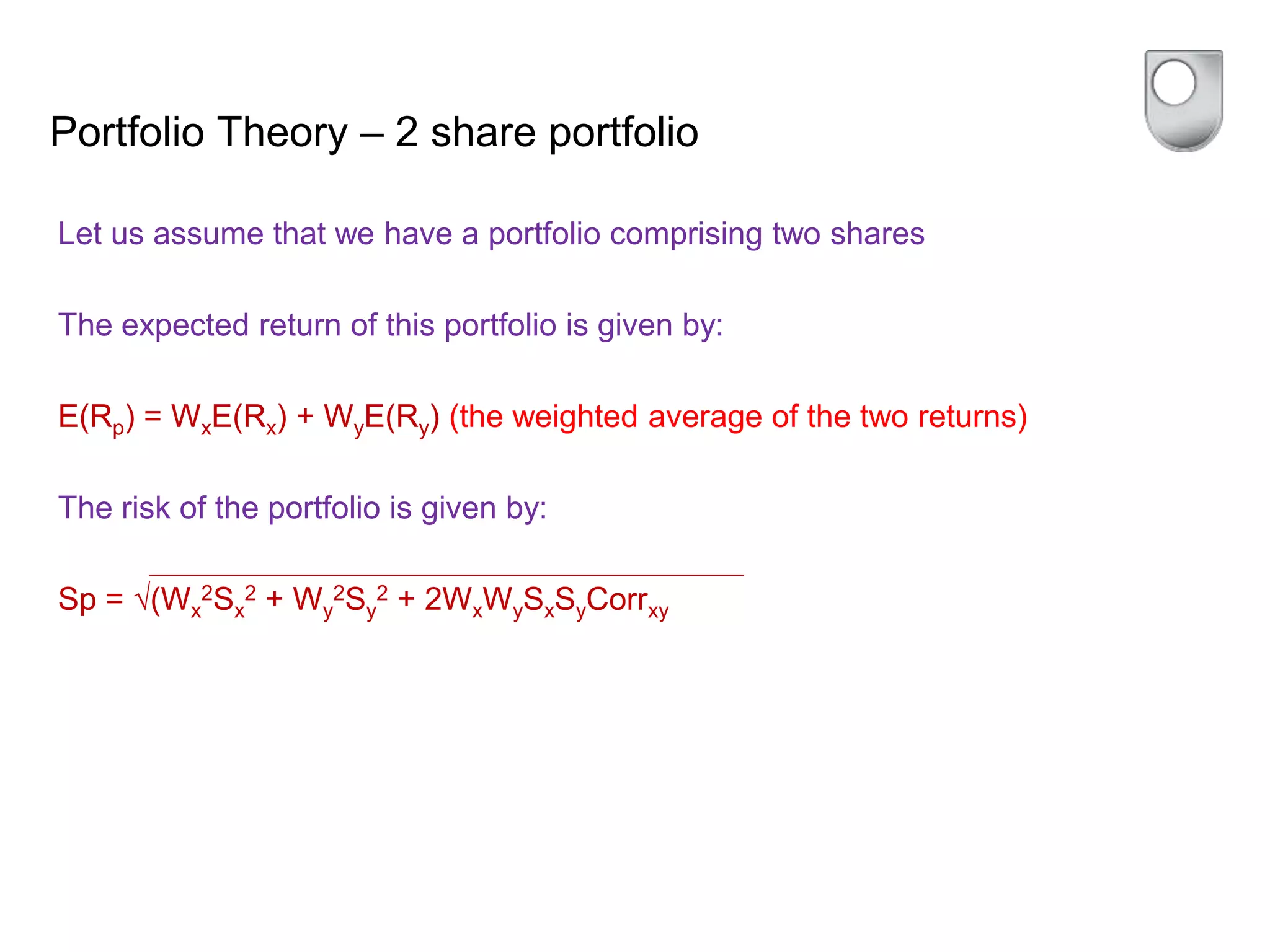

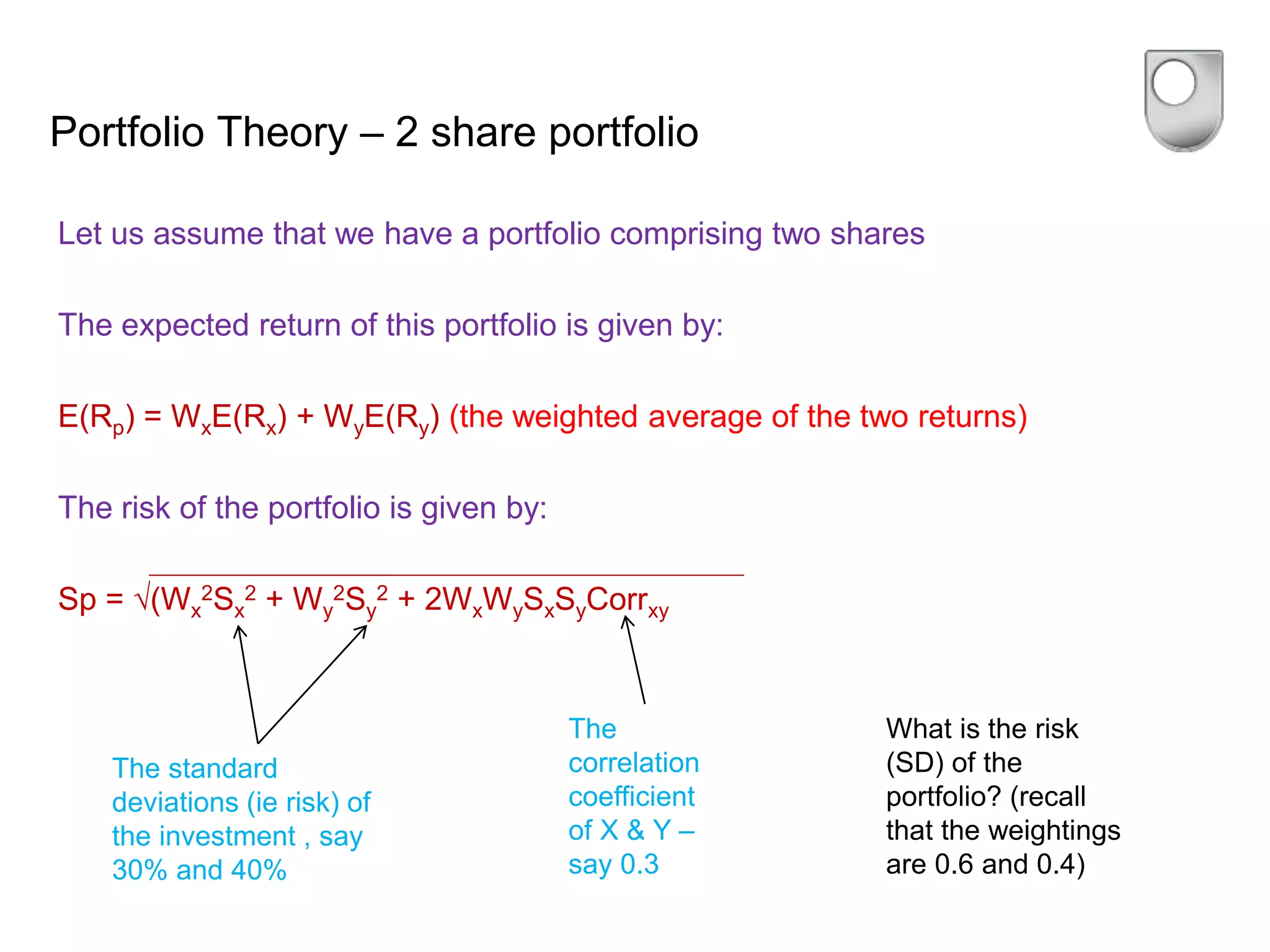

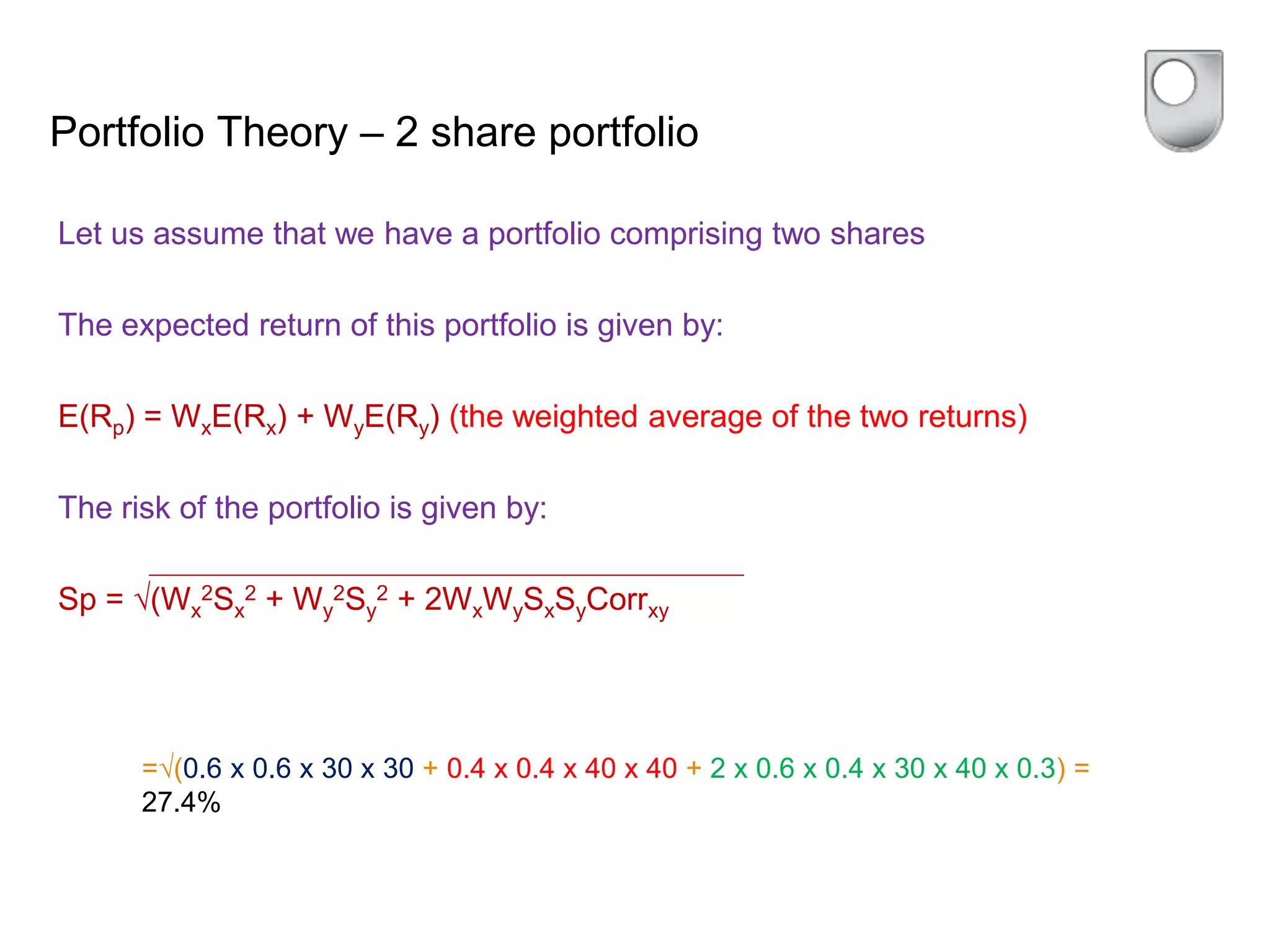

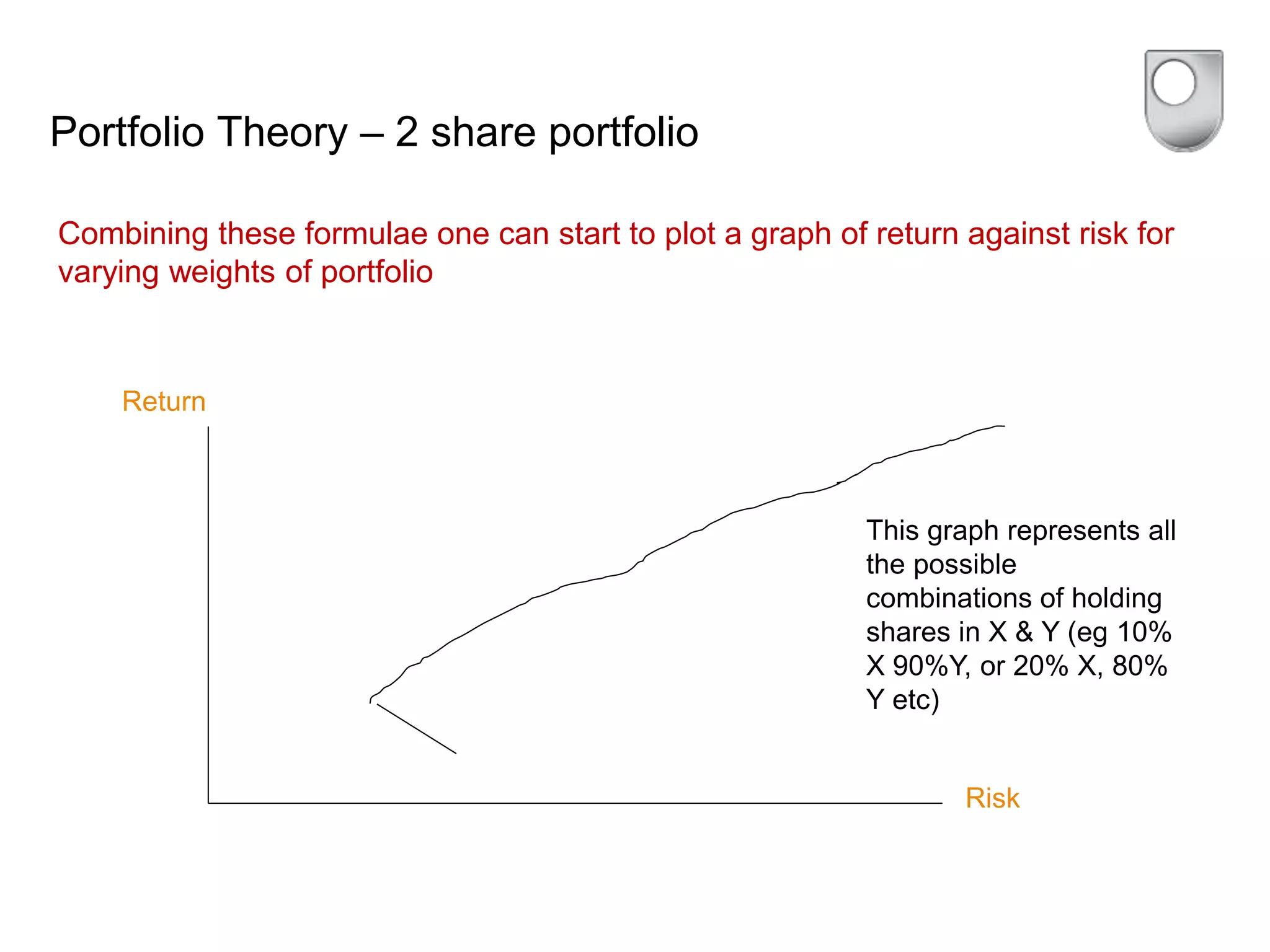

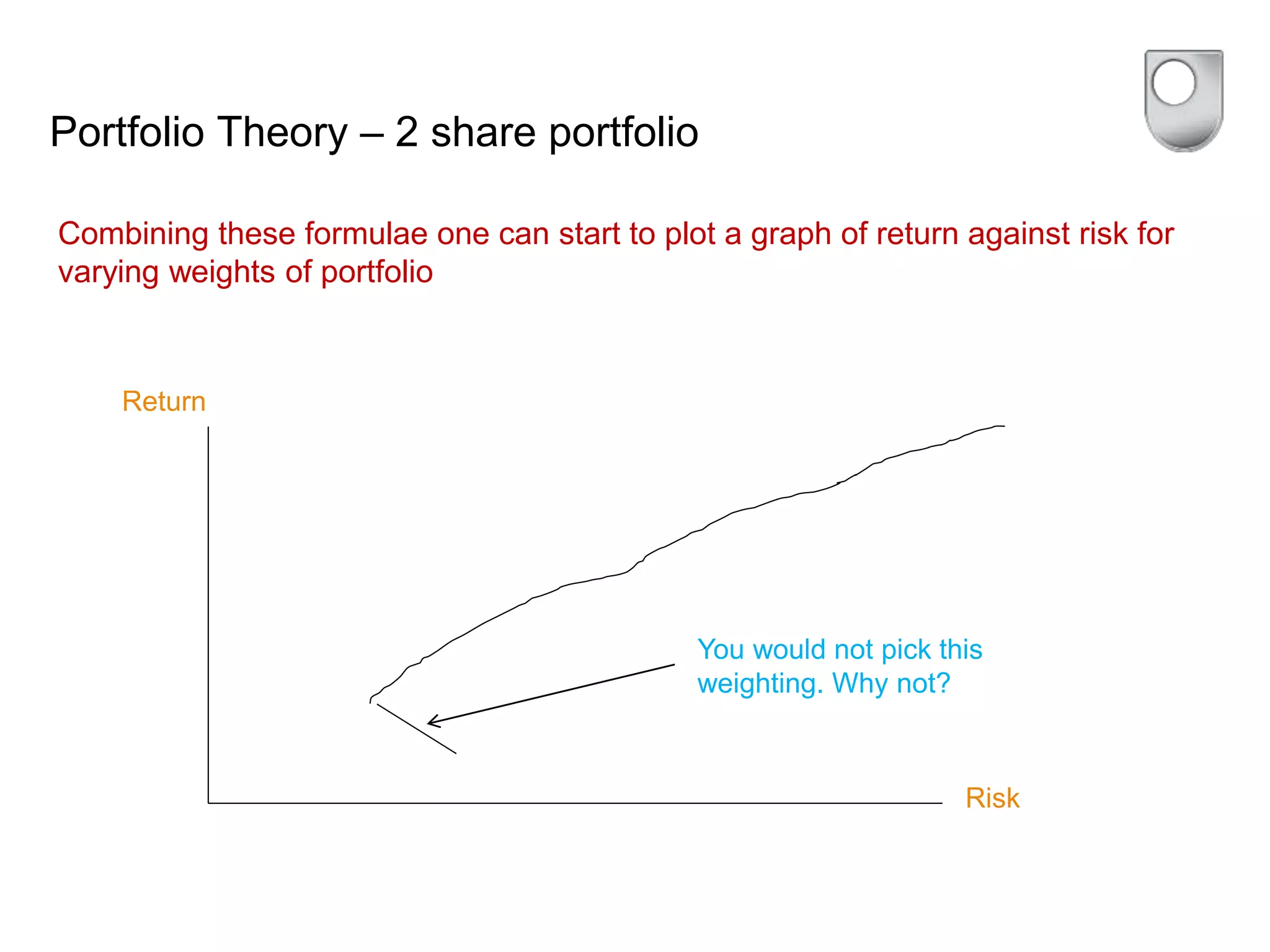

