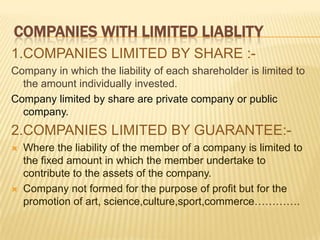

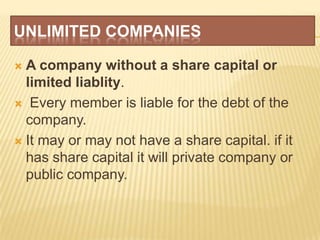

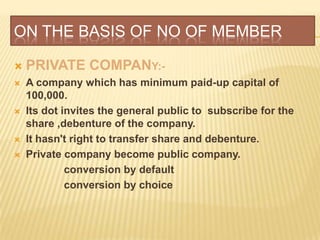

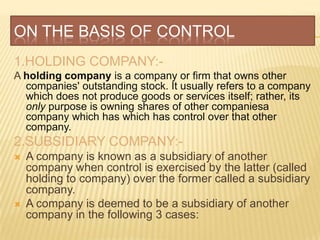

The document summarizes key aspects of the Companies Act of 1956 in India. It discusses that the Act was enacted by the Indian Parliament in 1956 and regulates how companies must maintain their books of accounts. It establishes rules around the formation, management, meetings and winding up of companies. The Act also requires all companies operating in India to register. It classifies companies based on aspects like incorporation, liability, ownership and control.