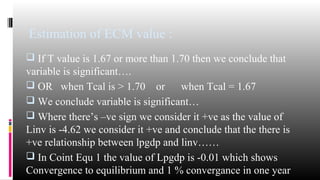

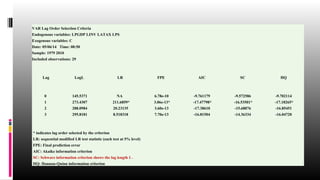

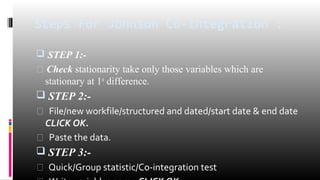

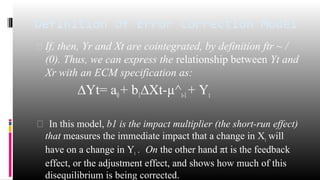

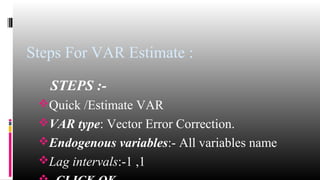

The document discusses the concept of cointegration and its various approaches, particularly focusing on the Engle-Granger and Johansen-Juselius methods. It outlines the conditions necessary for cointegration, interpretations of the Error Correction Model (ECM), and provides steps for conducting estimations using these methodologies. Additionally, it includes examples, definitions, and references for further reading on the subject.

![Vector Error Correction Estimates

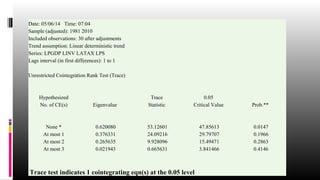

Date: 05/26/14 Time: 22:36

Sample (adjusted): 1981 2010

Included observations: 30 after adjustments

Standard errors in ( ) & t-statistics in [ ]

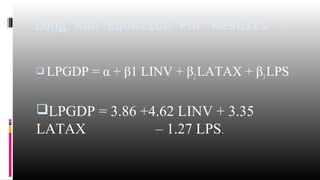

Cointegrating Eq: CointEq1

LPGDP(-1) 1.000000

LINV(-1) -4.620559

(0.47459)

[-9.73587]

LATAX(-1) -3.350165

(1.20384)

[-2.78289]

LPS(-1) 1.274220

(0.49822)

[ 2.55755]

C -3.861790

Error Correction: D(LPGDP) D(LINV) D(LATAX) D(LPS)

CointEq1 -0.011599 0.167417 -0.004750 -0.060848

(0.02160) (0.04974) (0.02840) (0.03017)

[-0.53695] [ 3.36570] [-0.16725] [-2.01682]](https://image.slidesharecdn.com/3cointegrationpresentationnrgs-140822082057-phpapp01/85/Co-integration-14-320.jpg)