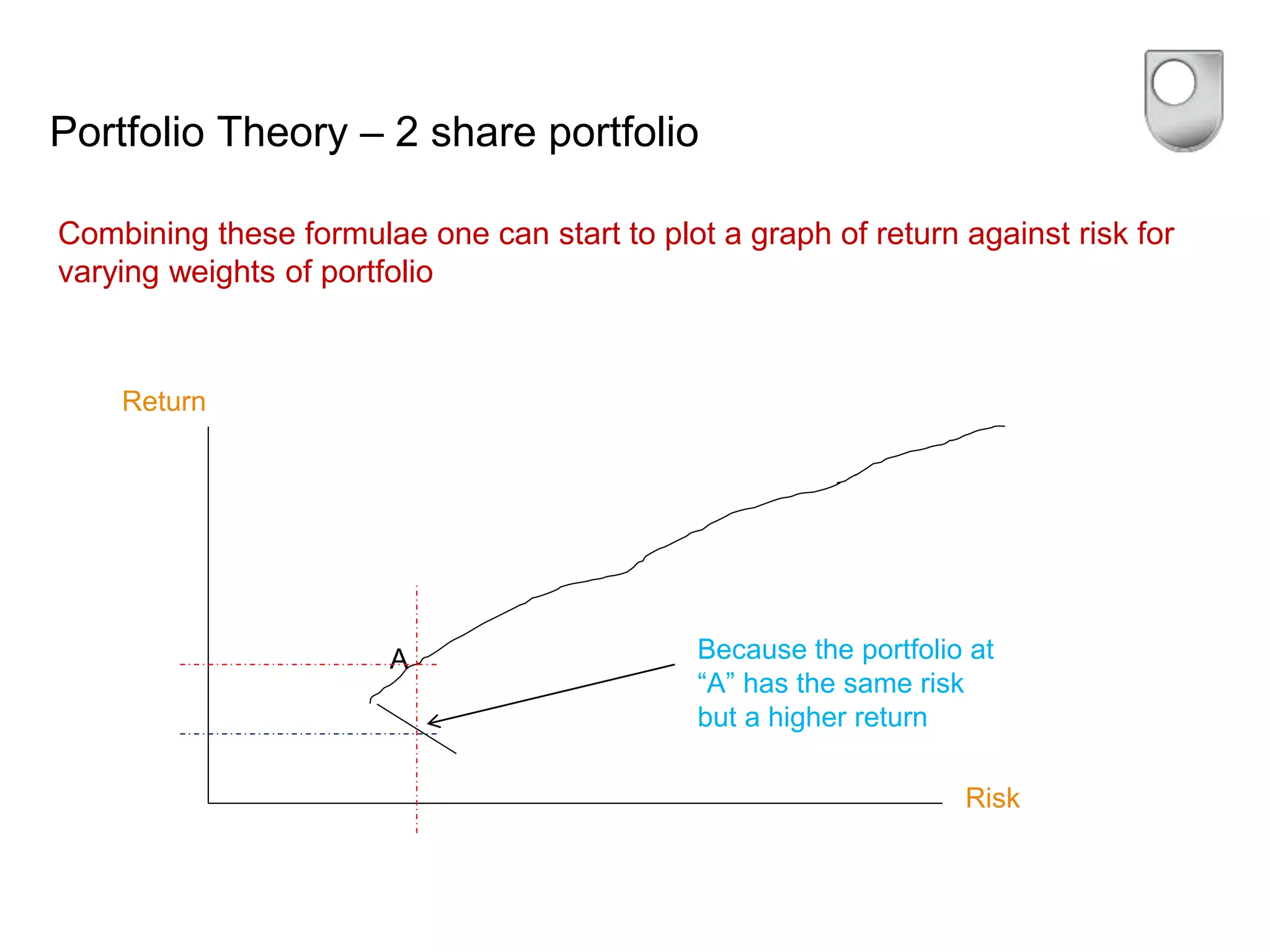

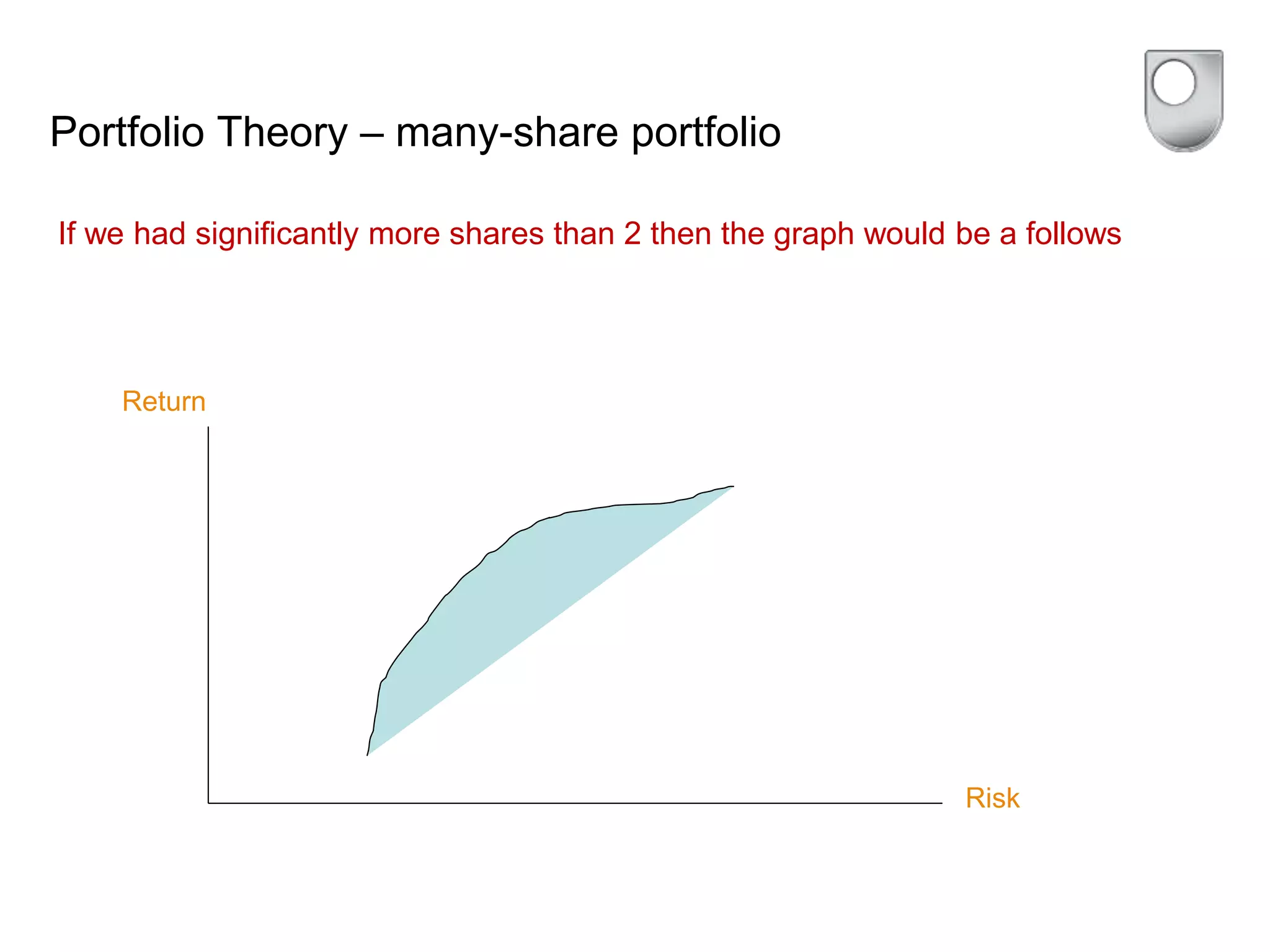

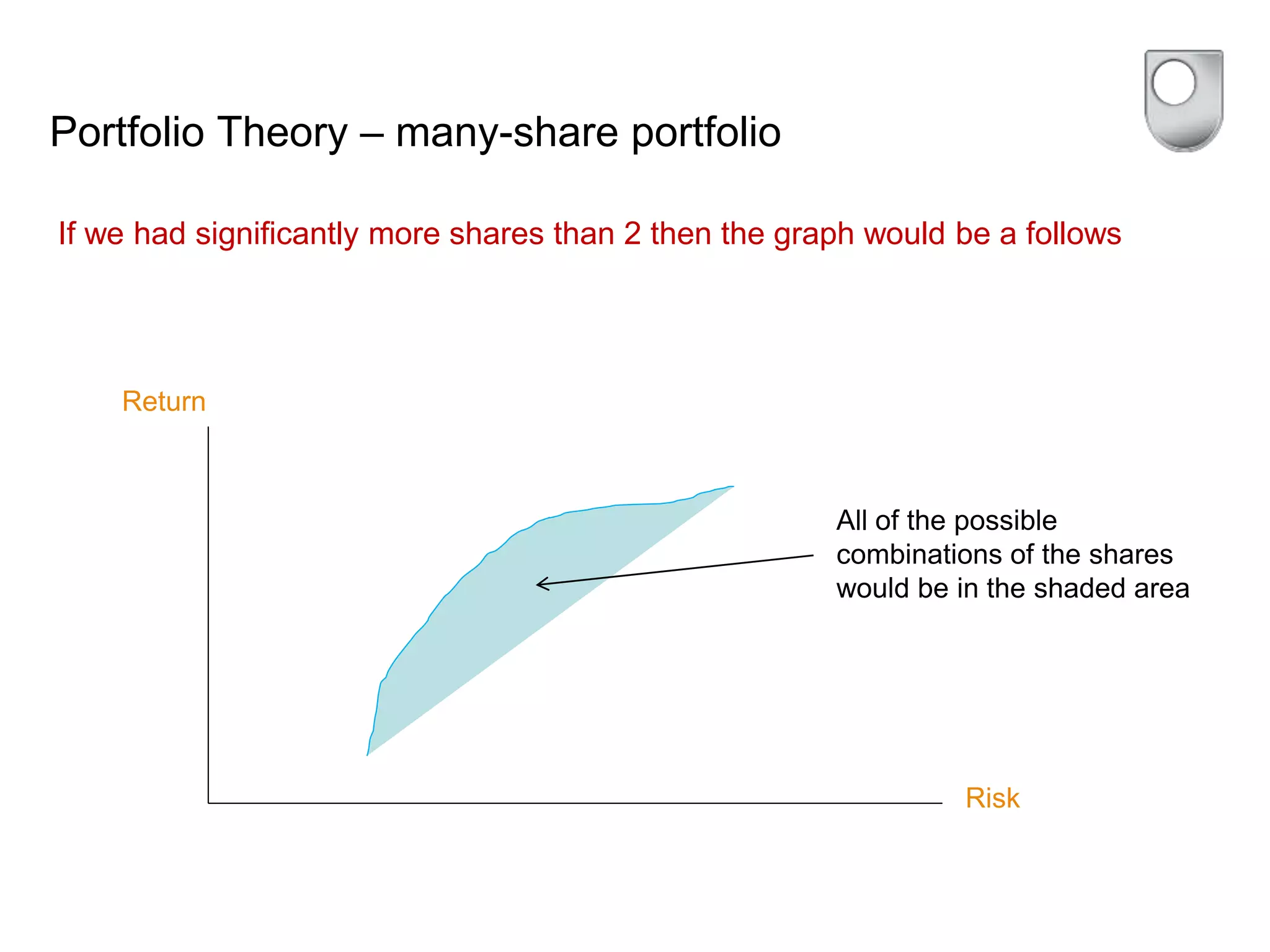

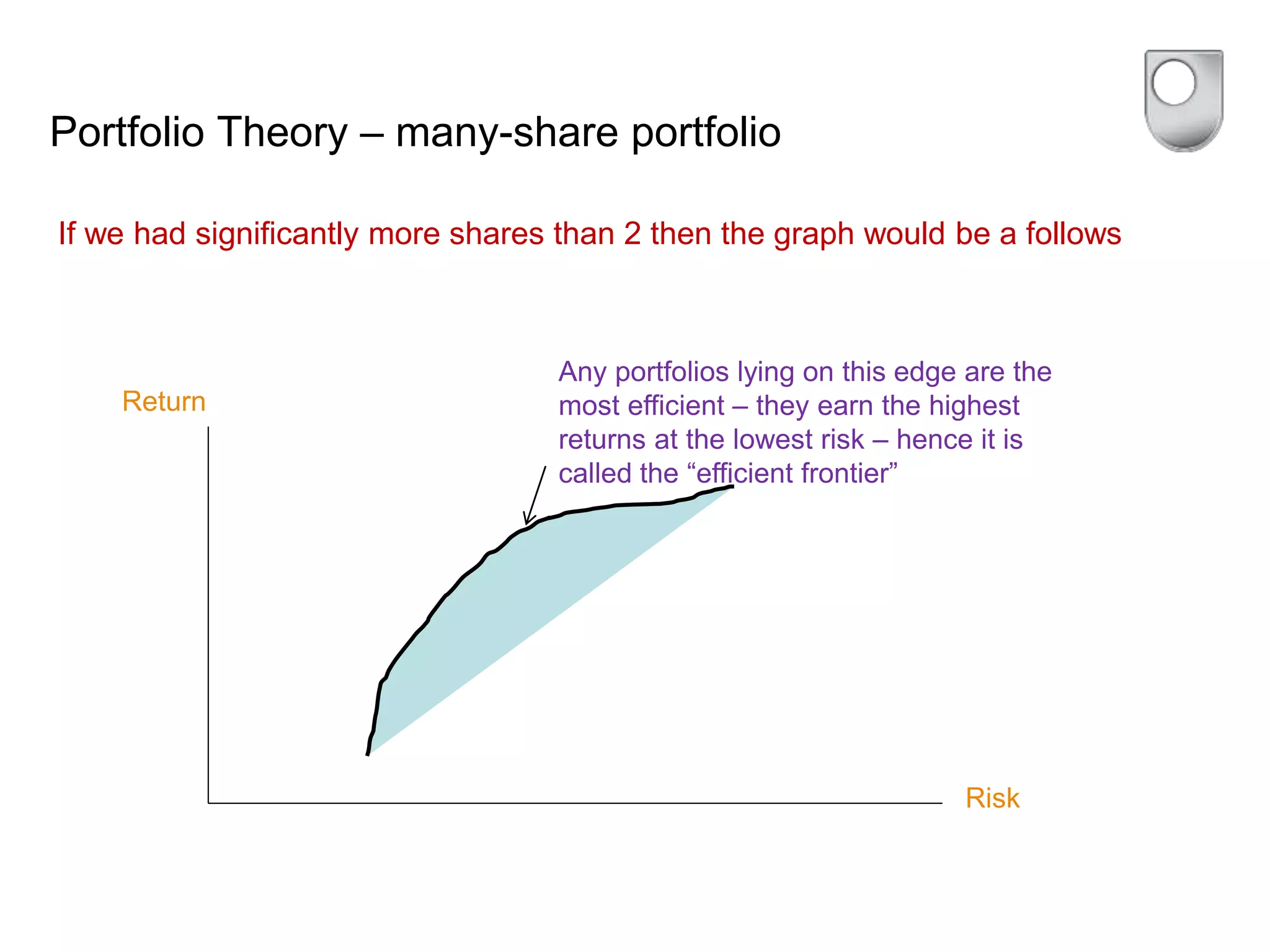

