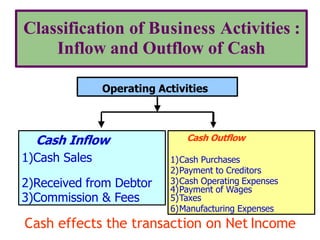

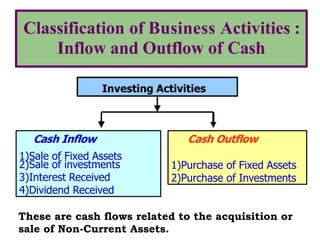

The document discusses the cash flow statement, which reports an entity's cash inflows and outflows during a period. It is separated into three sections: operating activities, investing activities, and financing activities. Operating activities involve core business operations like sales, expenses, and collections. Investing activities involve the purchase and sale of long-term assets. Financing activities involve raising or repaying capital through equity/debt. The direct method shows major cash categories, while the indirect method reconciles net income to net cash flow from operations by adjusting for non-cash items. The cash flow statement provides useful information about an entity's liquidity and ability to generate future cash flows.