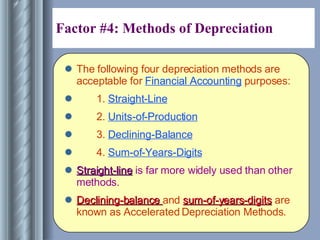

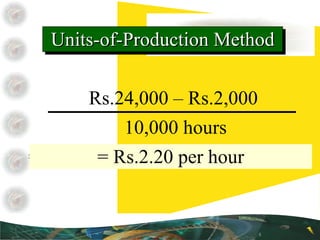

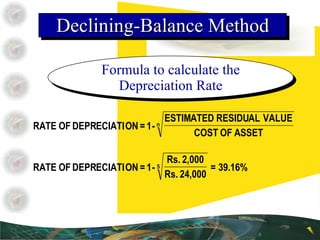

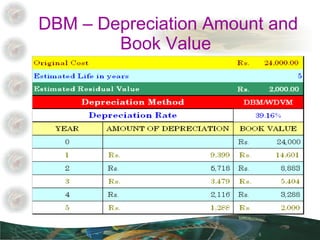

1. The document discusses various methods of accounting for depreciation of fixed assets, including straight-line, units-of-production, and declining balance methods.

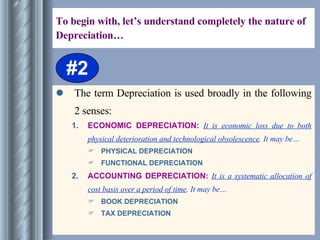

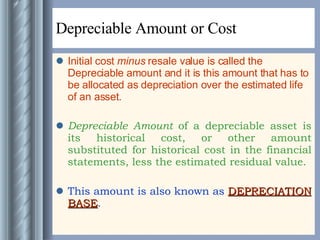

2. It explains that depreciation involves allocating the cost of tangible assets over the periods they are expected to provide benefits.

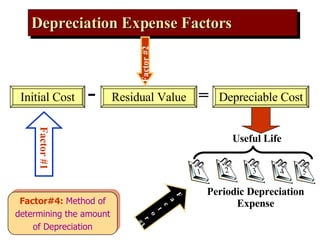

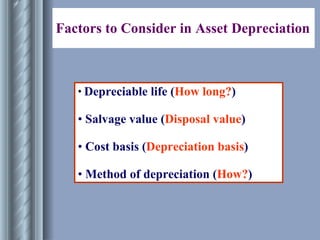

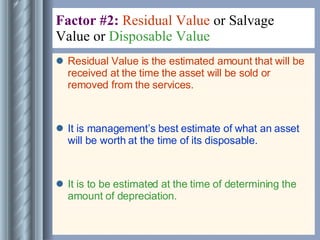

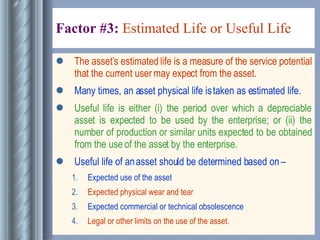

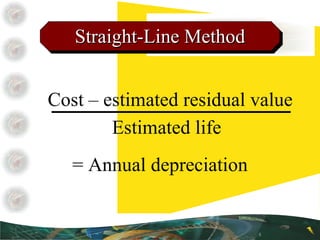

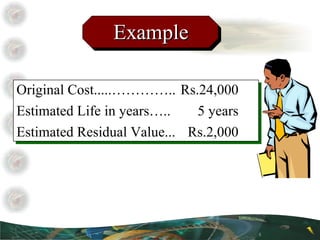

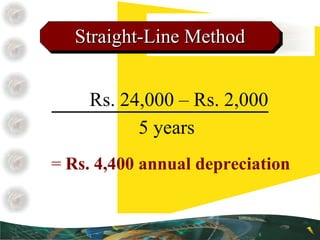

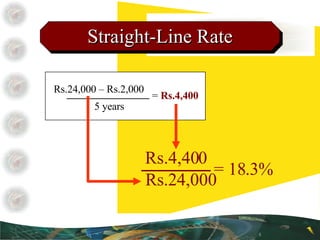

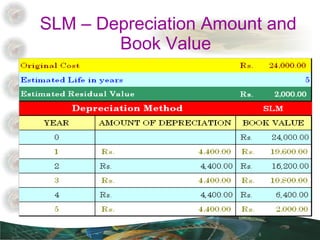

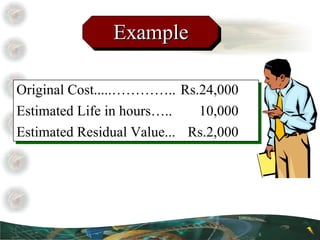

3. Key factors that determine depreciation expenses each year include initial asset cost, estimated residual value, useful life, and the depreciation method used.