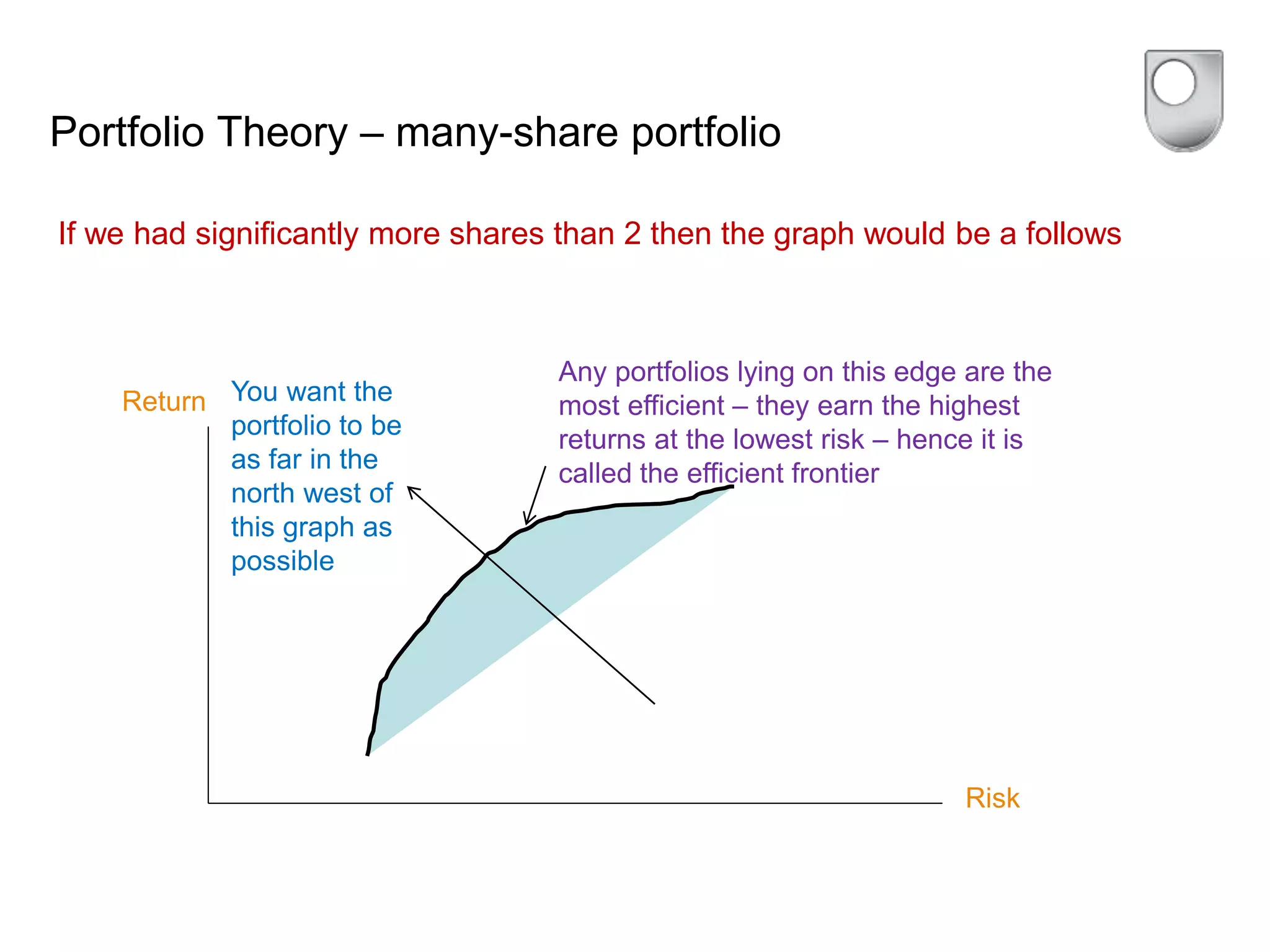

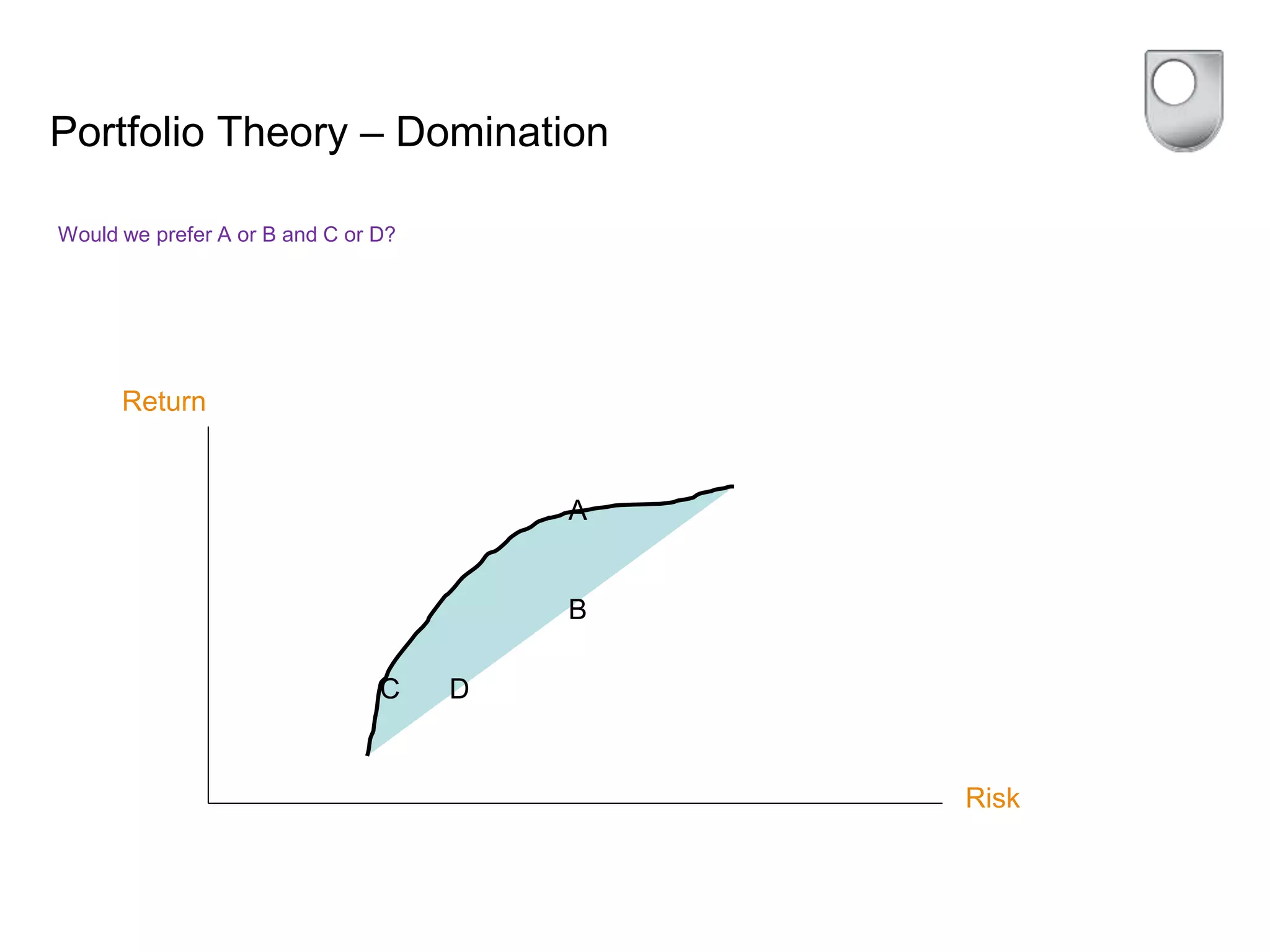

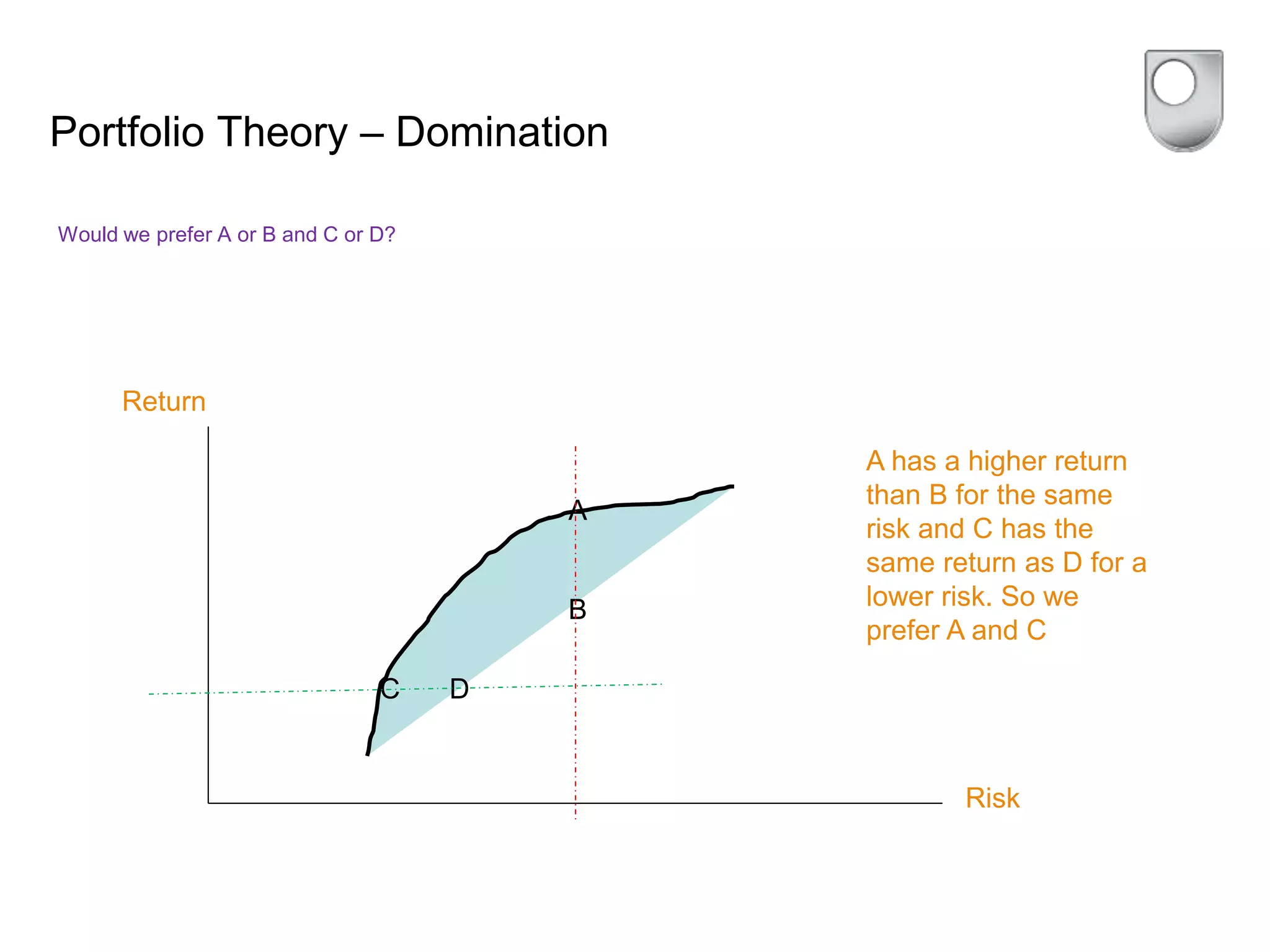

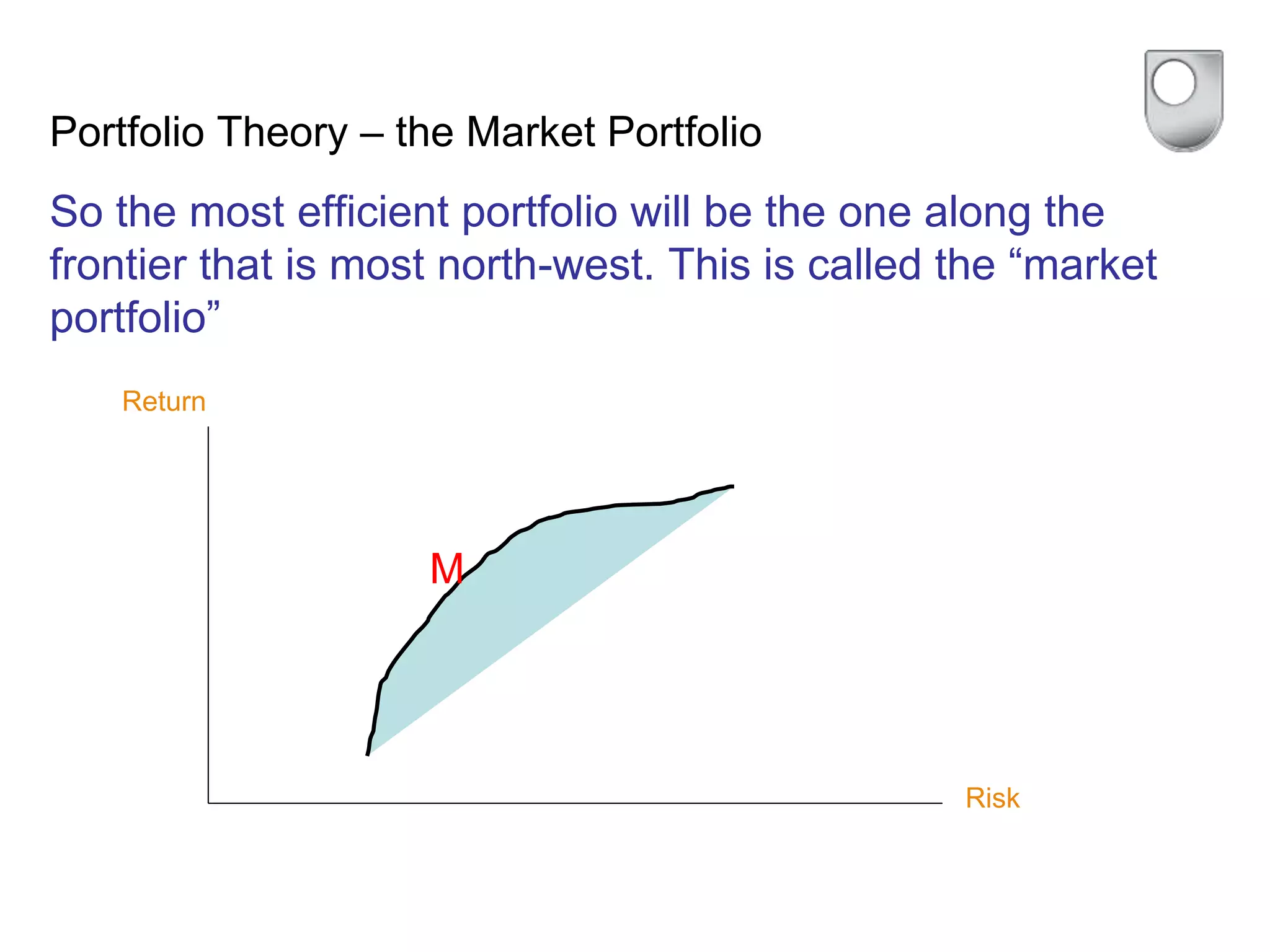

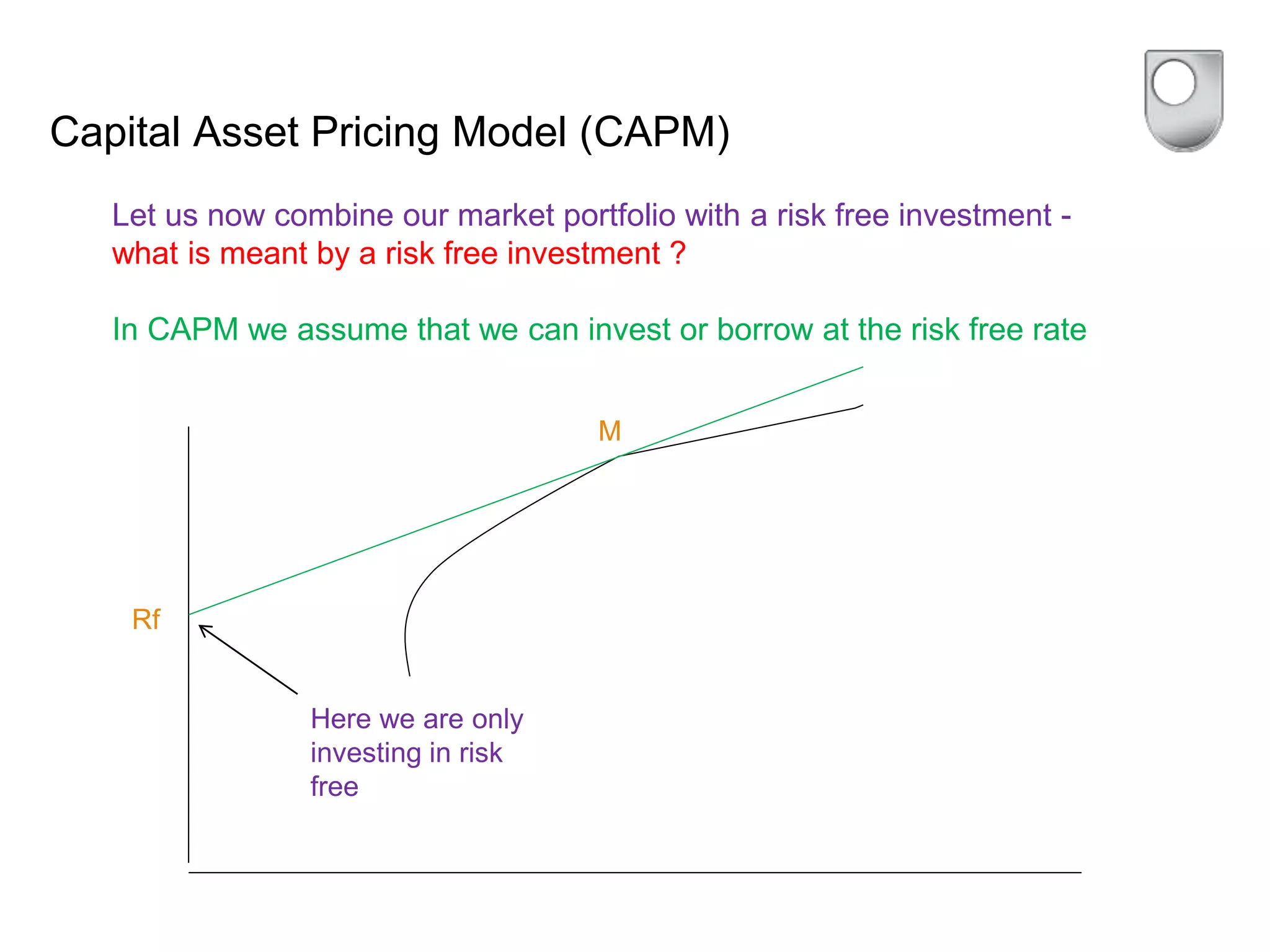

