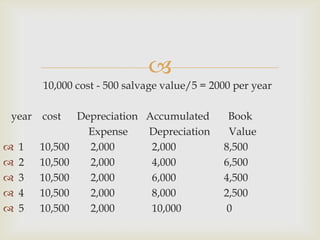

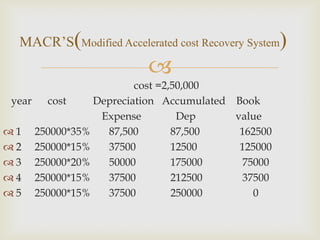

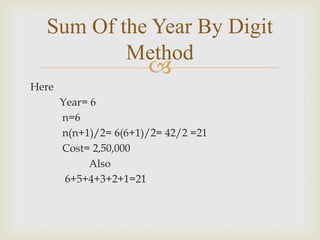

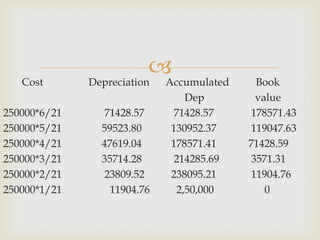

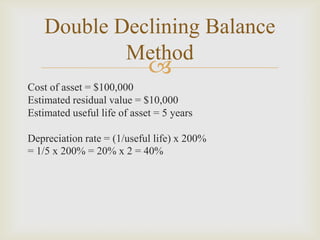

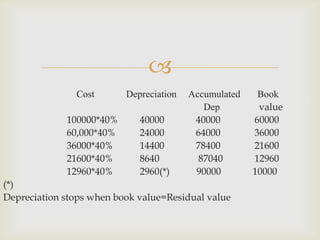

The document discusses four methods for calculating depreciation: straight line, MACRS, double declining balance, and sum of the years' digits. It provides examples to illustrate how to use each method. The straight line method evenly depreciates the asset cost minus its salvage value over its useful life. MACRS uses accelerated percentages in early years. Double declining balance applies higher depreciation rates in early years that decline each year. Sum of the years' digits allocates depreciation based on the digits of the useful life years summed together.