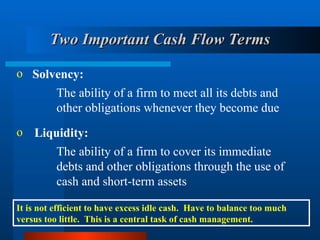

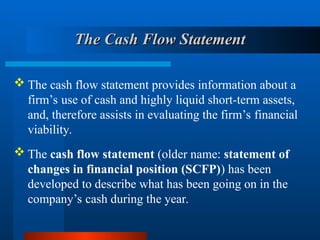

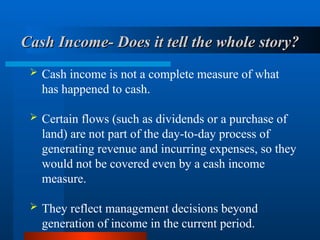

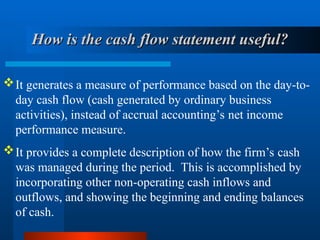

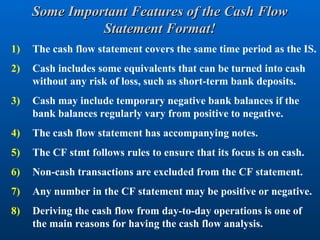

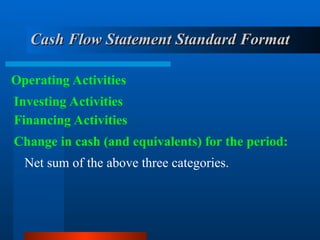

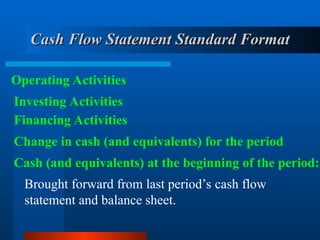

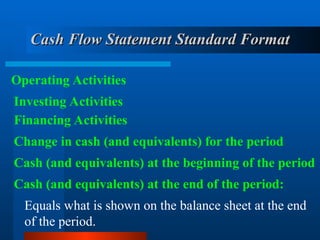

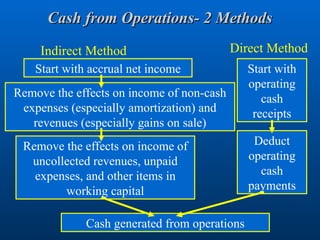

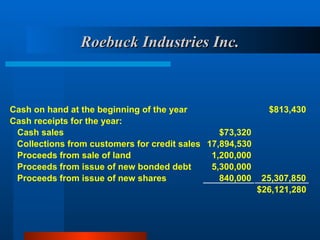

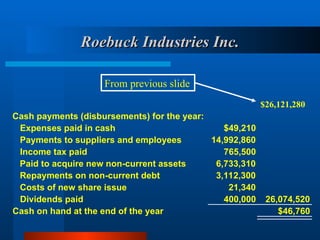

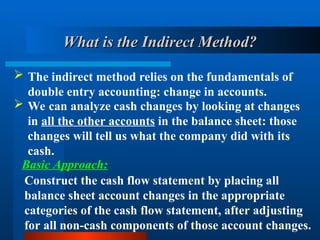

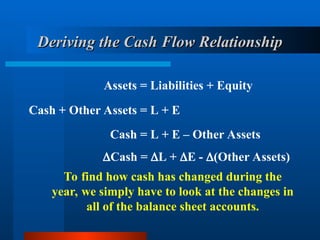

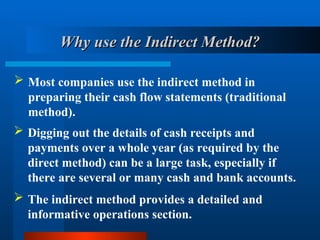

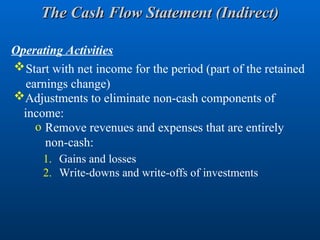

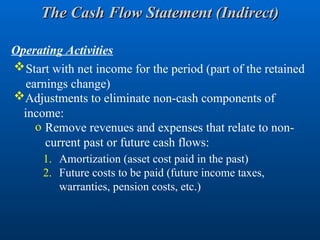

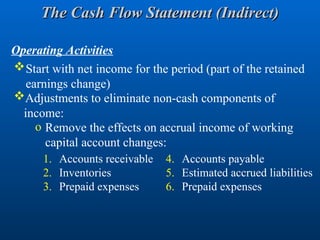

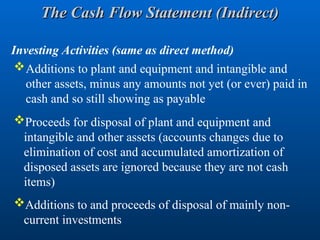

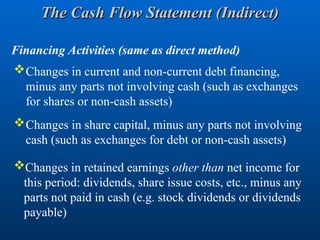

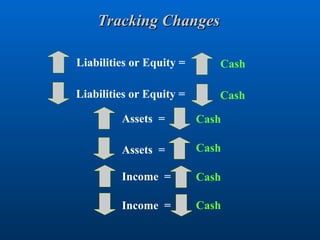

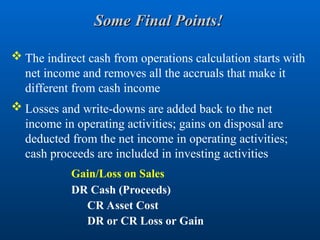

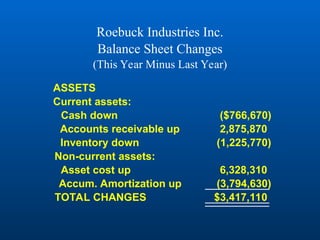

