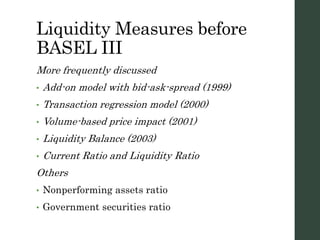

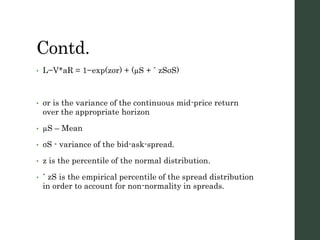

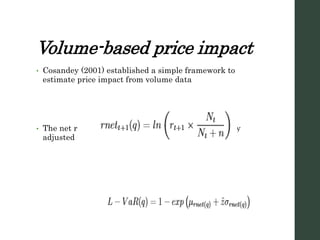

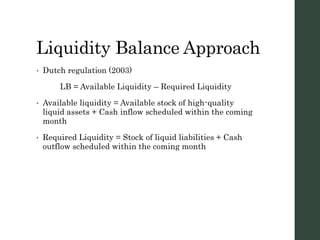

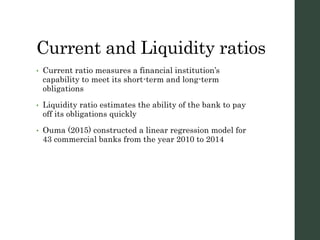

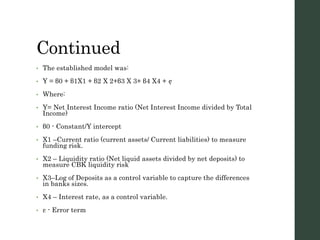

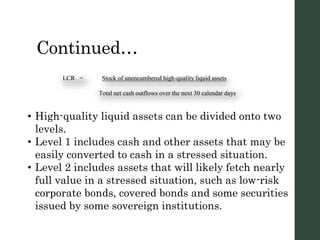

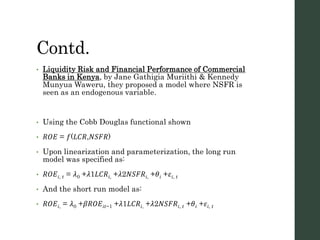

Liquidity risk arises from a bank's inability to meet its obligations. This document discusses various methods for measuring liquidity risk that were used before and after the 2008 global financial crisis. Before the crisis, models focused on bid-ask spreads, transaction volumes, and liquidity balances. Following the crisis, Basel III introduced two new ratios - the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) - to improve banks' short-term and long-term liquidity management. The LCR requires sufficient high-quality liquid assets to cover net cash outflows over 30 days, while the NSFR aims to ensure long-term assets are funded by stable sources over one year.