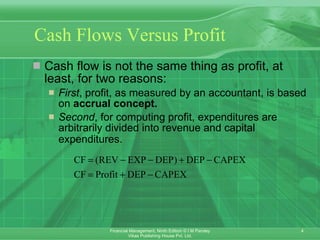

1. Cash flow analysis is important for investment decisions as it considers the actual inflows and outflows of money over time rather than accounting profits.

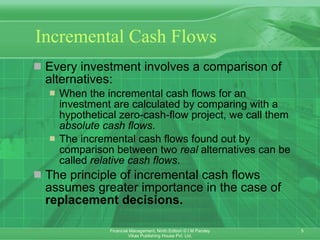

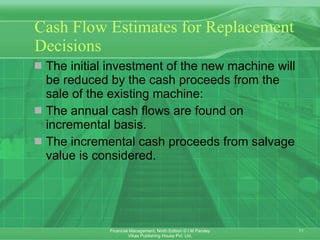

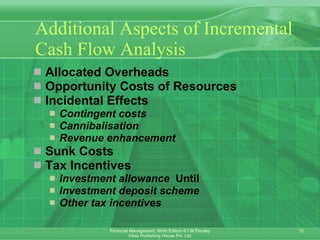

2. Incremental cash flows compare the cash flows of an investment to the alternative of doing nothing. Relative cash flows compare alternatives.

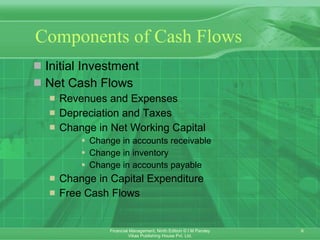

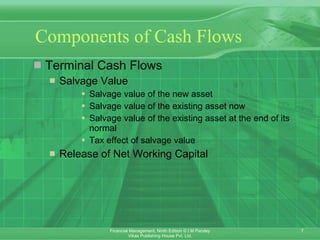

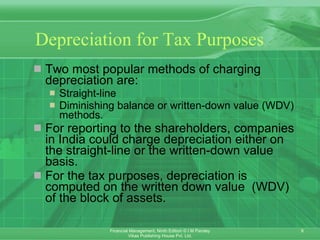

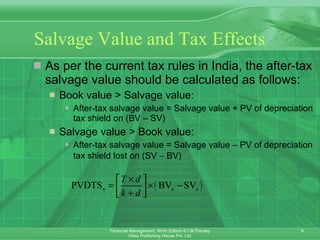

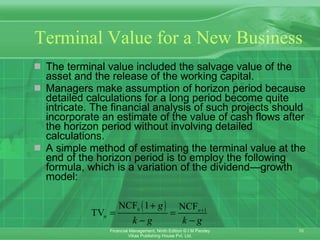

3. Key components of a cash flow analysis include initial investment, revenues and expenses, depreciation, taxes, changes in working capital, capital expenditures, salvage value, and terminal value.