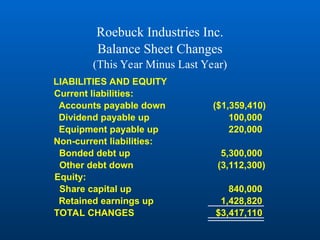

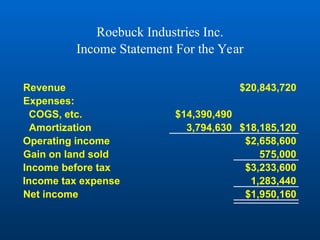

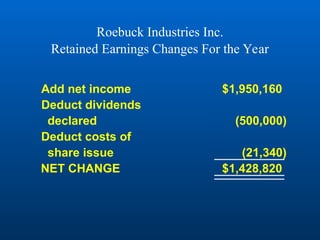

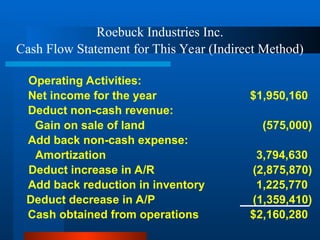

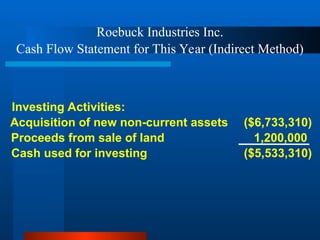

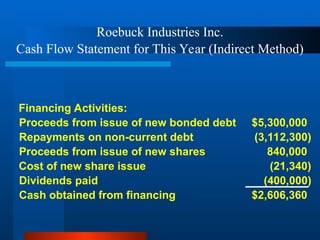

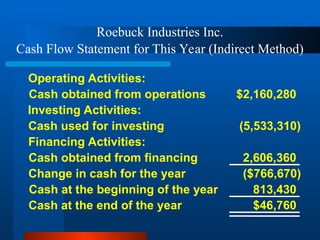

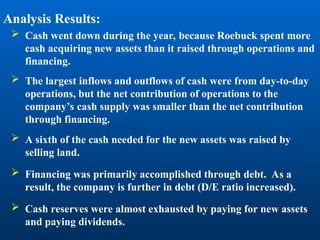

The document provides a comprehensive overview of cash flow analysis, including the structure and purpose of cash flow statements, and highlights the differences between cash income and accrual income. It emphasizes the significance of cash management for assessing a firm's financial viability, solvency, and liquidity, and details the preparation and interpretation of cash flow statements using both direct and indirect methods. Real-world examples, including Roebuck Industries, illustrate the application of these principles in evaluating cash flow dynamics.