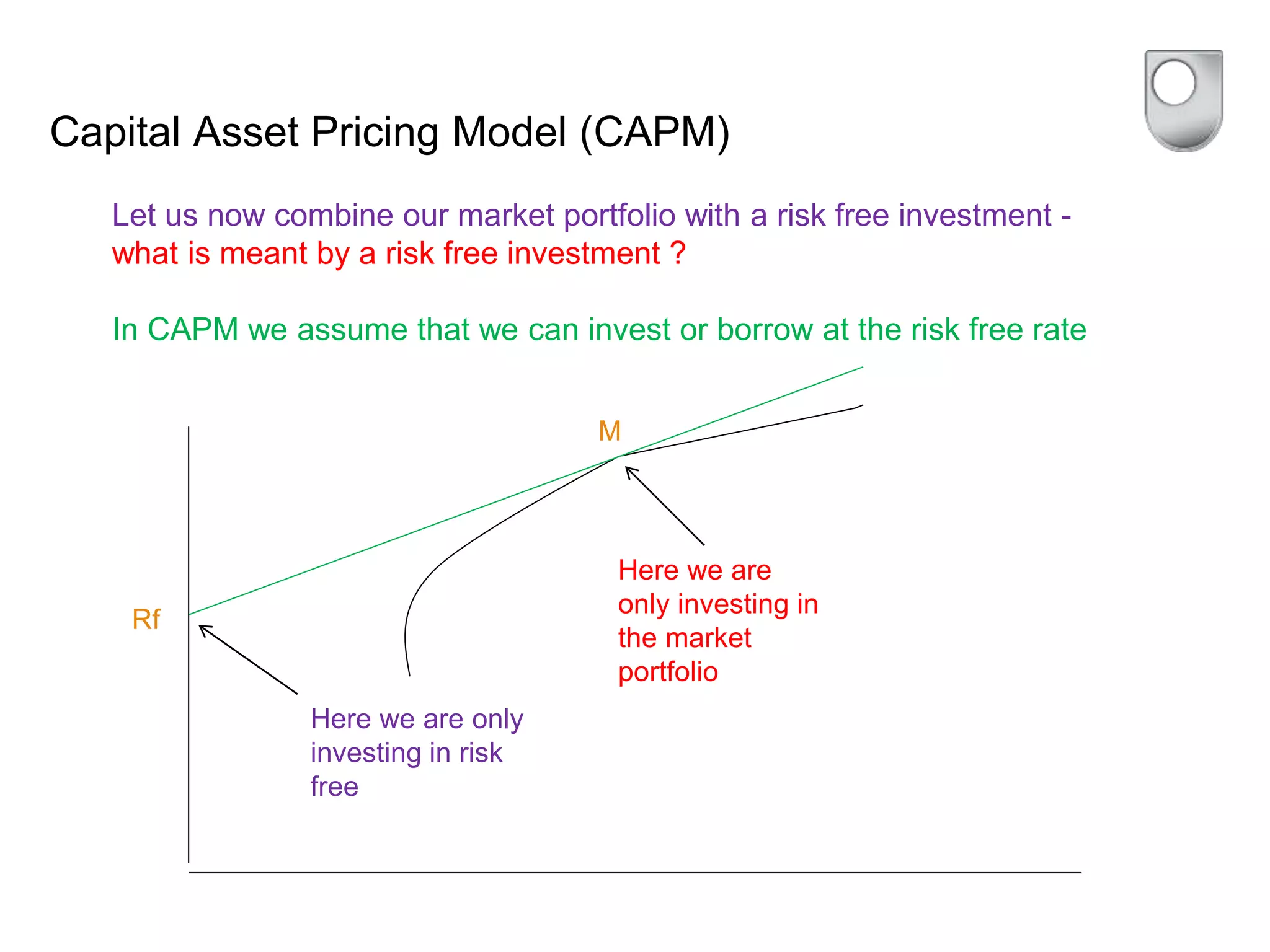

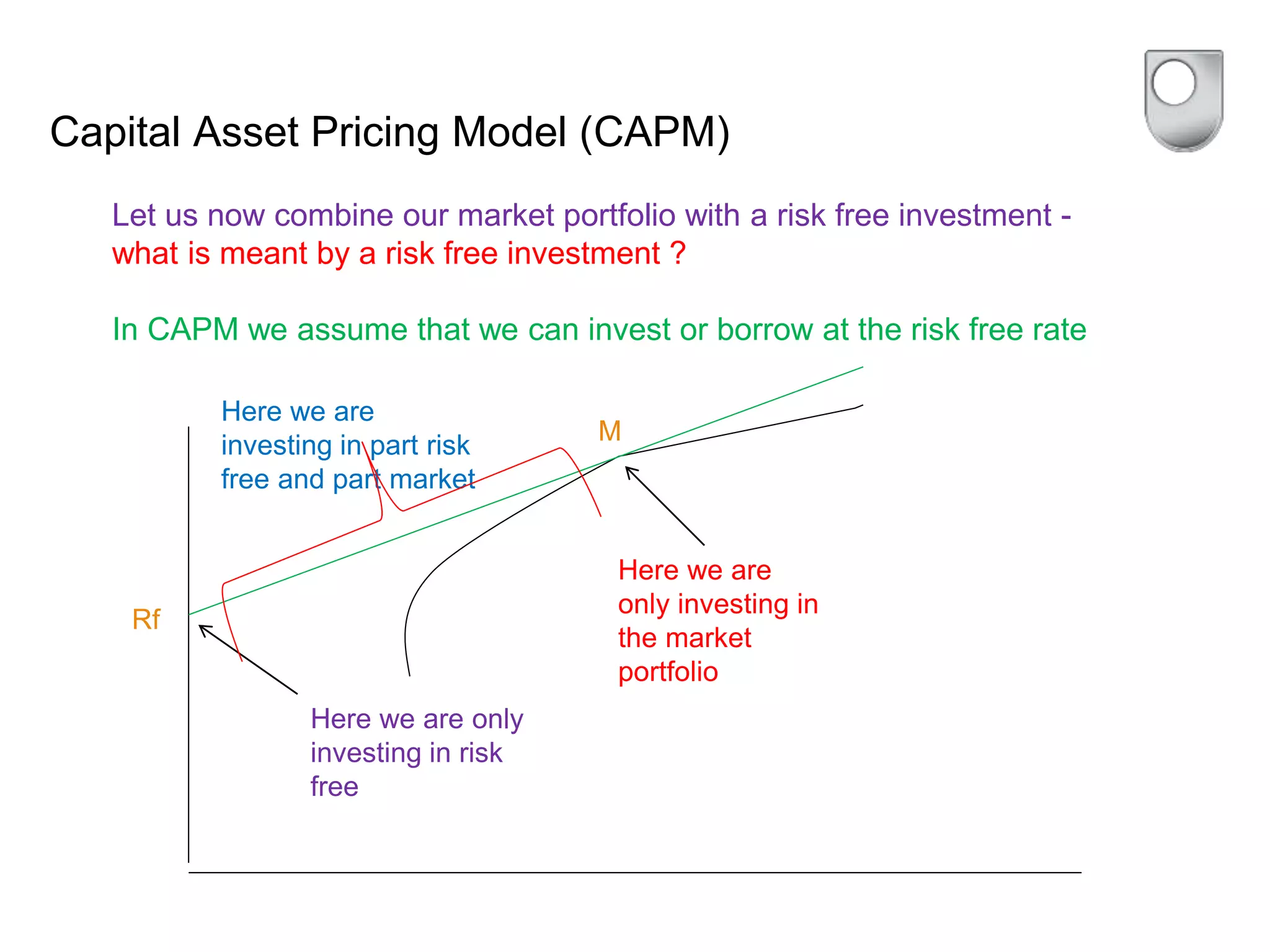

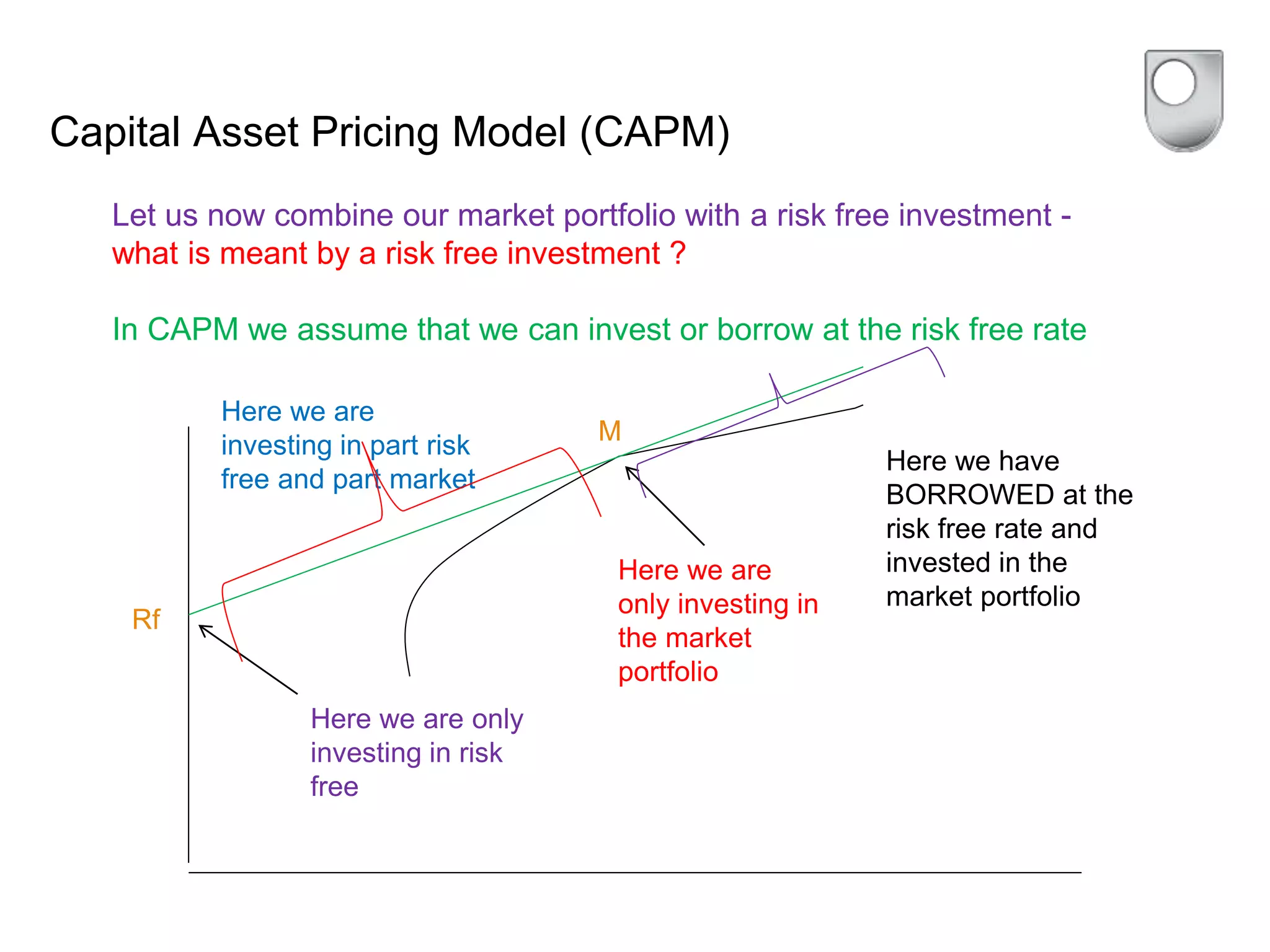

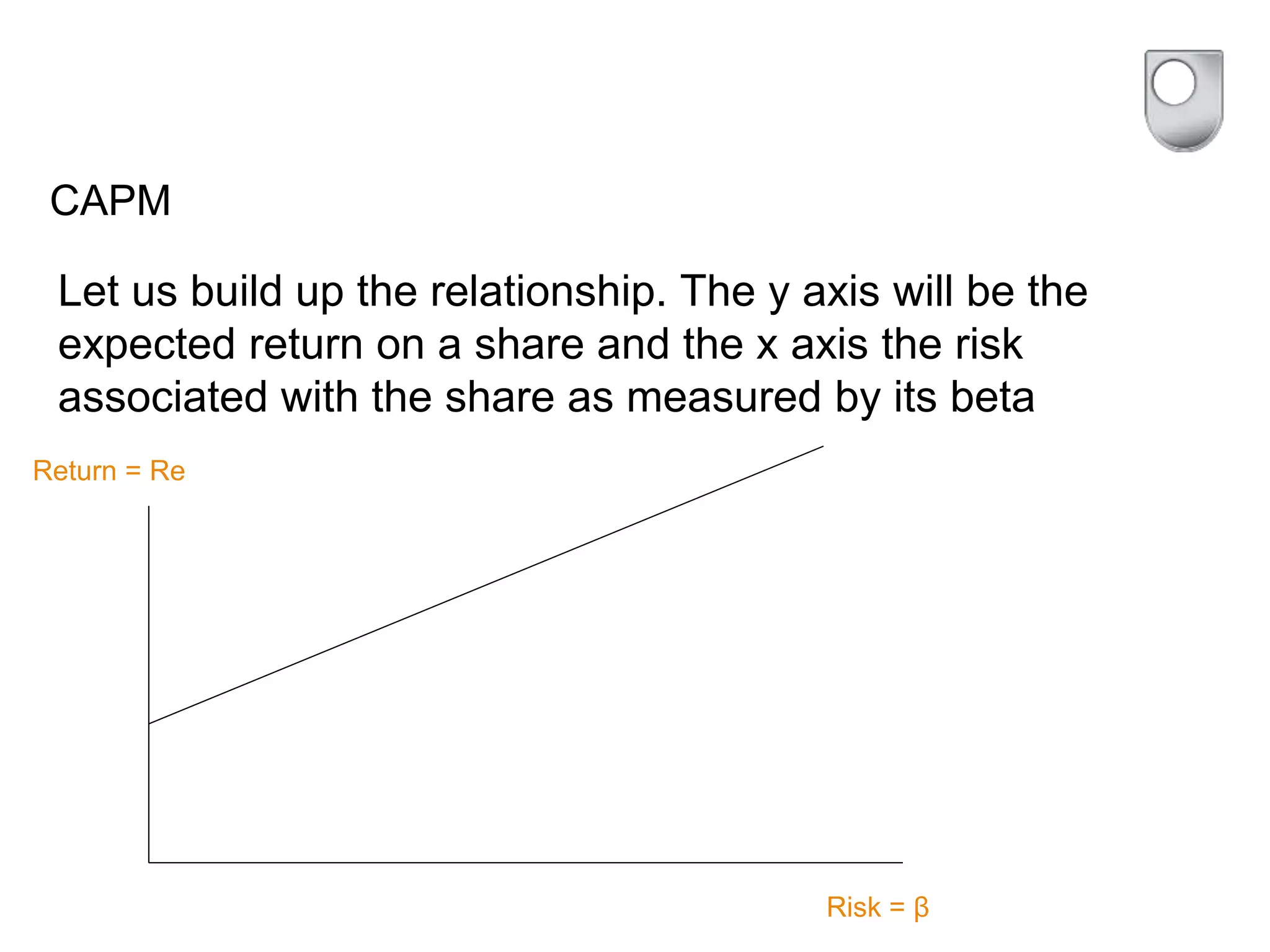

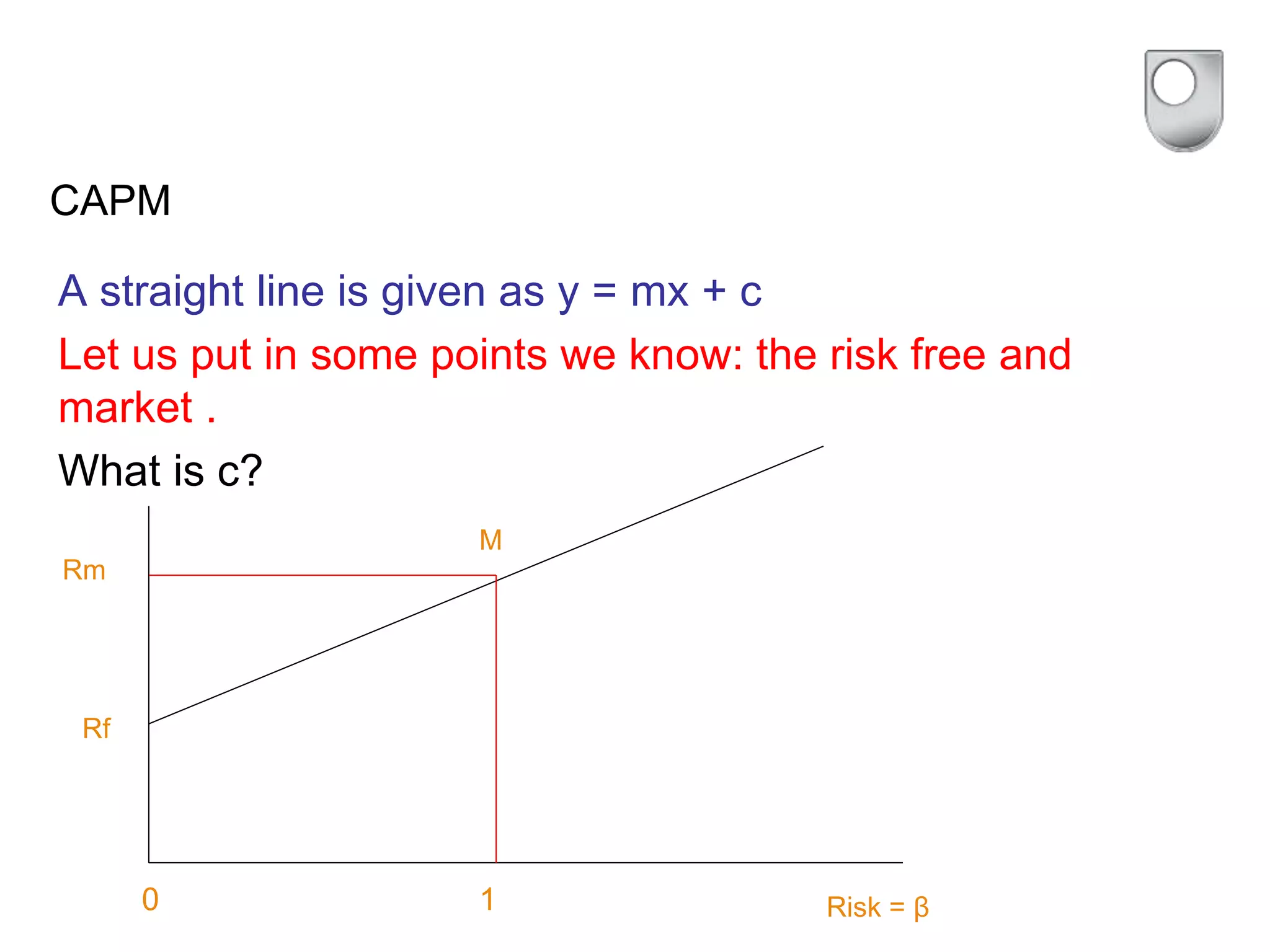

