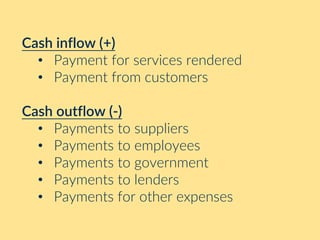

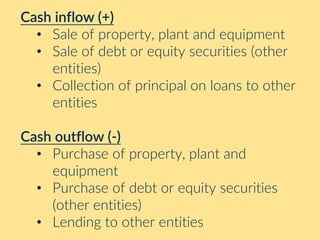

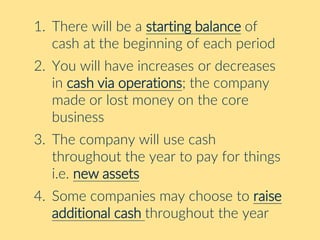

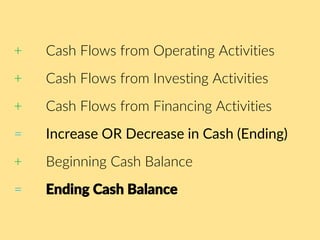

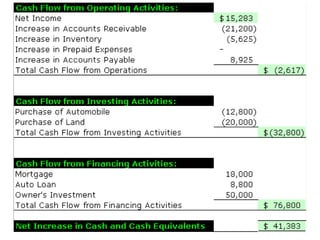

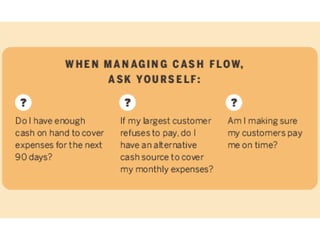

The cash flow statement is a financial document that tracks the movement of money in and out of a business, helping to assess cash receipts and payments. It differs from other financial statements by being prepared on a cash basis rather than an accrual basis, thus highlighting liquidity rather than profit. Key components include operating, investing, and financing activities, which can indicate business health and strategies for addressing negative cash flow.