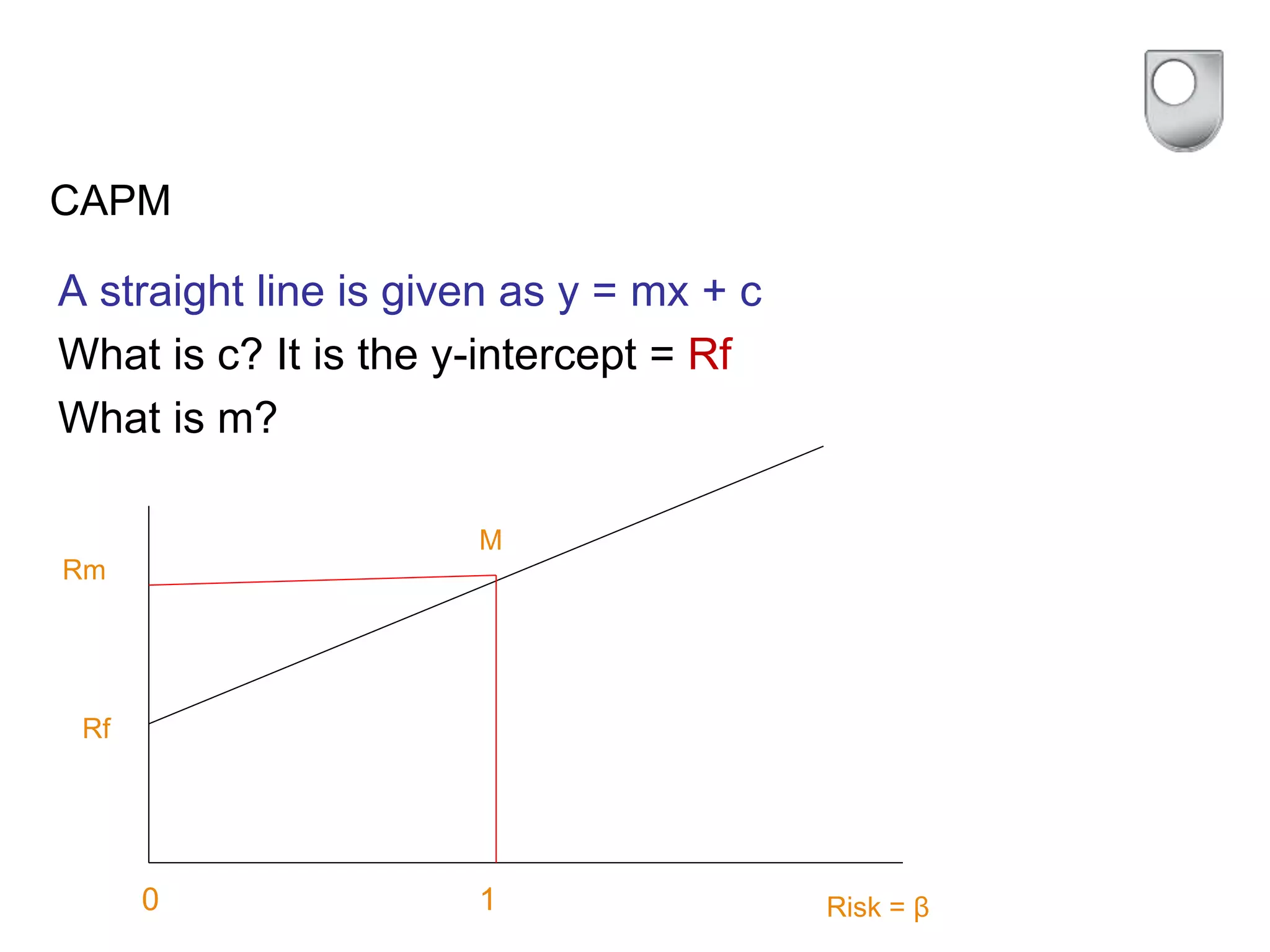

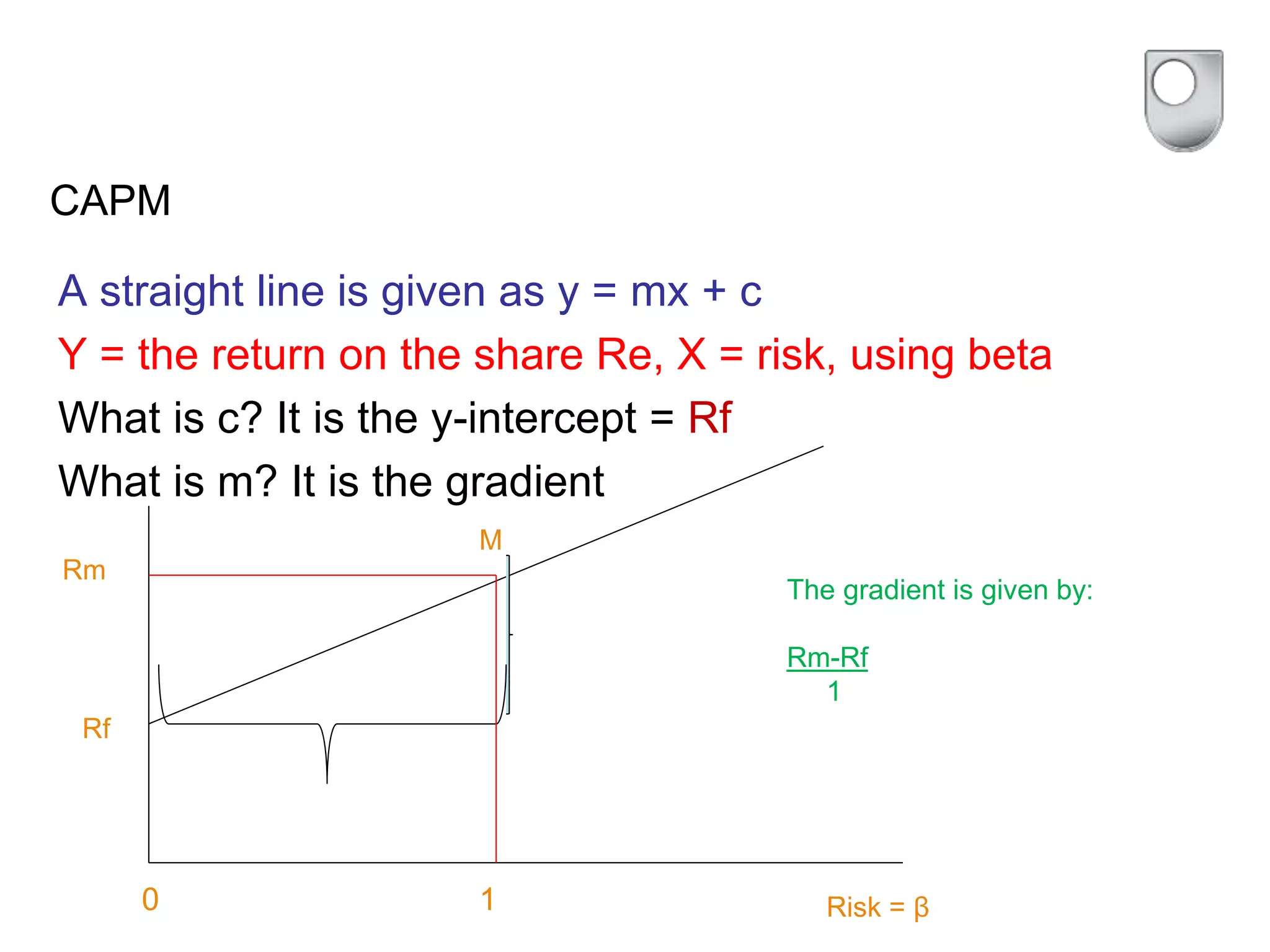

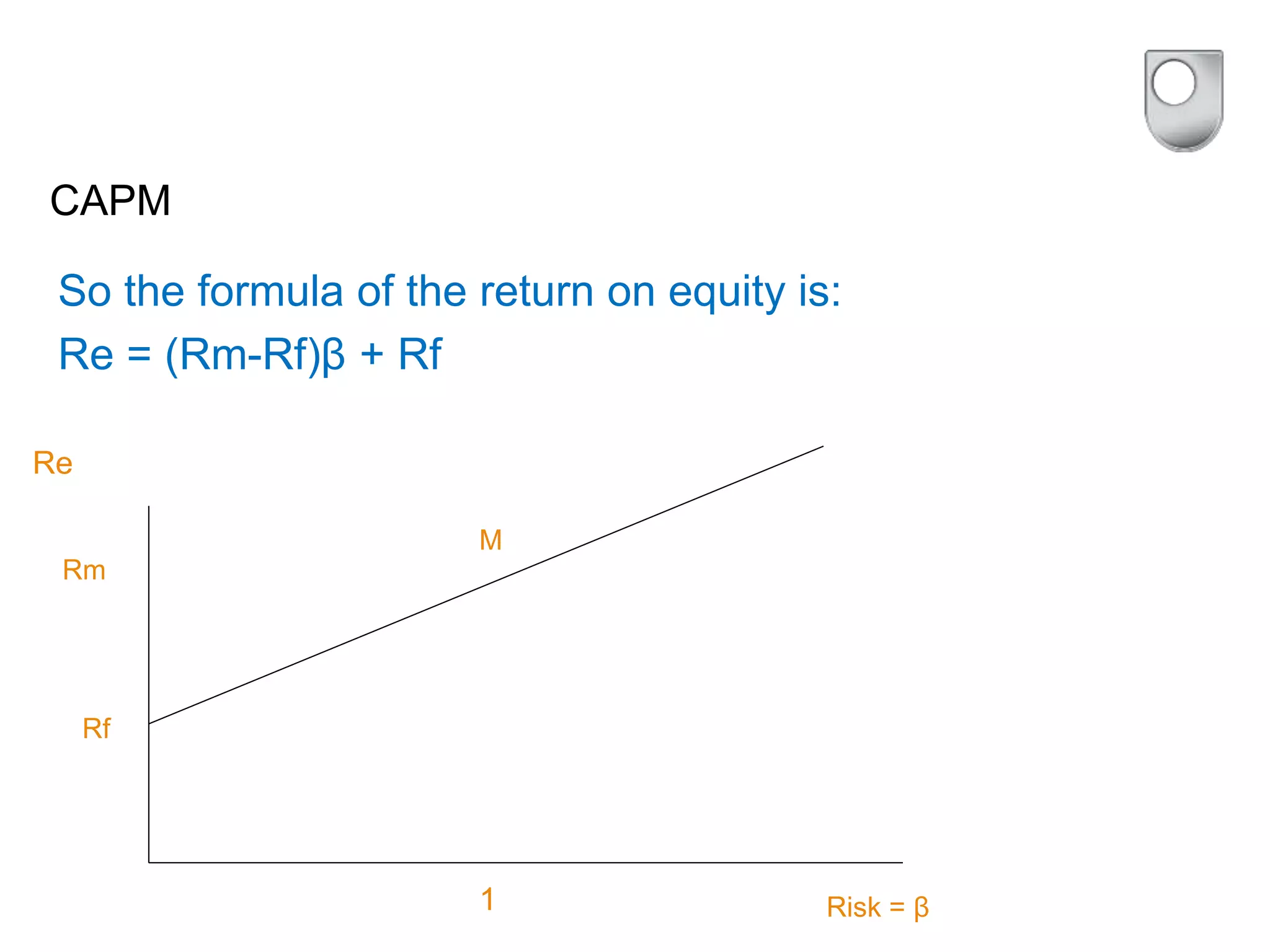

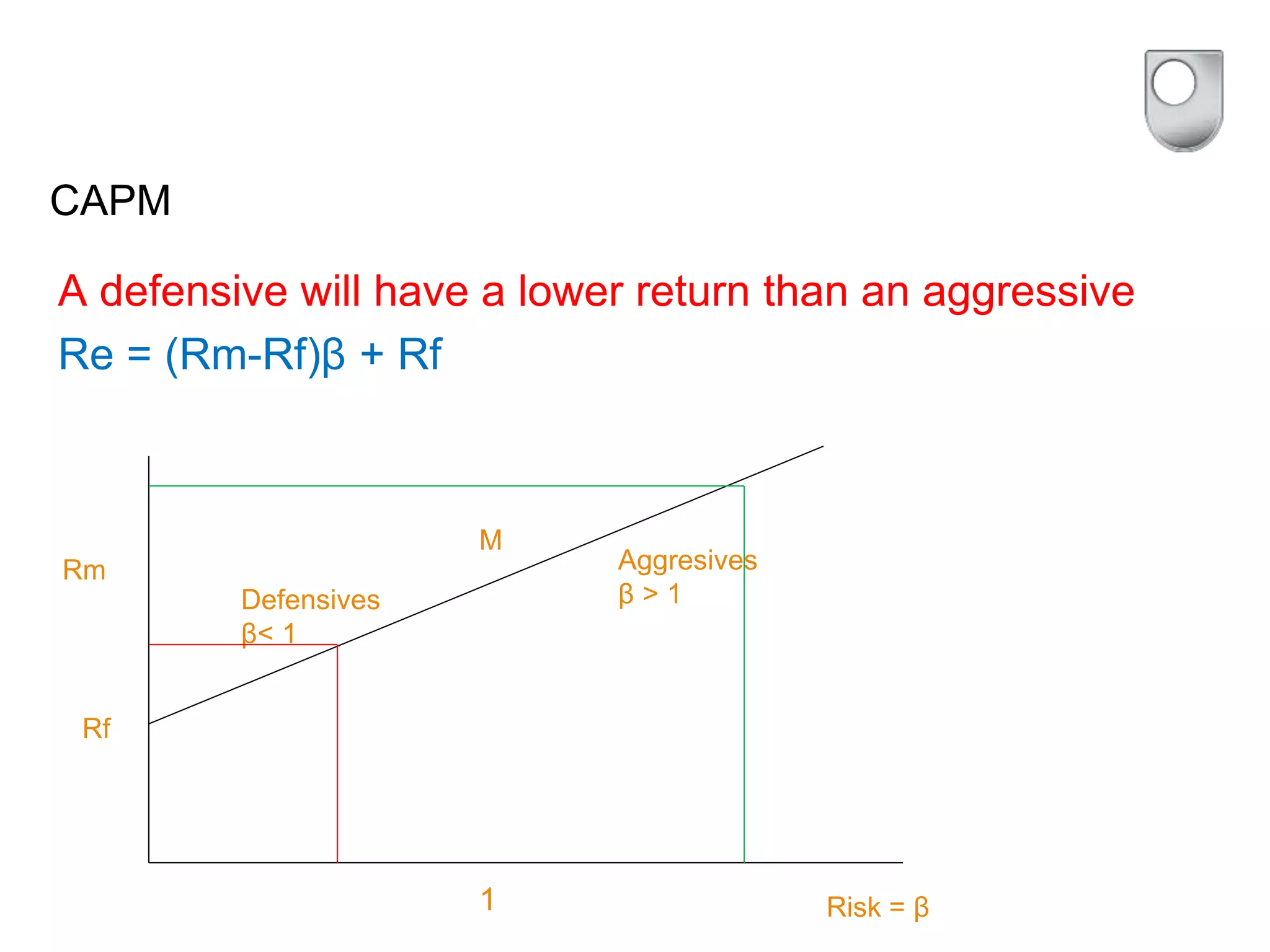

This document discusses portfolio theory and the Capital Asset Pricing Model (CAPM). It explains that diversification reduces risk through averaging effects. While specific risk can be diversified away, market risk cannot. Portfolio theory assumes investors are risk averse and seek the highest returns for a given level of risk. The CAPM uses beta to measure a stock's risk relative to the market and defines the security market line, where expected return is equal to the risk-free rate plus a risk premium based on beta. Stocks with beta greater than one are more volatile than the market.